2024 U.S. Investor Intentions Survey: Investment Activity Expected to Increase

Source – CBRE: “2024 U.S. Investor Intentions Survey: Investment Activity Expected to Increase”

We’ll be looking at demand from apartment renters in a moment, and I’ll say right now that compared to the demand from multifamily investors, we have a fairly crystal-clear view of the demand of apartment renters. Maybe it’s just me! But I can’t forecast the whims of apartment buyers and sellers, especially when sales volumes have been so low.

Will investor demand pick up? More accurately, is buyer demand going to pick up enough to match the going sale price for apartment properties?

CBRE SAYS: There’s going to be more buying, and there’s going to be more selling. “More than half of the investors surveyed plan to buy more assets in 2024 than in 2023.”

- Note that this survey covers all of CRE, and is not a multifamily-specific survey.

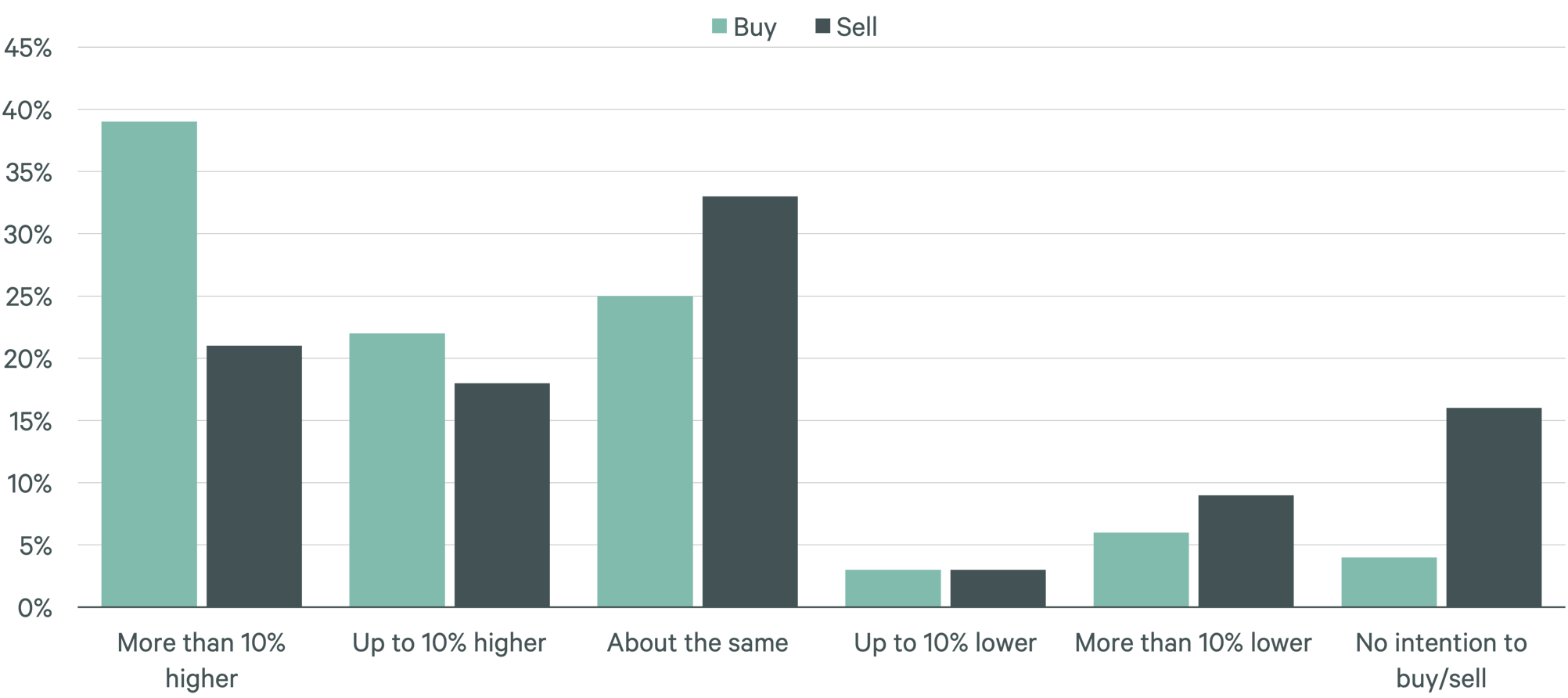

- Nearly 40% intend to increase their buying by over 10%, 20% expect to up their buying by 0-10%, and 25% think it’ll be about the same.

