Gray Report Newsletter: February 15, 2024

Could Multifamily Crash? Really?

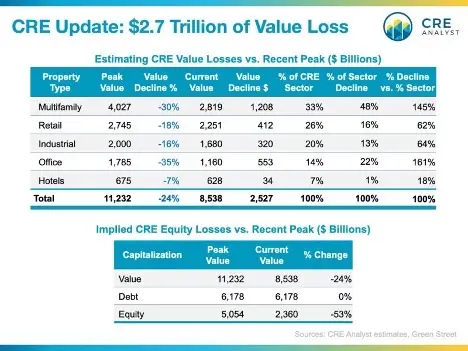

This month’s inflation report came in slightly higher than expected, causing some worry that the much-anticipated interest rate cuts from the Fed may not arrive as quickly as previously thought. A “higher for longer” environment is one reason why some are pessimistic about multifamily in 2024, but there is little evidence for continued declines in multifamily valuations, which are already 20-30% below the peak. Consistent demand, a more balanced supply/demand environment after 2024, and, yes, lower interest rate expectations are a strong counter-balance to multifamily doomsayers and help explain why investors intend to be far more active this year compared to 2023.

Multifamily, the Nation, and the Economy

Multifamily Is at High Risk of Continuing Its Historic Crash in 2024—Here’s Why

Via BiggerPockets: This article argues that lower valuations, lower rent growth, higher expenses, and persistently-high interest rates support a continued multifamily downturn in 2024. The pillars of this pessimistic argument are shakier than the author may admit.

- Jan. CPI: Annual Inflation Continues Decline, from 3.4% to 3.1% (Bureau of Labor Statistics)

- Employment Market and the Fed (Marcus & Millichap)

- Freddie Mac Economists’ Expectations for 2024: Multifamily Rent Growth at 2.5% (Freddie Mac)

