One Good Year Does Not Solve America’s Housing Shortage

Source – Moody’s Analytics: “One Good Year Does Not Solve America’s Housing Shortage”

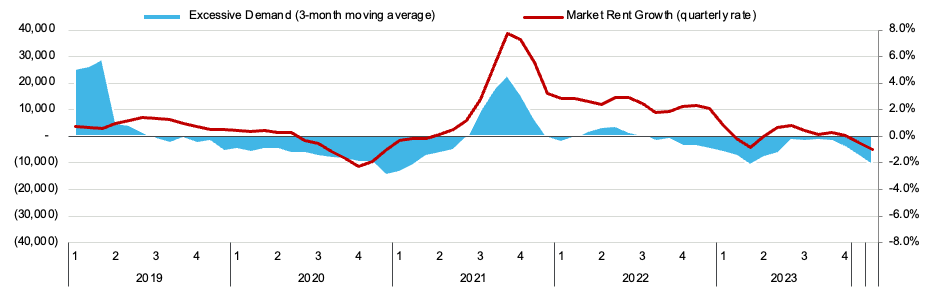

Multifamily construction projects increased by 11.1% in succession, reaching a seasonally adjusted annual rate of 509,000 units. However, household formation and mobility, which were high during the last half of 2021 and early half of 2022 due to lifestyle changes, location preferences, and lower mortgage rates, have now returned to normal. Although there was an excess supply of housing in the market for a year, it was only considered excessive when compared to the constrained demand due to affordability issues. There is still a long way to go in addressing the chronic housing shortage, but rental prices have responded with a modest decline of 0.7% last year, which is just a few dollars below the 2022 levels.

As we’ll see in the Harvard Joint Center for Housing Studies report, rents for high-end apartments have gone down much faster than rents for lower-end apartments, and I’ll mention too that this graph for apartment demand shows a different trend than the one from the Joint Center for Housing Studies, which shows demand ticking up.

Graphs notwithstanding, Moody’s would agree with Moody’s main point, which is that we really need more housing in the country, rental and otherwise.

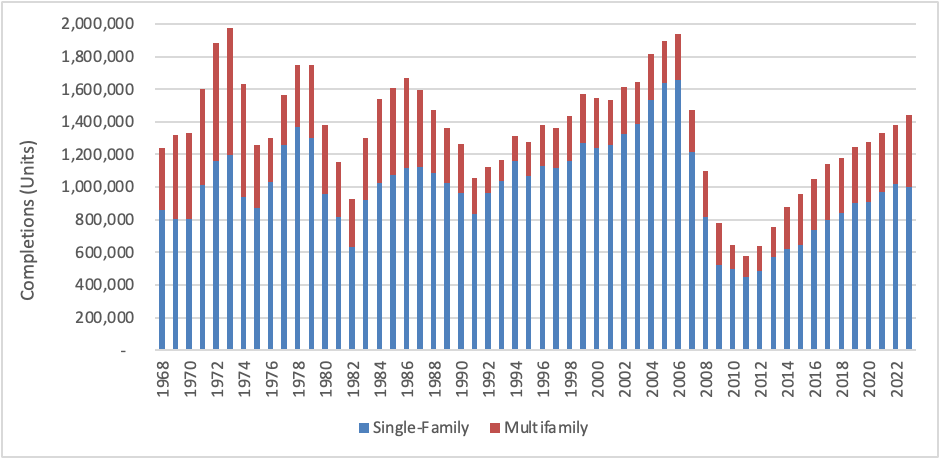

The Moody’s report illustrates this with a graph of housing completions by year. It bothers me that this graph doesn’t go up to 2023, but I was able to do a quick Google, and I can tell you that the number for 2023 is 1.5M total housing units completed, which is above the 1.1M average pre-GFC/Great Recession, but as Moody’s explains it, after that housing crisis in 2007-2008, the average units built were only 765 thousand. We may be above average for new housing, but we are catching up, and as the report puts it:

“[I]t is important to emphasize that preserving and increasing housing stock to restore a more balanced housing market will require many years of joint effort and creativity from both public and private sectors. The cost of land and access to construction financing are key factors to consider.”

Not only will it take many years to build enough housing, it’s going to take better financing.