Gray Report Newsletter: April 18, 2024

Is the Fed Keeping Interest Rates High?

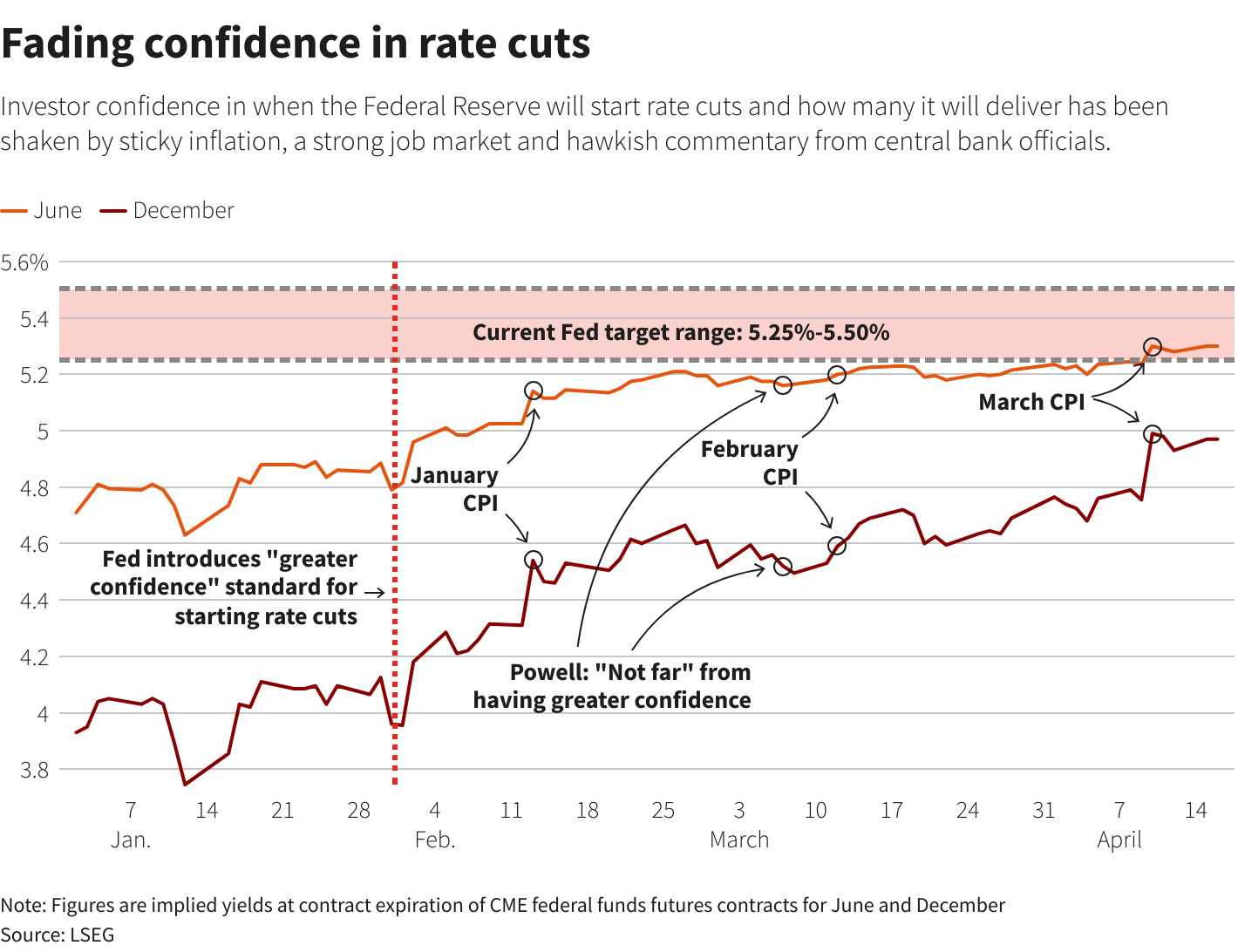

Comments this week from Federal Reserve Chair Jerome Powell are among the most forceful indications yet that interest rate cuts may be delayed past initial expectations. While some extreme predictions push the rate cuts all the way out to March 2025, futures data is pointing to July or September. These shifting interest rate expectations may curb the activity of a CRE sales market that was just beginning to revive after a sluggish 2023, but strong housing demand and solid apartment fundamentals continue to attract investor attention in the multifamily market.

