Interest Rates, Uncertainty, and a Multifamily Recovery

With earnings reports from major apartment REITs sharing a similar theme of higher-than-expected performance, the multifamily investment market could heat up in the second half of the year. Expectations for interest rates, however, are less-than-optimistic, with the Federal Reserve “grappling with uncertainty” as multifamily buyers and borrowers—some of whom are approaching distress—are challenged with higher financing costs.

Multifamily, the Nation, and the Economy

Commercial Real Estate Prices Dip in April, but Not Everywhere

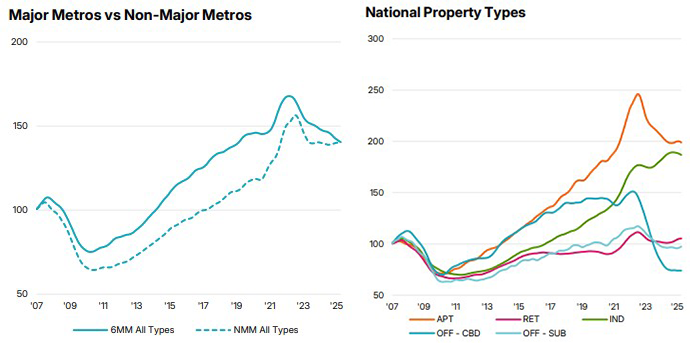

MSCI: “New uncertainty about the U.S. economy may not be fully reflected in pricing or deal flow for some time. In April and March, deal volume was on par with that of a year prior,” but CRE valuations are improving in secondary/tertiary markets (that aren’t Boston, LA, NYC, D.C., San Francisco, or Chicago).

- Strong Operational Performance in 1st Quarter REITs Earnings Calls (RealPage)

- Multifamily Investors Brace for Change As Trump Mulls End to GSE Conservatorship (GlobeSt)

- 94% of Multifamily Starts Are for Rental Units (NAHB)

Multifamily Markets and Reports

Headline Rent-to-Income Ratio Returning to Pre-Pandemic Levels

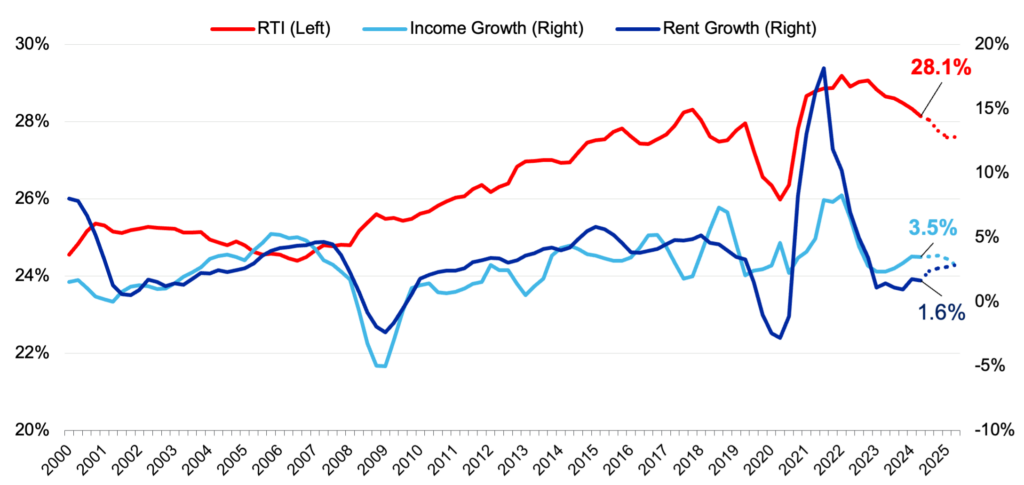

Moody’s Analytics: “The average rent-to-income (RTI) ratio at the national level has declined for six consecutive quarters and finished at 28.1% in the first quarter, nearing pre-pandemic levels. This improvement was driven by the rise in median household income, which held steady and outpaced rent growth on a year-over-year basis.”

