Oh The Places You’ll Know: Secondary and Tertiary Real Estate Markets

There are clear reasons why many investors and institutions choose to only invest in the primary or gateway markets of L.A., Boston, Chicago, D.C., San Francisco, and New York City. There is steady demand, the infrastructure for development is readily available, liquidity is not a problem, and for the most part, many of the investors in these markets have a wealth of knowledge that they cannot match when it comes to smaller metropolitan areas. This last point is close to the crux of what motivates this blog post. There are worthwhile investments outside primary markets; investors need only the knowledge and motivation to participate.

The first thing that you need to keep in mind is that, whether you are talking about major real estate markets or minor ones, the characteristics of each area are not uniformly applicable to all real estate properties within their limits. There are outliers and outperformers on the national level just as there are within a given city, but even when accounting for this potential variability, looking into secondary and tertiary real estate markets is a productive endeavor that rewards your knowledge of an area and the work you put into a development or deal.

Understanding and Exploiting Market Inefficiencies

So much about multifamily investing involves acting on the right information and possessing the insight to determine whether a project is worth pursuing. There are countless deals in smaller markets where an attentive investor can capitalize on specific, unique knowledge of the upside to make a lucrative investment—not through luck or privileged relationships but through the willingness to dig into the fundamentals of a real estate market that does not receive the same kind of attention as larger cities. Primary markets, with all of the attention from institutional investors, with so much volume, and with so many assets passing from seller to buyer, have fewer opportunities for a given investor to act on their knowledge and make that investment. These are well-trod grounds. There are fewer stones left unturned.

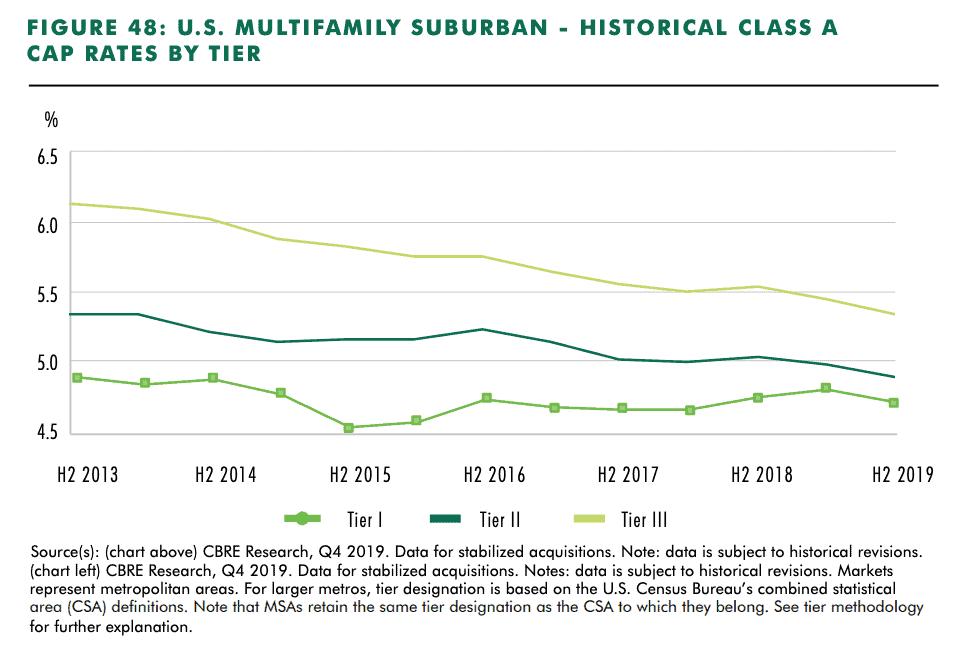

Many investors see primary markets as a safe bet—a known quantity. If investors do not know as much about Columbus, Ohio as they do about Boston, that lack of knowledge can be translated into risk, and that risk can be translated into a higher cap rate for a comparable property in Columbus than in Boston.

Some of the value of secondary and tertiary markets is linked to less tangible factors. Many of the largest real estate investment companies are based in primary markets, these companies commonly build their portfolios with assets based in their home cities, and there is a certain amount of momentum associated with these well-established systems and organizations in place. There is comfort in these established methods and known quantities, but as we have noted, the feeling of comfort is not an objectively effective way to evaluate a real estate investment.

Cap Rate and Debt Arbitrage

Unless one is using all cash, the yield and cash flow of a real estate investment is most often a function of the purchase cap rate and the interest rate on the mortgage that is typically the largest source of capital for a transaction. This spread between the unleveled return (the cap rate) and the interest paid on the debt creates a yield in excess of the unleveled yield for a project. While lenders do at times give lower interest rates to buyers in the larger primary and gateway markets, the difference is much less material than the difference between cap rates comparing primarily, secondary and tertiary markets. Essentially one is using the same cost of debt to purchase higher rates of cash flow when acquiring assets in secondary and tertiary markets that have elevated cap rates.

Gray Capital has built a successful portfolio of assets by combining our knowledge of the market and addressing the market inefficiencies that allow us a clearer path to outsize returns. Secondary and tertiary markets have less of the sales volume that is needed for complete price discovery. With less information out there, there are more opportunities for investors to use their own knowledge of a smaller market to make successful investment decisions. Granted, the lower sales volume can lead to liquidity issues that make it more difficult to find the right buyer at the right price in a smaller market, but issues with lower liquidity are less significant than the concrete advantages of these markets. It’s important to balance proper levels of liquidity in a given market with the right opportunity. You can buy a great deal, but if there is not a clear exit with ample buyers lining up, what was a great deal can turn into a major problem.

Lower Cost of Living

A final, yet significant, piece of knowledge working in favor of smaller markets: Cost of living. Yes, the greater employment options and higher average incomes in a large city can counterbalance the higher cost of living, but this balance is not perfect. Many residents in secondary and tertiary markets pay a lower portion of their income in rent as residents in primary markets, and these cost of living differences are already driving some migration into more affordable areas, with rent prices holding stronger in smaller and less costly markets, especially for those who are able to work from home.

Whether it’s knowledge of primary and secondary real estate markets or a firm grasp of how to calculate the Internal Rate of Return, knowledge and expertise are immensely important to successful real estate investment. At Gray Capital, we are interested in creating successful investors, and we provide these blog posts, reference materials, and reports for free in service of that goal. If you’re interested in receiving more up-to-date information, reports, and news about multifamily real estate investment, follow the button below to sign up for our free weekly Gray Report.