CRE Overview: Stable Multifamily, Improving Economy

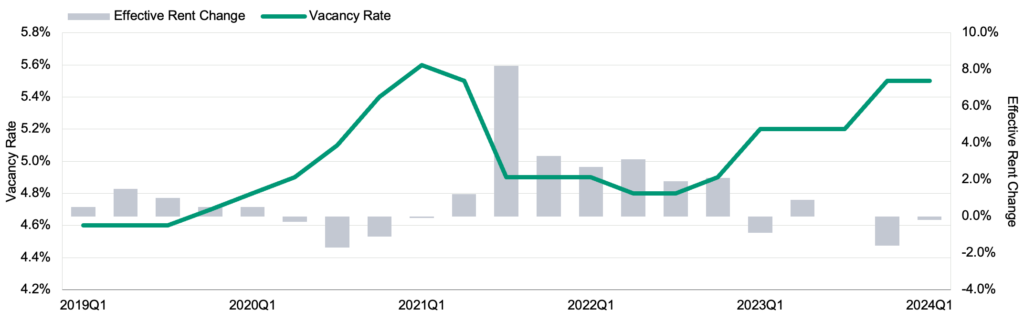

Source – Moody’s Analytics: “Q1 2024 Preliminary Trend Announcement”

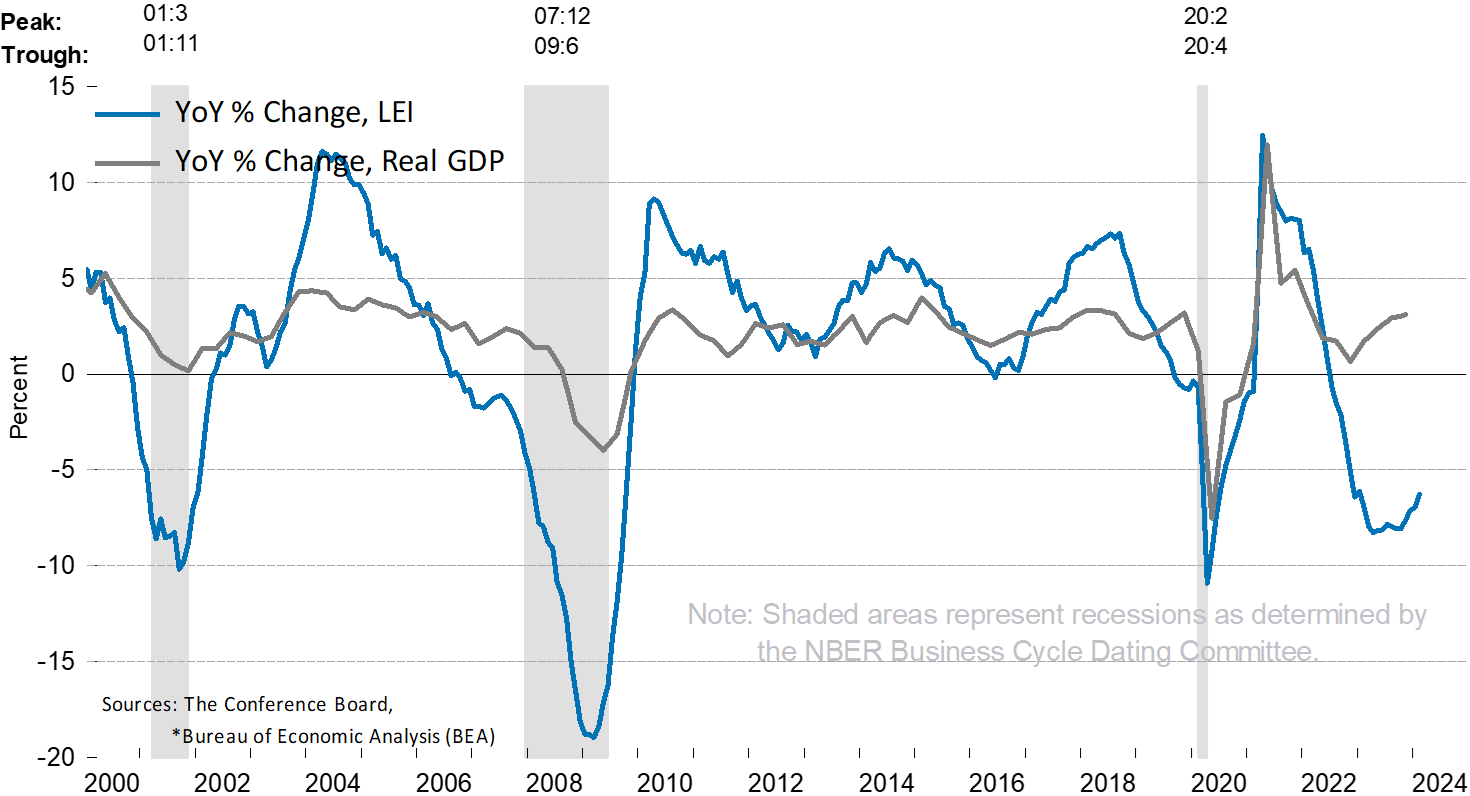

Source – The Conference Board: “U.S. Leading Economic Indicators”

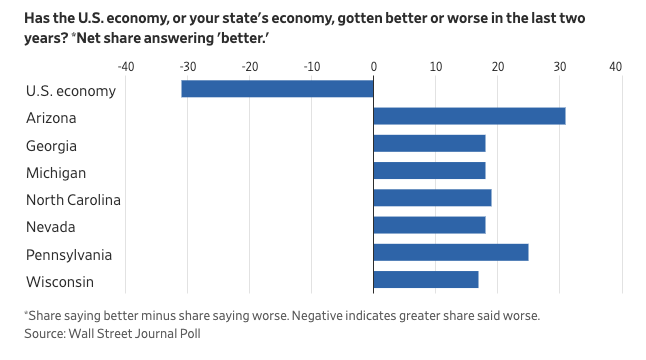

Source – The Wall Street Journal: “What’s Wrong with the Economy? It’s You, Not the Data”

Summary

- “Apartment and Retail in Holding Pattern, Office Evolution and Stress Continued, And Industrial Fundamentals Leveled Off”

- Economy normalizing

- “Real GDP forecasts for 2024 revised up to 2.1%”

- Apartments “absorbed at a slightly faster speed”

- Apartment construction delays remain

- Office market: “slow bleed” and no doomsday yet

- Retail: Remarkably stable.

- Industrial: slight uptick in vacancy

Economy: This isn’t explicitly stated in the Moody’s report, but alongside the GDP revised upward is recent data from the Conference Board showing the first positive monthly number for their Leading Economic Indicator Index for the U.S., the first positive monthly number since February 2022, more than 2 years ago!

There’s a long way to go before we get past all of the accumulated bad economic baggage and bad vibes of the recession. It’s trending up now, finally, but the Conference Board LEI calculation still points to an economic downturn at the moment.

BUT—just look at this trend! Even when the report forecasts “headwinds to growth,” the accompanying graph of the LEI 6-month growth rate clearly looks like it’s trending up and is poised to break through the danger zone and into a less fraught and paranoid economic moment.

Might as well use this opportunity to point to another study out from the Wall Street Journal that gives us a little more data behind this so-called “vibe-cession” where people’s perception of the economy is more negative than the hard numbers indicate. In a poll of individuals living in swing states,

- When respondents were asked about the national economy, whether it’s doing better or worse, most people think that it’s doing worse. When asked how their own state is doing, the respondents said it’s doing better.

- Most people, a whole “74% of respondents said inflation has moved in the wrong direction in the past year.”

- Really love this quote: “This assessment, which holds across all seven states, is startling, sobering—and simply not true. I’m not stating an opinion. This isn’t something on which reasonable people can disagree. If hard economic data count for anything, we can say unambiguously that inflation has moved in the right direction in the past year.”

- This paragraph is wonderful, but it is not typically the way I have encountered coverage of this mismatch between economic sentiment and economic data.

