Gray Report Newsletter: April 25, 2024

Apartment Investors Are More Confident, Will the Market Follow?

Multifamily investor sentiment improves even as debt financing challenges continue. Strength in the labor market, robust apartment demand, and stable consumer sentiment are some of the reasons behind this, but another significant factor is the decline in the multifamily construction pipeline. For investors looking beyond the current apartment supply dynamics in the next few years, multifamily assets have an appeal that breaks through current interest rate challenges.

Multifamily, the Nation, and the Economy

Multifamily, the Nation, and the Economy

Survey: Multifamily Investor Sentiment Suggest More Apartment Sales Activity on the Way

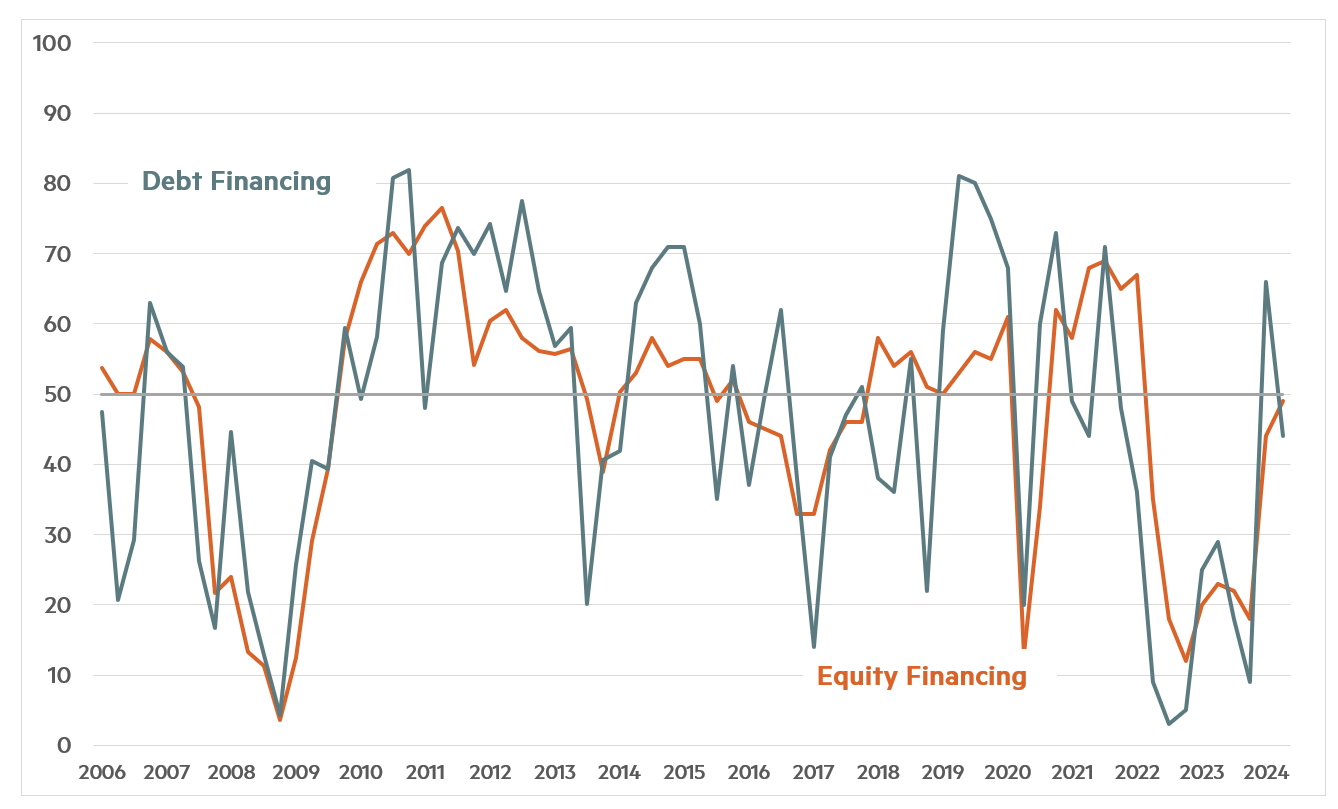

Via NMHC: For investors surveyed, debt financing confidence decreased, but confidence in apartment fundamentals has increased for investors, alongside expectations of greater sales activity.

