Fannie Mae 2023 Outlook, a Sobering Outlier

Fannie Mae’s recent forecast for this year is titled, “2023 Multifamily Market Outlook: Turbulence Ahead,” and their projections describe a multifamily market with notably weaker performance than the forecasting down by institutions like Marcus & Millichap and Yardi Matrix.

We’ve covered Fannie Mae’s multifamily market commentary before, and while they release this each month, Fannie Mae focuses on a different aspect of the market each month. Some months may not be interesting for everyone, but this month is a real doozy, so to speak. In a far more lengthy and detailed commentary than usual, Fannie Mae outlines their expectations for the multifamily market in 2023.

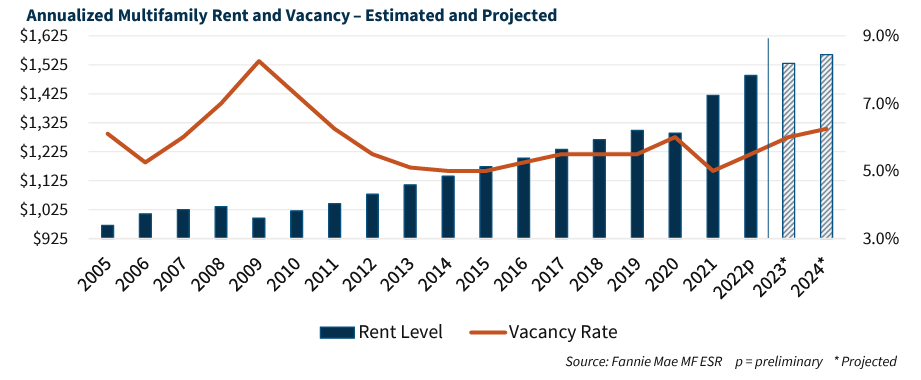

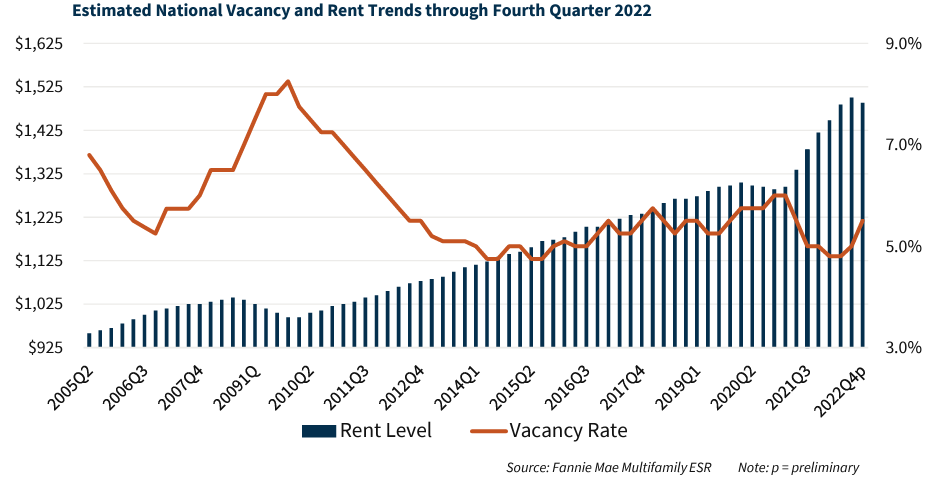

Expected rent growth: 1.5% – This is not the 3.1% we heard from Institutional Property Advisors or Yardi Matrix.

Vacancy: Increase to 6% in 2023

Absorption: Will start out negative but end the year at a positive 492,862 units, which is such a precise and exact number that I’m sure the prediction is going to come true. Pinpoint accuracy aside, this 492,862 looks pretty good compared to the negative 103,485 of 2022, and it’s not so much less than the huge 661,910 units absorbed in 2021.

