A diversified portfolio of cash flowing multifamily assets in growing Midwest markets.

A diversified portfolio of cash flowing multifamily assets in growing Midwest markets.

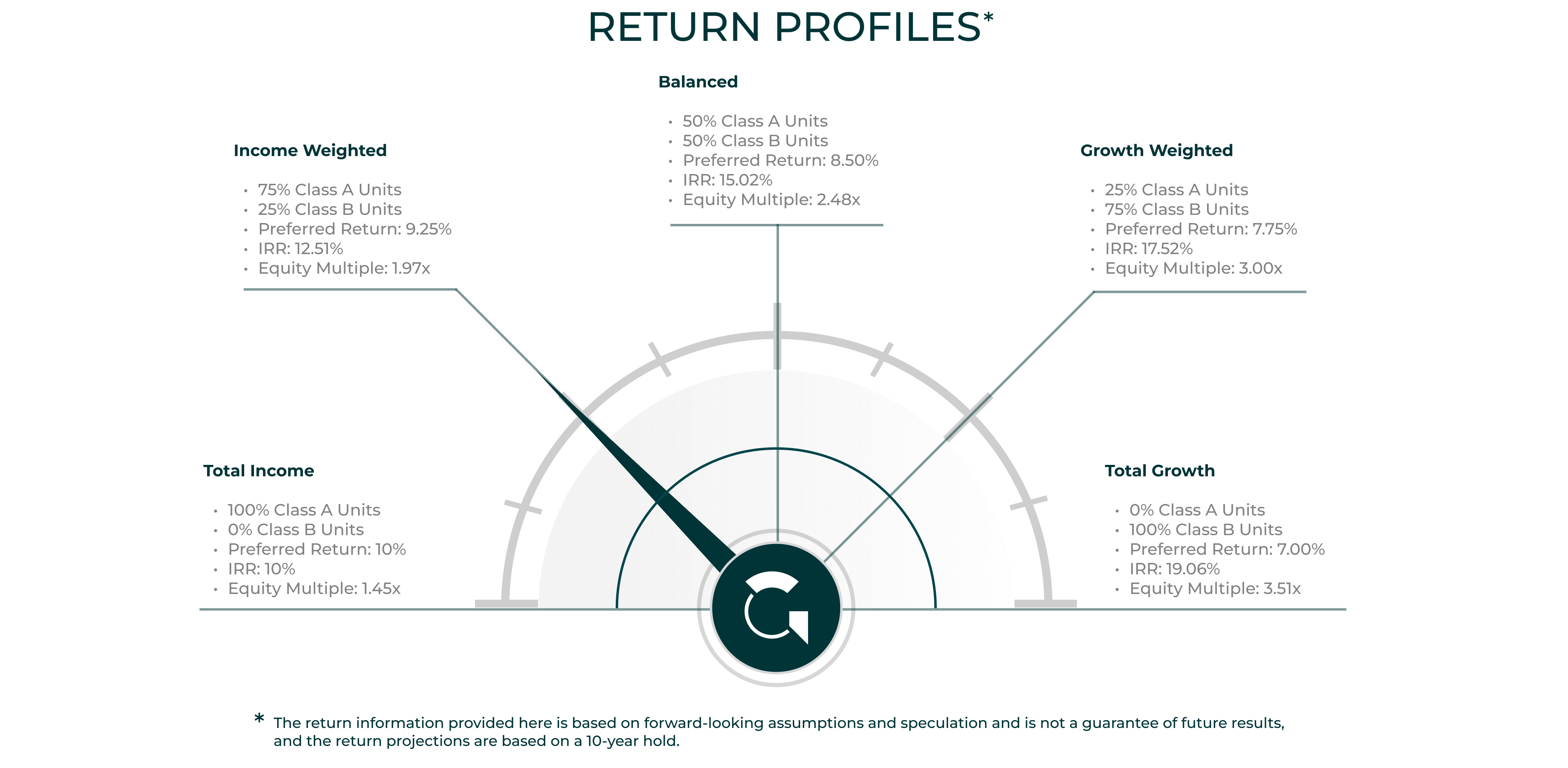

Invest with confidence to create tax-efficient cash flow up to 10% annually (A Units) or upside targeting 4X (B Units). Combine A and B units to create a tailored risk and return profile designed to achieve your goals.

Click the button below to learn more about The Gray Fund.

Invest with confidence to create tax-efficient cash flow up to 10% annually (A Units) or upside targeting 4X (B Units). Combine A and B units to create a tailored risk and return profile designed to achieve your goals.

Click the button below to learn more about The Gray Fund.

The Gray Fund is centered around the dynamic investment strategy that Gray Capital has successfully used to acquire over 10,000 multifamily apartment units providing a 30% average return (IRR) to investors since launching in 2015.

Now is the time

to invest in apartments

- Lack of development over the last decade has lead to a record supply and demand imbalance for housing

- Single-family homes are out of reach to many, increasing the demand for rental housing

- Downsizing baby-boomers are renting for flexibility

- Would-be homebuyers and downsizing baby boomers drive up apartment demand

- Incredible tax benefits including tax-sheltered income

- Apartments are the best risk-adjusted hedge against inflation

- Apartments have proven to be recession resilient

- Global search for yield will keep cap rates low

- Insulated from stock market and geo-political risk

- Ability to force appreciation and increase returns

- Economies of scale compared to single-family homes and duplexes

- Stable stream of income from cash-flowing apartment assets

Fund criteria

- Value-Add and Core Plus Strategies

- Primary Investment Region: Midwest, USA

- Growing Secondary/Tertiary Markets

- 100+ Unit Properties

- 1980-2022 Vintage

- Stabilized A/B-Class Assets

- Market Rate Multifamily Properties

- 7-10 Properties

- 75% Average Loan to Value

Fund Terms and Structure

The structure of the Gray Fund, which includes income-focused Class A units and growth-oriented Class B Units, allows investors to create a risk/return profile that meets their specific investment goals.

- 5-10 Year Term (Close-Ended)

- $100M Targeted Equity

- Dual-Class Structure for Individualized Risk Profiles

- 7%** or 10%* Preferred Return, Distributed Monthly

- 18-25% Target IRR**

- $100k Min. Investment First 6 Months of Fundraise

- $250k Min. Investment After 6 Months

- 80/20 LP/GP Split, 60/40 After an 18% IRR **

- Below-Market Fees

*Class A Units; **Class B Units