- Reviewing the Research on Commercial-to-Apartment Conversions (Fannie Mae)

- Chicago Loop Office-to-Apartment Conversion Stalls Out (TheRealDeal)

- HUD Lending Volume Down for 3rd Straight Year (Trepp)

- Apartment Starts Fall 43% From 2023 (Bisnow)

Multifamily and the Housing Market

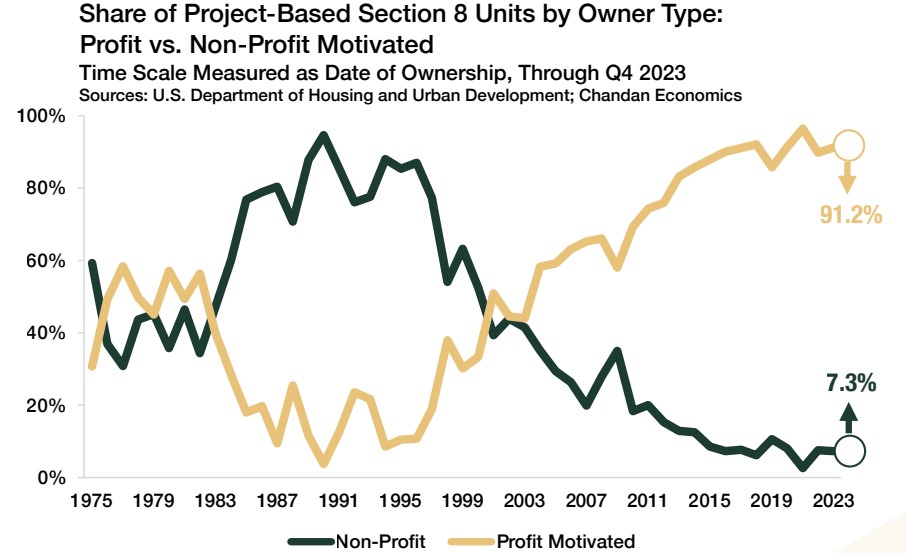

Arbor: “Looking ahead, increasing the affordable housing supply will continue to require an all-hands-on-deck approach,” including zoning, financing, and other reforms.

- Despite Higher Mortgage Rates, New Home Sales Post Solid Gain in March (NAHB)

- Pricey Markets on the West Coast Stalling Pandemic Recovery (RealPage)

- Harnessing the Potential of Manufactured Housing to Expand Entry-Level Homeownership (Harvard Joint Center for Housing Studies)