Multifamily and the Housing Market

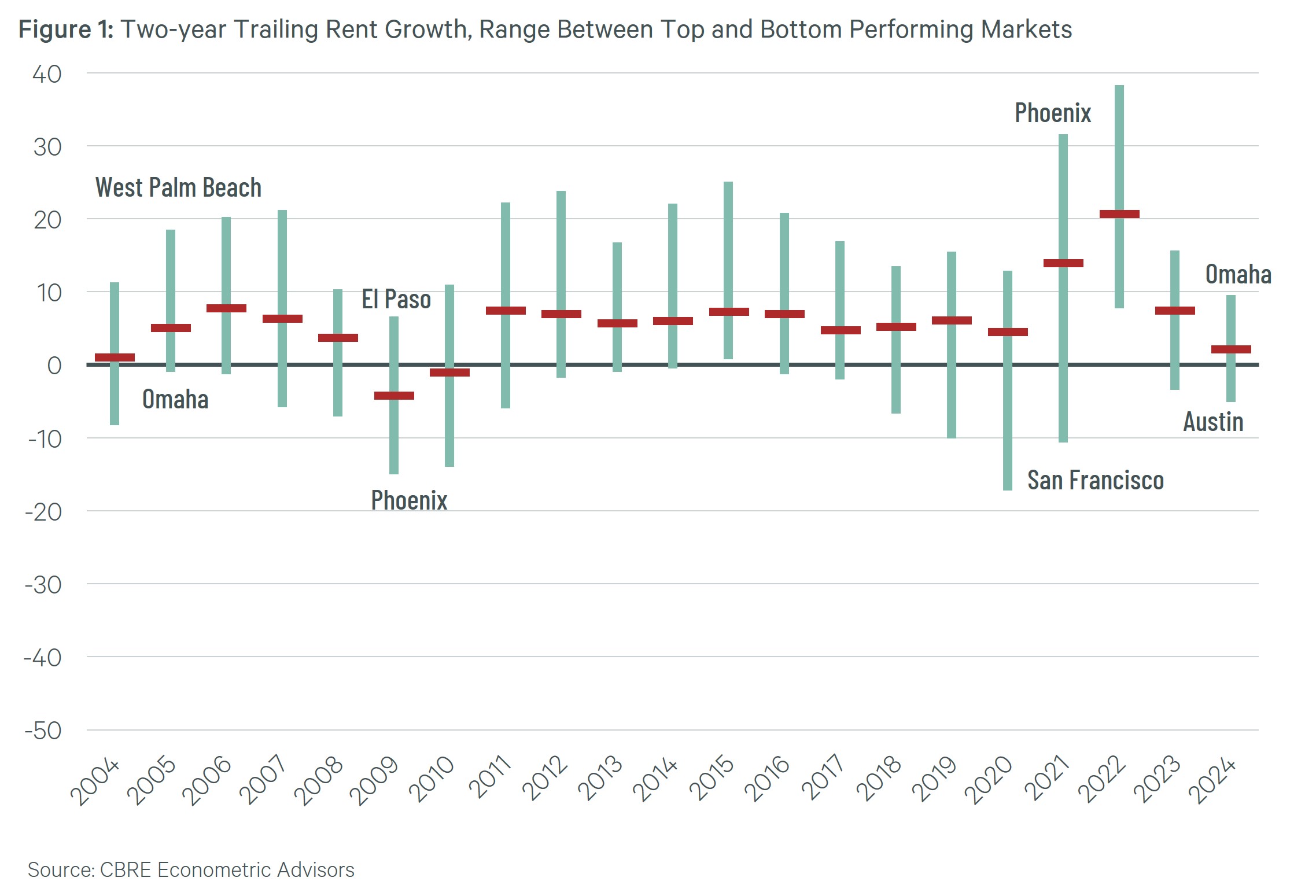

The Gap Between the Top and Bottom Multifamily Markets Will Be Narrower Than Usual in 2024

CBRE: “Rent growth for the median multifamily market will slow to just over 2% this year, its lowest level since 2010. The upshot is that short-term performance will be only partly driven by differences among markets, and properties will need strong asset management to generate better-than-average returns.”

- HUD’s Julia Gordon Calls for Boost in Housing Supply and Quality (GlobeSt)

- The Age of the U.S. Housing Stock [IS GROWING] (NAHB)

- Investors See ‘Huge Opportunity’ To Cash In On Stigma-Prone Manufactured Housing Sector (Bisnow)

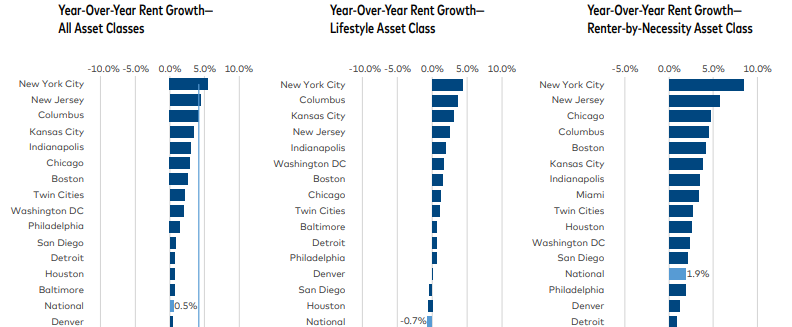

Multifamily Markets and Reports

Jan. 2024 Multifamily Report: Supply the Key to Multifamily’s Future

Yardi Matrix: From the report: “New supply, however, is not spread evenly. Deliveries are greatest in high demand and fast-growing tertiary markets such as Huntsville, Ala.; Port St. Lucie, Fla.; Colorado Springs; Boise, Idaho; and secondary markets such as Austin, Miami, Charlotte, Denver, Phoenix and Nashville.”