- For Sales, the numbers are not as strong but are still positive: 20% expect to sell more than 10% compared to last year, 17ish% expect a 0-10% increase, and 37% say it’ll be about the same.

- COMPARE THIS TO 2023: Nearly 60% said that they would buy less, and over 50% said that they would sell less or the same amount of properties as the year prior.

- Vastly different picture of investor intentions.

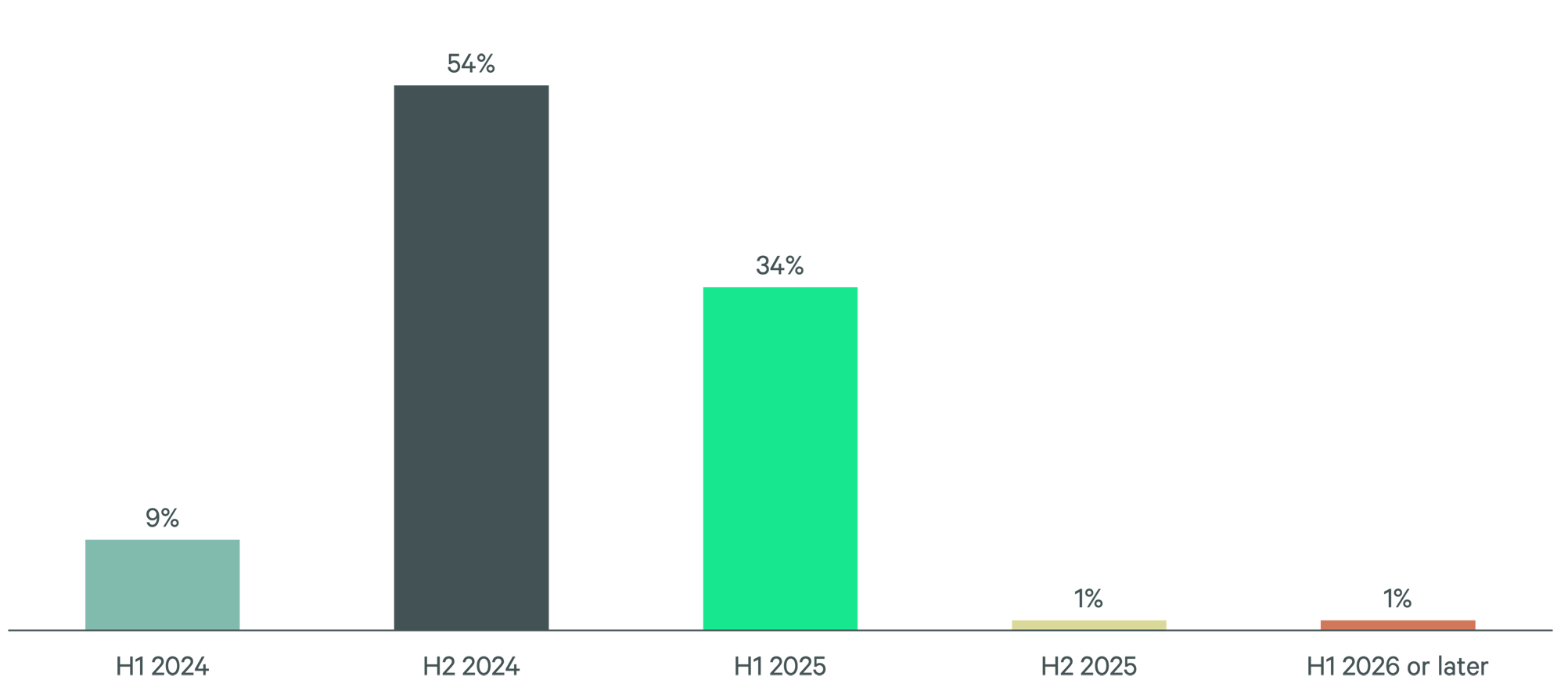

With that in mind, when can we expect the multifamily investment market to heat up?

- H2 2024. That’s the target.