Multifamily Markets and Reports

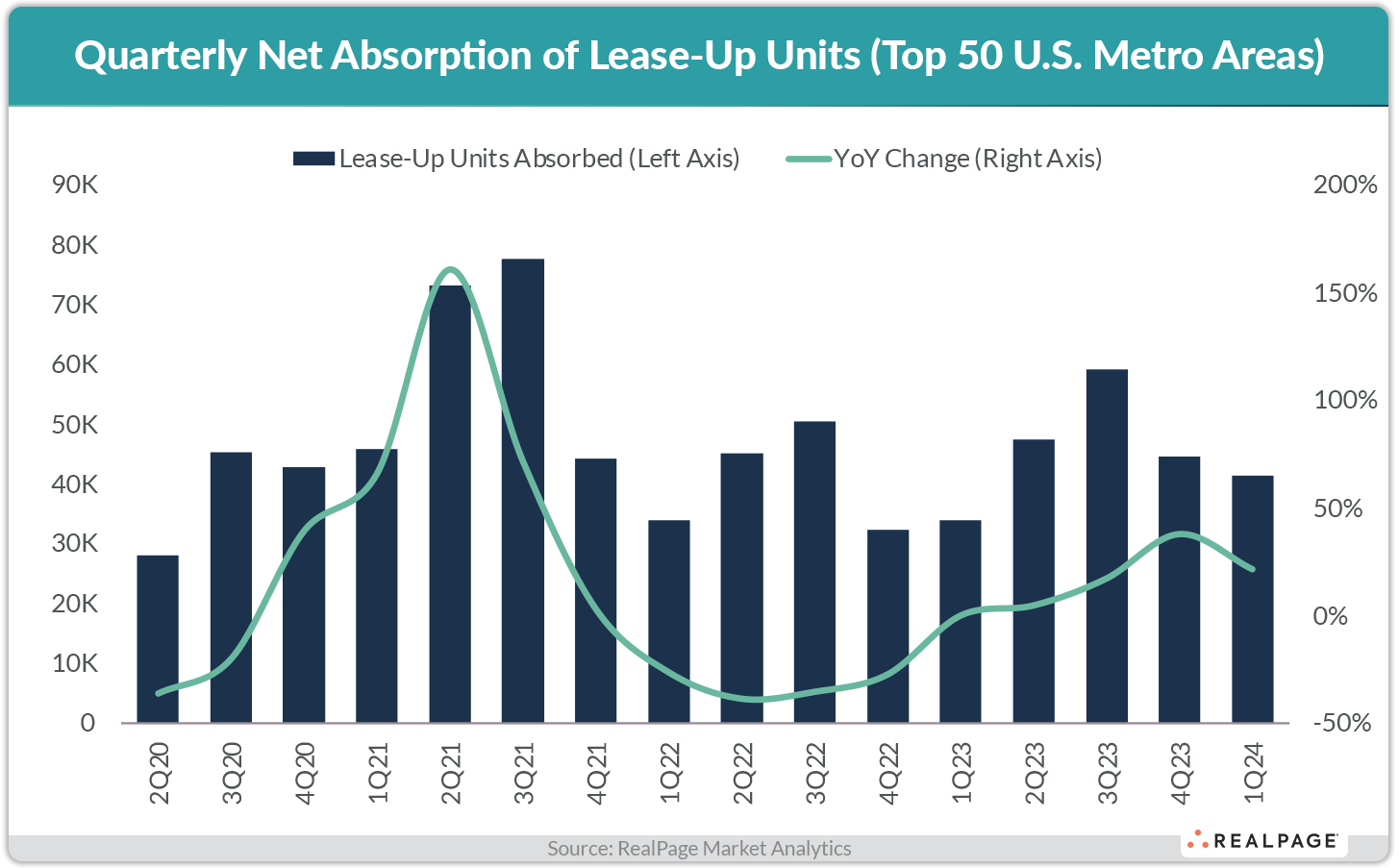

Lease-Up Demand is Solid, But it Doesn’t Feel Like It

RealPage: “Record volumes of new apartment supply are giving the average U.S. renter more options from which to choose. But demand trends remain favorable in lease-up properties yet to hit stabilization.”

- New Single-Family Rentals Reach All-Time High, With Another 45,000 on the Way (RentCafe)

- National Rent Report, April 2024: Descent Slows, High Demand Points to Future Growth (Zumper)

- U.S. Economic, Housing and Mortgage Market Outlook: Resilient Labor and Strong Housing Demand (Freddie Mac)

Commercial Real Estate and the Macro Economy

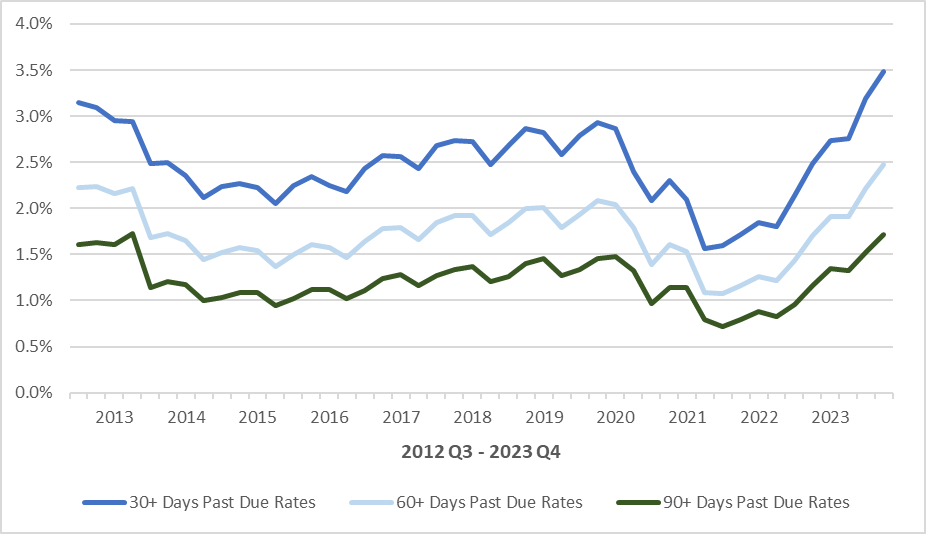

U.S. Consumers Remain Resilient but Blemishes Exist

Via Moody’s Analytics: “With both job creation and inflation running hotter-than-expected during the first quarter of 2024, Monday’s retail sales report followed suit – increasing by 0.7% MoM and 4.0% YoY – underscoring the continued resiliency of the American consumer.”

- Retail Sector Boosted by Broad-Based Retail Sales Gains (Marcus & Millichap)

- Q1 Retail Report: “Tighter fundamentals amid reduced market returns” (Colliers)

- Net Interest Income Under Pressure: A Perspective from Banking Consortium Data and CRE Lending (Trepp)

Other Real Estate News and Reports

National Office Report, April 2024

Via Yardi Matrix: “Of the office stock under construction, the vast majority is located in the largest markets. Boston leads the nation, representing more than 15% of national stock under construction.”

- Office Report, Q1 2024: Occupancy Losses Persist (JLL)

- Q1 Office Stats: Construction Pauses, Demand Low (Colliers)

- Office Loan Maturity Monitor: Has the Dust Settled, or Is There Hope for Further Workouts in the Future? (Moody’s Analytics)