Made in the Midwest

Source – CBRE: “Made in the Midwest”

Summary

- Manufacturing developments in the Midwest.

- Part of the “race to re-shore”

- [relevance to multifamily: Job growth correlates with rent growth]

- Nicely-arranged report with examples of manufacturing developments in each Midwest state

- Indiana, Kansas, Ohio have the largest projects listed in the report

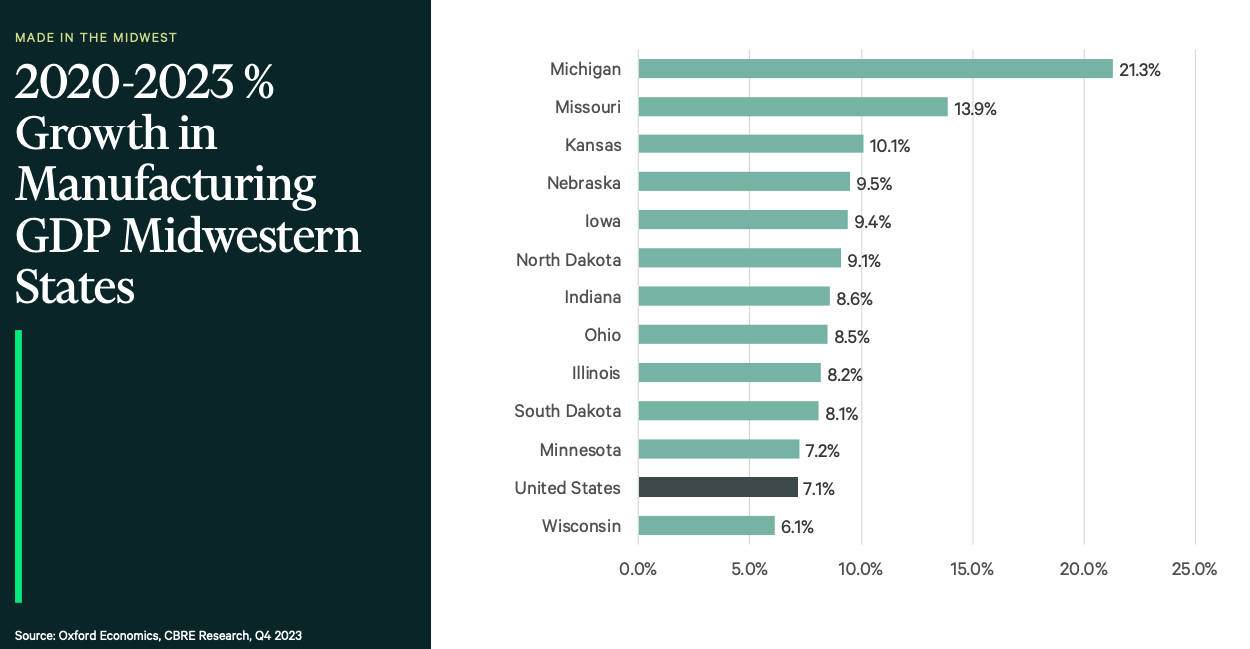

- Also has data for Manufacturing GDP growth, Manufacturing Employment growth, Manufacturing wage growth from 2020-2023

- Michigan and Missouri some of the best numbers for manufacturing growth

The “onshoring” or “reshoring” movement is more closely linked to industrial real estate than apartment real estate, but these plans to bring more manufacturing and production within the country can really transform a market or sub-market. I’m not sure what the effect could be across the country because I don’t know how much or how fast this onshoring is happening, but when it comes to specific, knowable projects—the ones that cost billions of dollars and bring thousands of jobs, you can see a clear picture of more people moving nearby, money flowing into an area, and housing demand increasing. Multifamily, I would argue, is uniquely able to address this demand, but it requires some foresight and planning.

I’m not sure there’s an easy metric for calculating how much manufacturing growth is expected in the future; otherwise, I bet CBRE would include it here. They list 3 major projects for each Midwestern state, but again, I don’t know how much the projects listed are representative of the other developments going on. At the very least, their examples here will have a big impact on the surrounding area.

There’s things like a $55 million, 150-jobs-bringing plant just built by Milwaukee Tool in Wisconsin, a $3.7B Eli Lilly project adding 900 jobs in Indiana, and a huge $20 billion, 3,000-jobs-adding Intel mega-site in Ohio just outside of Columbus.

Those projects listed for Ohio also include separate EV plants for Ford and Honda promising another 4,000 jobs, and if these examples are any indicator of general manufacturing growth prospects, Ohio is the clear leader in the Midwest.

That being said, there are other indicators, like how much manufacturing jobs, wages, and GDP has grown between 2020 and the end of 2023.

- Michigan leads for both manufacturing GDP growth at 21.3% (far and away the best here), and manufacturing job growth at 9.4%, and Indiana leads in manufacturing wage growth at 16.3%, just a hair above Missouri’s 16.1% wage growth.

It will be interesting to see the kinds of industries that will be the most common target for onshoring/reshoring efforts, whether that’s due to being the most profitable or having the most government resources behind them.

This report argues that the draw of the Midwest lies at least partly in its “ample land available for development and a reliable workforce,” and again, if reshoring continues as a major trend, it’s worth thinking about the details of the population and geography that would be attractive to manufacturing projects. How much is temperature, rainfall, highway proximity, water aquifers, or other features an important for these kinds of projects?