Multifamily, the Nation, and the Economy

Multifamily, the Nation, and the Economy

Fed. Chair Throws Cold Water on Hopes for Interest Rate Cuts

Via Reuters: “There’s no doubt there’s a doubt about any U.S. interest rate cuts this year.

After weeks of market trepidation about stalling U.S. disinflation amid still-brisk economic growth, Federal Reserve top brass are making clear that this year’s rate cut plans are on ice until further notice.”

- Housing Market Challenges Intensify And Expert Warns, ‘If You’re A Parent Of Gen Z Kids, Get Used To Them Living In Your House For A While’ (Yahoo Finance)

- Housing Starts Fall on Interest Rate, Financing Concerns (NAHB)

- Apartment Demand Jumps Significantly in Q1 2024 (RealPage)

Multifamily and the Housing Market

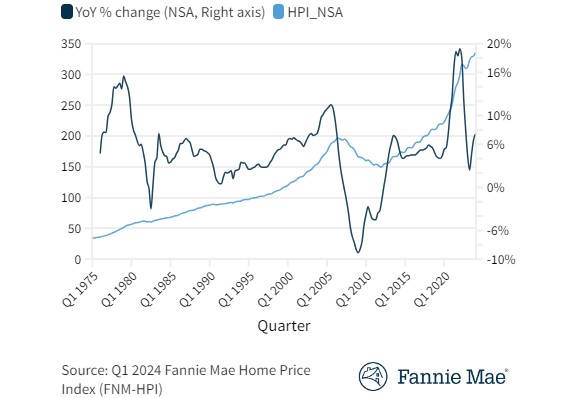

Home Prices Grew 7.4 Percent Year over Year in the First Quarter

Fannie Mae: “Mortgage rates have trended upward again of late, but there is support for home prices in strong demographic demand from younger generations. We expect home sales to rise modestly this year as potential homebuyers appear to be acclimating to the higher-rate environment and, in some cases, may be less able to put off moving for life reasons.”

- The Fed Is Poised To Hold Interest Rates Steady—Here’s What That Will Do to Mortgage Rates (Realtor.com)

- “A rental increase of between 3 and 5 percent is seen as normal, so these numbers suggest that the rental crisis is over in most parts of the country,” (FAU)

- Urban Cores No Longer Grossly Underperforming Suburban Counterparts (RealPage)