- Realtor Confidence Dips, Lower Home Sales Expected (NAR)

- Agency CMBS Spreads Tighten to Pre-Liberation Day Levels (Berkadia)

- Some home buyers opting to wait amid uncertainty (Zillow)

Multifamily and the Housing Market

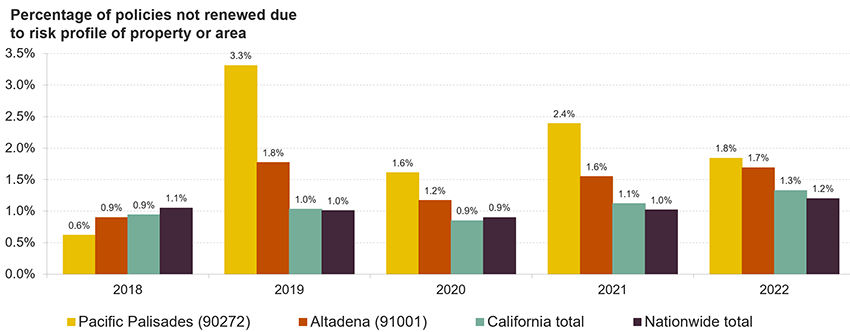

California Homeowner’s Insurance Is a National Bellwether

Harvard Joint Center for Housing Studies: “In California and other states, insurance regulators require insurance premium discounts for specific home mitigation actions. Innovative product solutions such as climate endorsements in residential insurance policies can further incentivize incorporation of climate-resilient features into homes rebuilt with insurance claims payouts.”

- Volatile Spring Home Sales Season Continues (NAHB)

- How tariffs will change the fix-and-flip market (John Burns Research and Consulting)

- Homebuilder unsold inventory swells to 2009 levels: Housing markets to watch (Fast Company)

Commercial Real Estate and the Macro Economy

1Q25 U.S. Industrial Market Trends & Conditions Report

Via Newmark: “Positive momentum was reflected in key performance metrics: new leasing activity surged, net absorption soared to its highest level since the fourth quarter of 2023, and the development pipeline fell below 300 MSF for the first time since 2019.”

- CRE Analysts’ Jobs Are Changing Because Of AI. Here’s What That Means For Hiring (Bisnow)

- H1 2025 Single-Tenant Net Lease Report (Institutional Property Advisors)

- Why Everyone Wants Retail in 2025 (GlobeSt)

Other Real Estate News and Reports

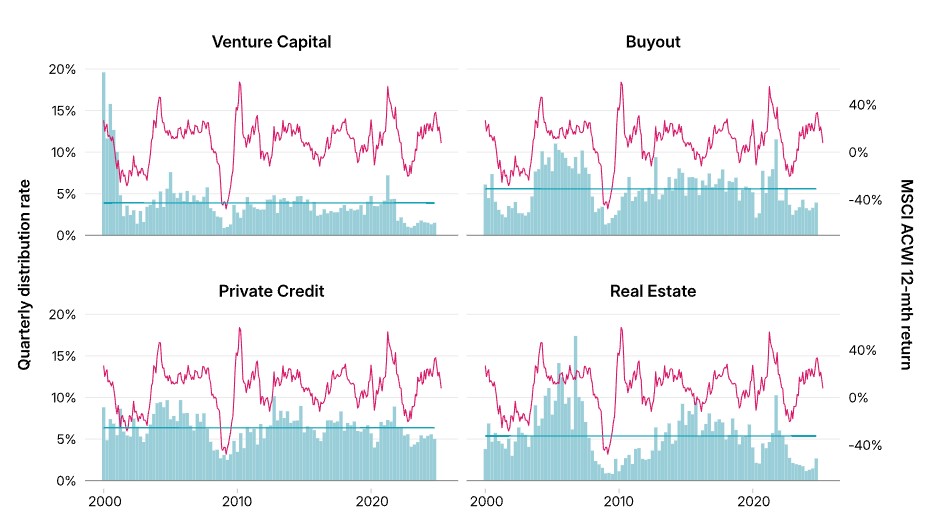

Private Capital in Focus: Depressed Distributions, No End in Sight

Via MSCI: “For LPs counting on distributions to fund capital calls from other private commitments, this combination of public-equity sell-offs and falling distribution rates presents a challenge: If forced to sell liquid assets to meet capital calls, it’s likely to be when prices are down.”

- Q1 2025 Leading Office Markets Snapshot (Colliers)

- Interest Rates on the Rise? (Marcus & Millichap)

- Why prime workspace is getting scarce — and how to find it (JLL)