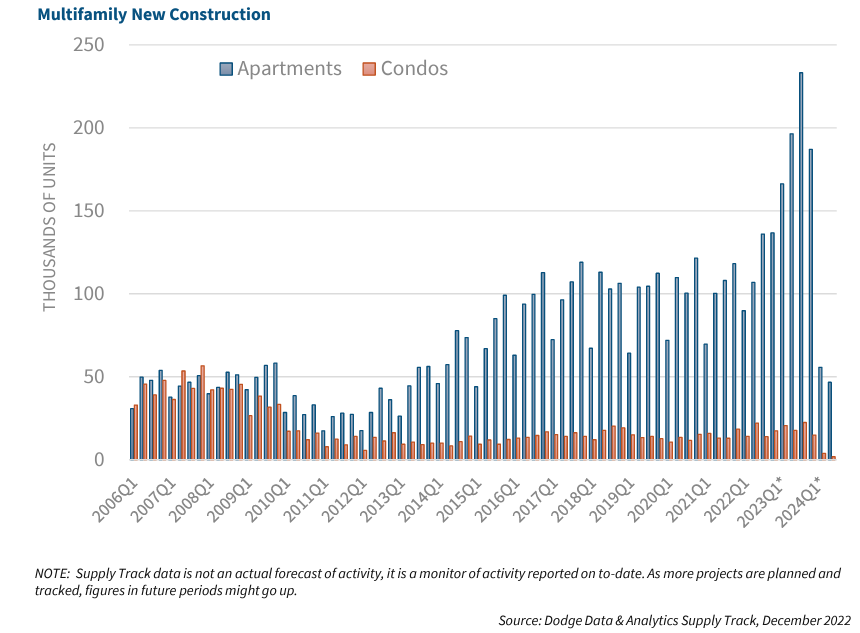

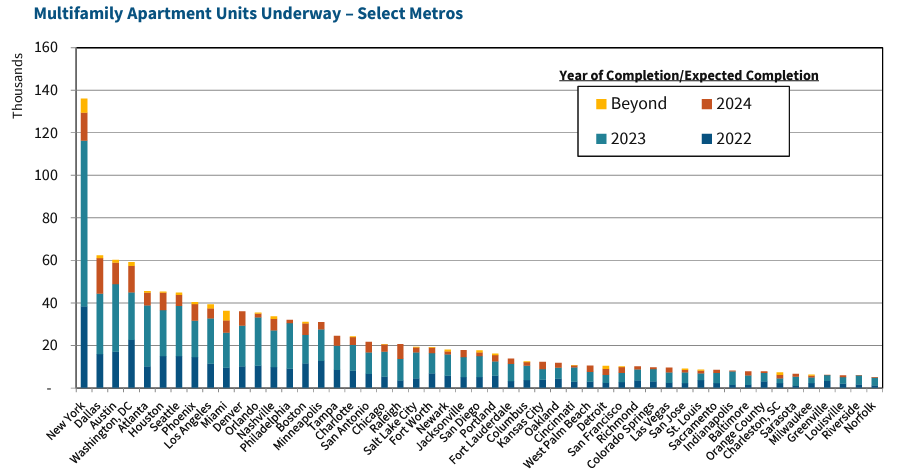

Supply: 783,000 units are “expected” to be completed, but Fannie Mae very much doubts that completions will be that high. Even so, big supply increases are going to have an impact on a few key markets.

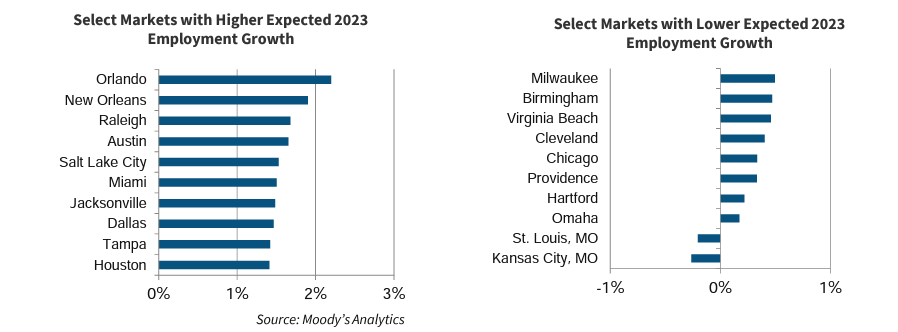

I have been curious to know how Sun Belt markets like Tampa, Austin, and Miami might fare in 2023, but unlike some of the other forecasts that expect solid rent growth in these markets, which stand out by having strong job growth than other Sun Belt markets, Fannie Mae argues that the job growth is not strong enough to generate the amount of housing demand in these markets that will be necessary to meet the increased supply expected this year.

Behind these projections for national and market-specific multifamily performance is Fannie Mae’s economic outlook:

According to their economic forecast, total employment is expected to decrease by 1.4% by the end of the year, unemployment is expected to increase from the current 3.5% to 5.4% by Q4 of this year.

Fannie Mae describes how this might progress, saying, “While the year now appears to have ended on a stronger footing than previously anticipated, we continue to expect a modest recession to begin during the first half of the year and are forecasting Q4/Q4 GDP growth for 2023 to be negative 0.6 percent, a tick down from our previous forecast.”

On the investment and acquisition side of things, Fannie Mae anticipates lower sales volumes, closer to $200 million than $275 million for the year.

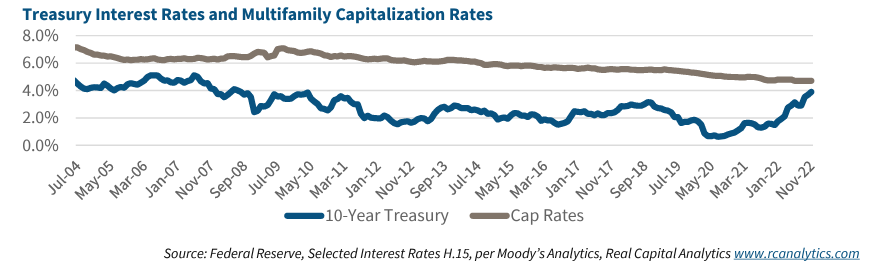

Cap rates are expected to move up slightly, from 4.7% to 5%

In all, Fannie Mae’s report is a relatively harsh and unwelcoming forecast for 2023, and as much as I want to say that all of this hangs on the direction of the economy, they anticipate readers like me and say, as their closing sentence, that “[i]t is important to note that whether the expected recession occurs earlier in the year or later, we expect the multifamily housing market to experience a softening in demand in 2023 and extending into 2024.”

It’s as if they wrote “Hey, Matt, I know you’re reading this, and you’re going to reassure yourself that this harsh forecast will change once the economy stabilizes. Don’t count on it, Matt.”

Unfortunately for Fannie Mae, they aren’t the boss of me. Even though they explicitly told me not to, I still do think that this forecast is based on a grim view of the economy in 2023 that underestimates housing demand. Now, Fannie Mae’s forecast could be true if the economy slides into a deeper downturn or recession, but in cases where the economy doesn’t take such a huge hit, I would disagree with Fannie Mae’s description of softening demand. Instead of widespread lower demand, I would expect the challenges to be most keenly felt among class-A assets located in specific markets with a high percentage of newly-built apartment buildings relative to existing supply.