Multifamily Markets and Reports

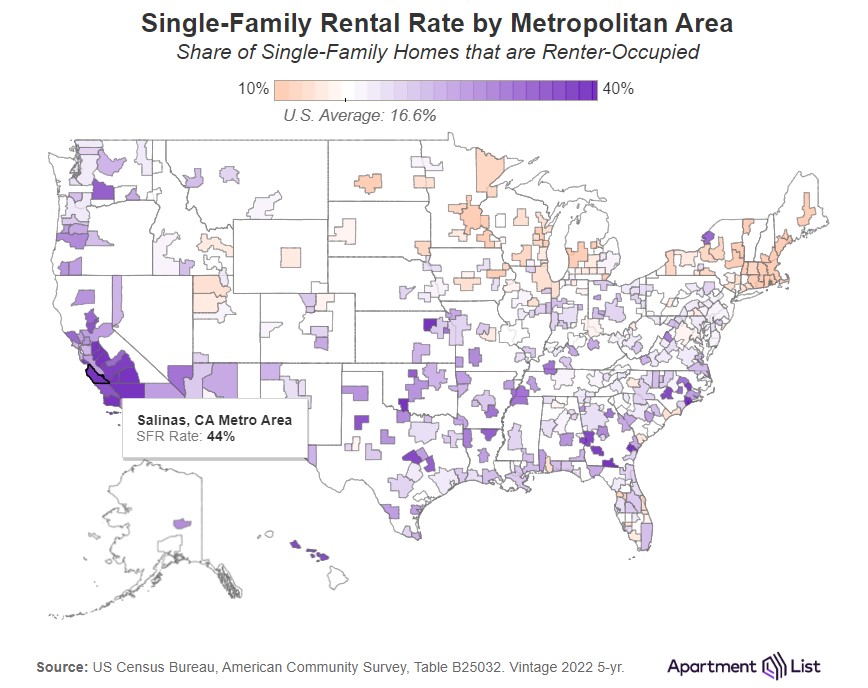

Built-for-Rent Construction Continues Booming

Apartment List: “Owing to their larger size, the median rent for a single-family home is 13 percent higher than an apartment. But this is more than offset by household incomes, which are 26 percent higher for single-family renters.”

- March Rental Activity Report: Minneapolis Leads the Chart; Alabama City Makes Bold Entry Into Top 10 (RentCafe)

- Rental Market Tracker: Asking Rents Rose for the Third-Straight Month in March, Driven By the Midwest (Redfin)

- February US Rent Growth Posts Highest Annual Increase Since Spring 2023 (CoreLogic)

Commercial Real Estate and the Macro Economy

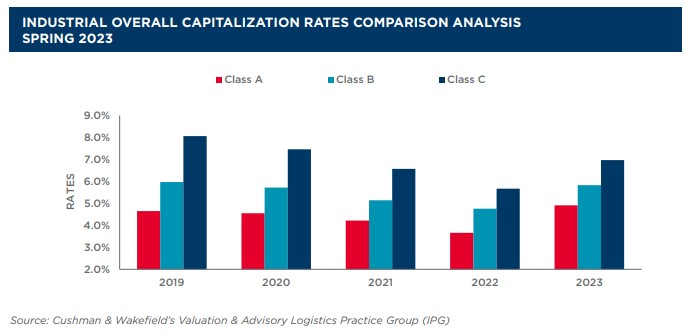

Industrial Market Outlook: Strong, Normalizing Demand through 2025

Via Cushman & Wakefield: “Logistics, food and beverage, cold storage, biotech/pharmaceutical and data center assets are the preferred asset classes. However, e-commerce is clearly driving the demand as online shopping continues to accelerate, with the infusion of AI driving supply chain efficiencies.”

- Treasurys Get Harder to Sell and That’s Not Good for CRE (GlobeSt)

- Hotels State of the Union Shows Subtle Signs of Slowdown for the Sector (CBRE)

- Most Expensive Streets Report 2024 (JLL)

Other Real Estate News and Reports

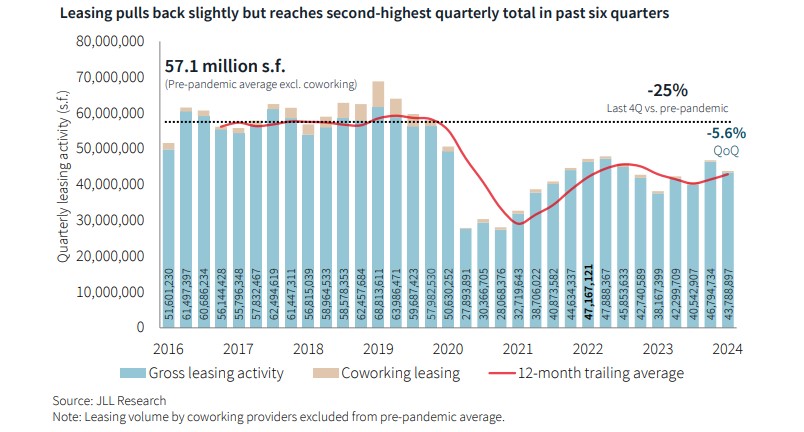

Office Market Outlook: A Slow Recovery for a Sector Still in Flux

Via JLL: “One factor in the sluggish recovery of large transactions has been financial turmoil for large landlords which is complicating concessions offerings—large leasing during the earlier stages of the pandemic recovery was fueled by growing tenant improvement allowances which have become considerably more costly amid higher interest rates.”

- Not Another Inflation Crush (Moody’s Analytics)

- Busting Gen Z Myths—What the Housing Industry Needs to Know (JBREC)

- Land sales rose 1.2% in 2023, moderating from the previous years (NAR)