- 20 Percent of Commercial and Multifamily Mortgage Balances Mature in 2024 (MBA)

- Protected: America’s Hottest Rental Markets at the Start of 2024: Miami Holds Leading Spot Amid Rising Competition in the Midwest (RentCafe)

- Student Housing Pre-Lease Rate Reaches All-Time High in January (RealPage)

Commercial Real Estate and the Macro Economy

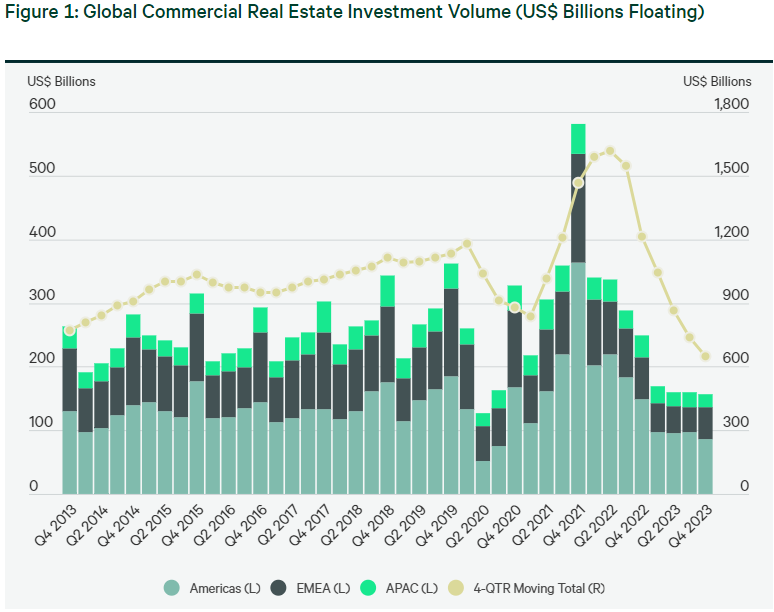

Global Investment Activity Stays Subdued in Q4; Recovery Expected in H2 2024

Via CBRE: “Global commercial real estate investment volume fell by 37% year-over-year in Q4 2023 to US$157 billion. 2023 annual volume fell by 47% year-over-year to US$647 billion.”

- $929B In Commercial Property Loans Set To Mature In 2024 (Bisnow)

- The Interdependency of Office and Retail (Colliers)

- One Size Does Not Fit All in the Office Market (MSCI)

Other Real Estate News and Reports

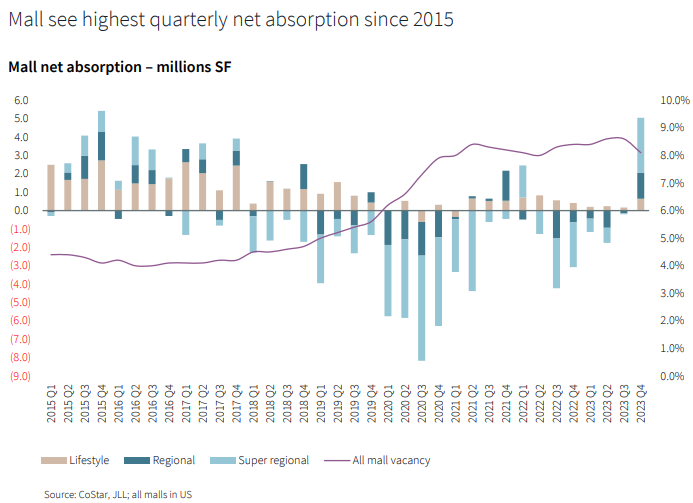

United States Retail Outlook Q4 2023

Via JLL: “Retail net absorption surged 37.2% quarter-over-quarter to 17.6 million s.f. – boosted by a significant jump in mall net absorption. Conversely, deliveries decreased 5.1% from the previous quarter.”

- Beyond the Rent: How Market Conditions Influence Rent Discounts (Moody’s Analytics)

- The Housing Market Sees the ‘Biggest Jump’ in 3 Years (Realtor.com)

- Why Aren’t Developers Building in the Midwest? (John Burns Research and Consulting)