- I think this is very heavily tied to interest rate expectations.

- If inflation stays a little higher (which is a possibility given the recent signs of strong economic activity), then investors could delay jumping back into the market until later this year or early next year.

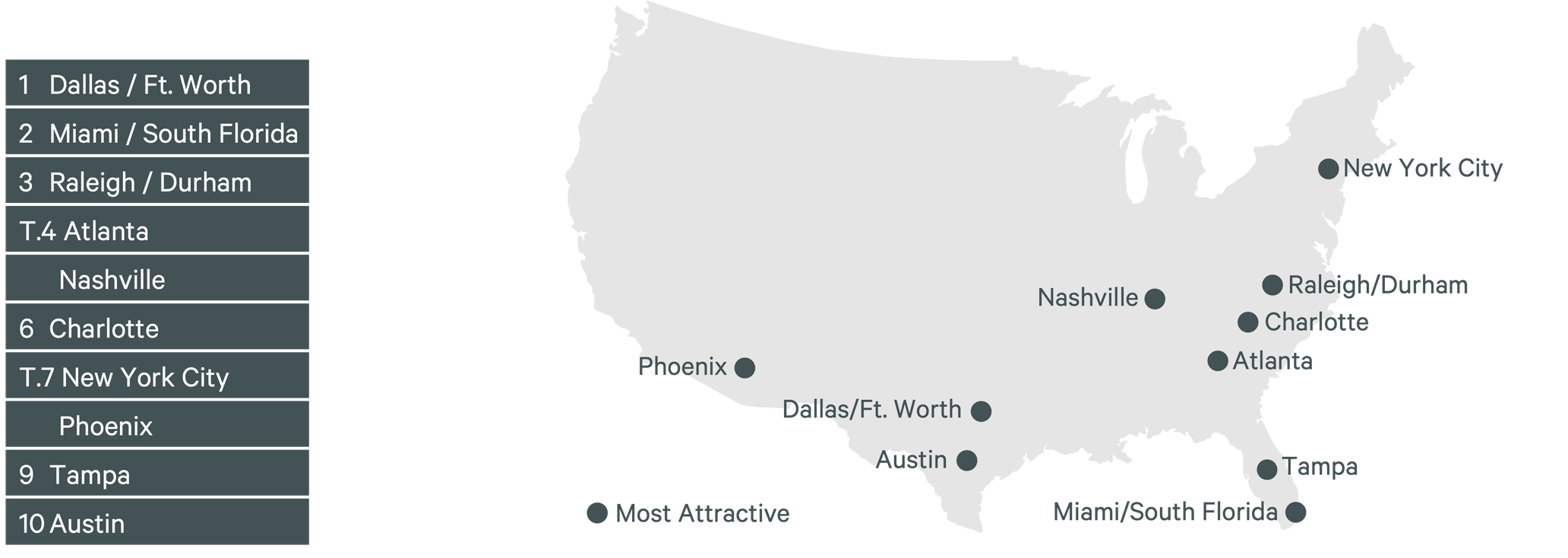

What markets are these CRE investors targeting?

- DFW, Miami, Raleigh-Durham, Atlanta, Nashville, Charlotte, NYC, Phoenix, Tampa, and Austin. — this is roughly the same list as the top-performing markets, except Boston is among the top-performing markets and Phoenix is not.

“Investors continue to expect pricing discounts across all sectors,” reports this report, but “just under half of investors expect less than 10% pricing discounts for multifamily and industrial & logistics assets,” which, what, does that mean that just over half expect more than 10% discounts? I’d like more clarity here but I think CBRE’s point here is the multifamily and industrial property prices may not come down as much as office properties, considering that multifamily and industrial show up as “the most sought-after property sectors” according to their report.

The final paragraph of this report is a least a little bit funny. They review how investors expect lower activity in H1 and higher activity in H2, and CBRE closes things out by saying: “CBRE concurs with this view as interest rates fall and financial conditions stabilize.” I love it when the researchers and analysts tell us where they stand! And maybe I thought that it was kind of funny how the report speaks for CBRE as a company, and I want to take this opportunity to remind our audience that the opinions I express on the Gray Report are mine and mine alone, and they are in no way representative of the official position of Gray Capital and its subsidiaries.