- From one side, you might see someone mention people’s poor sentiment as shorthand for things going bad. Ex: “You know, the jobs report did come in stronger than expected, but a recent survey shows that most respondents, by a wide margin, still believe that the economy is doing worse. That’s a big problem, and really a reflection of the bad policy decisions of this administration.”

- From the other side, I’ll here something like: “Despite the great policy decisions of this administration leading to an improved economy, most people still aren’t getting the message. What will it take to get through to people and address these very legitimate feelings that people have? You know, a lot of people are worse off, and there’s a lot of the economy that isn’t fully captured by these numbers.”

- Again, this paragraph that I like in the Wall Street Journal offers a tantalizing third option: “I know that you feel this way, but your feelings are wrong. Nope—no—don’t go carrying on. Here’s the numbers. The sky is blue. It is not red. You are wrong.”

- Jobs data just came out showing 303,000 jobs added, which is pretty good numbers. Pre-pandemic, that 303,000 number would be on the high end. I mean, from June 2010 to Feb 2020, the peak was 387,000, and the average was a like, 185,000. Good jobs numbers, sad feelings.

Returning to the Moody’s report, they take stock of Retail, Industrial, Office, and Apartment real estate

- Apartments look like they’re at the trough right now when it comes to occupancy, and while this report mentions high homebuying costs as a reason why demand remained flat instead of going down due to elevated apartment supply, I am not as convinced.

- The idea is that would-be homebuyers see the high cost of purchasing a home, homebuyer demand goes down, and apartment demand goes up.

- This idea has persisted after gaining traction during the early run-up in home values during the pandemic, and even then, there were compelling counter-arguments saying that apartment and housing demand doesn’t really work that way: It’s not this zero-sum game where lower homebuyer demand brings higher apartment demand. Or if it does, the effect is negligible.

- Instead, a better idea is that when housing demand goes up, apartment demand goes up. Far more typically than SFH competing with apartments are times when SFH values and apartment rents go up at the same time.

- The only reason that apartment demand has diverged from homebuying demand in the past 18 months is because we’ve got huge, historic amounts of new apartment supply entering the market.

- I haven’t yet read a study that could tell us if high home prices meaningfully increase apartment demand, which is frustrating because there are a lot of really great reports by expert analysts, and they still throw that idea in there like it’s measured fact.

- Moving to the office sector, they’re depiction is of a sector holding on, still holding on, “slowly bleeding” as they put it, but certainly not dead. It definitely feels like, as the economy gets closer to normal, there should be at least a partial recovery in the office market, but we’re not there quite yet. I’m guessing the the performance of office real estate doesn’t perfectly track with remote working trends due to the length of leases and other factors, but as it stands now, no revivification of the office market.

- For retail, it’s had an uncanny stability compared to other CRE sectors, with demand steady, basically a flat plane compared to the uphills and downhills of apartment, office, and industrial performance.

- Speaking of which, for industrial real estate, vacancy looks like it’s ticking up, but rents never went negative in the past few years, unlike retail/office/apartments. There’s no reason to panic here, but maybe some cracks forming in the once-flawless and stalwart industrial sector.

Following these accounts of CRE sectors, the report looks at regional variations for different sectors and individual markets, noting, for instance, that “Minneapolis’ zoning reform, which removed single-family-only zoning and minimum parking requirements over the past five years, started showing the desired benefits of rent correction, especially for the metro’s moderate- and lower-income renter households.”

For apartment markets, there’s some additional evidence of lower rent growth in the Sunbelt compared to the Midwest and Northeast, but not a whole lot of data, just some nice supporting evidence.

In all, the report wraps things up proclaiming that “2024 will be another year packed with uncertainties but many more exciting opportunities, too.” Is this a take? Doesn’t seem like much of a take!

- Do you think George Washington said this to the troops at Valley Forge?

- Here’s a juicier take: This report has three different authors listed, but I know a Thomas DiSalvia quote when I see one! Last week, he told us that cities “are better thought of as living and breathing organisms than static masses of concrete and asphalt,” and this week, we’ve got the whole uncertainty and opportunity thing going on. I love it!