Gray Report Newsletter: September 7, 2023

Near-Term Struggles and Long-Term Strength for Multifamily

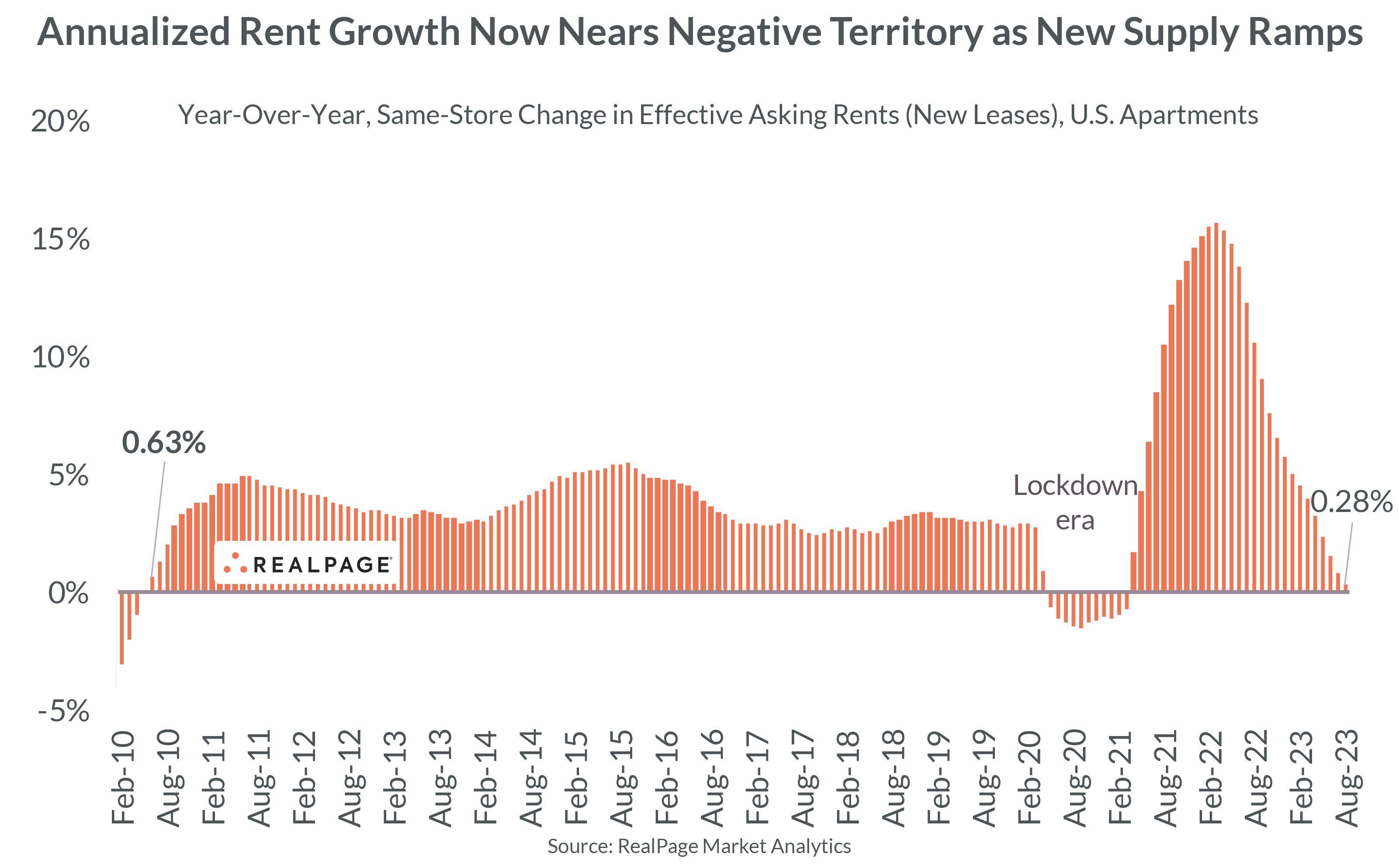

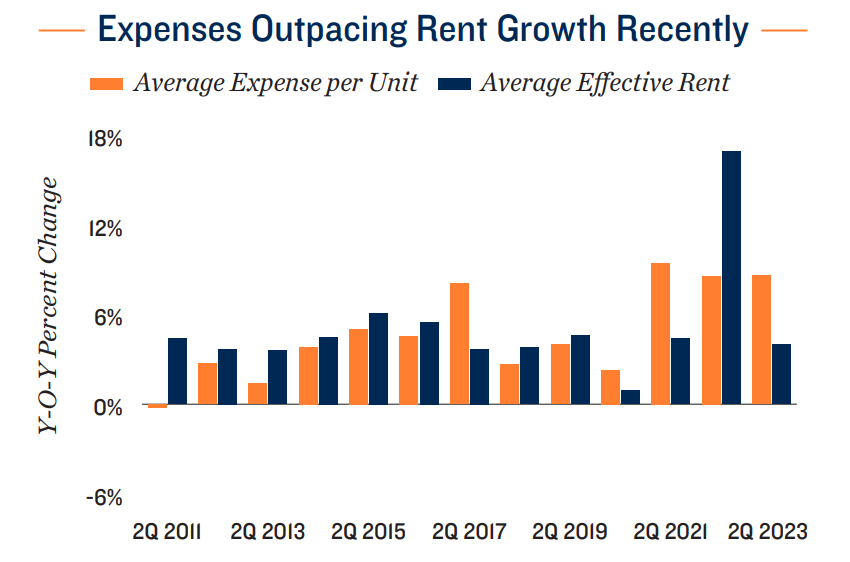

Year-over-year rent growth has been consistently decelerating for over 18 months since its peak in late-2021/early-2022, and recent reports on the apartment market show year-over-year rent growth heading into negative territory after 18+ months of deceleration from its peak in late 2021/early-2022. Alongside lower rent growth and higher vacancy, apartment operators contend with rising expenses and higher interest rates, and the sharp increase in multifamily loan maturities in the coming months is a dramatic example of the potential for near-term distress in the market. Despite these ongoing challenges, the long-term fundamentals of the apartment market are strong. Climbing homebuying costs and consistently-high single-family home valuations signify continued high housing demand in spite of high interest rates, and the apartment market remained relatively stable while adding the most new apartment supply in decades, a mark of resilience for the sector that will strengthen as new supply is expected to decrease in the coming years.

Multifamily, the Nation, and the Economy

Apartment Rent Growth Continues its Rapid Descent in August

Via RealPage: Key passage from Jay Parsons: “For the first time in decades, U.S. apartment rents are rapidly flattening (and could soon go negative) at the same time demand remains healthy and the economy continues to produce jobs. Why? Apartment construction is at 40+ year highs – shifting the balance of power to renters.”

- Why Multifamily Investor Activity Could Soon Revive (Marcus & Millichap)

- Local Population Growth Dependent on Migration and Immigration (Harvard Joint Center for Housing Studies)

- Suburban rent growth exceeds urban counterpart in 28 of 33 metro areas (The Wall Street Journal)

Multifamily Markets and Reports

Multifamily National Report, 3Q 2023

Via Marcus & Millichap: ” Operational costs grew by 8.6 percent on average year-over year in the second quarter of 2023, as persistent inflationary pressures drove up expenses from multiple directions.”

- $205B of Dry Powder Ready to Pounce on Distressed CRE Assets (GlobeSt)

- Senior Housing Sector Getting Hit With Depressed Demand, Billions In Loan Maturities (Bisnow)

- Pullback in Multifamily Construction Starts (Institutional Property Advisors)

Multifamily and the Housing Market

U.S. Capital Markets Report, 2Q 2023

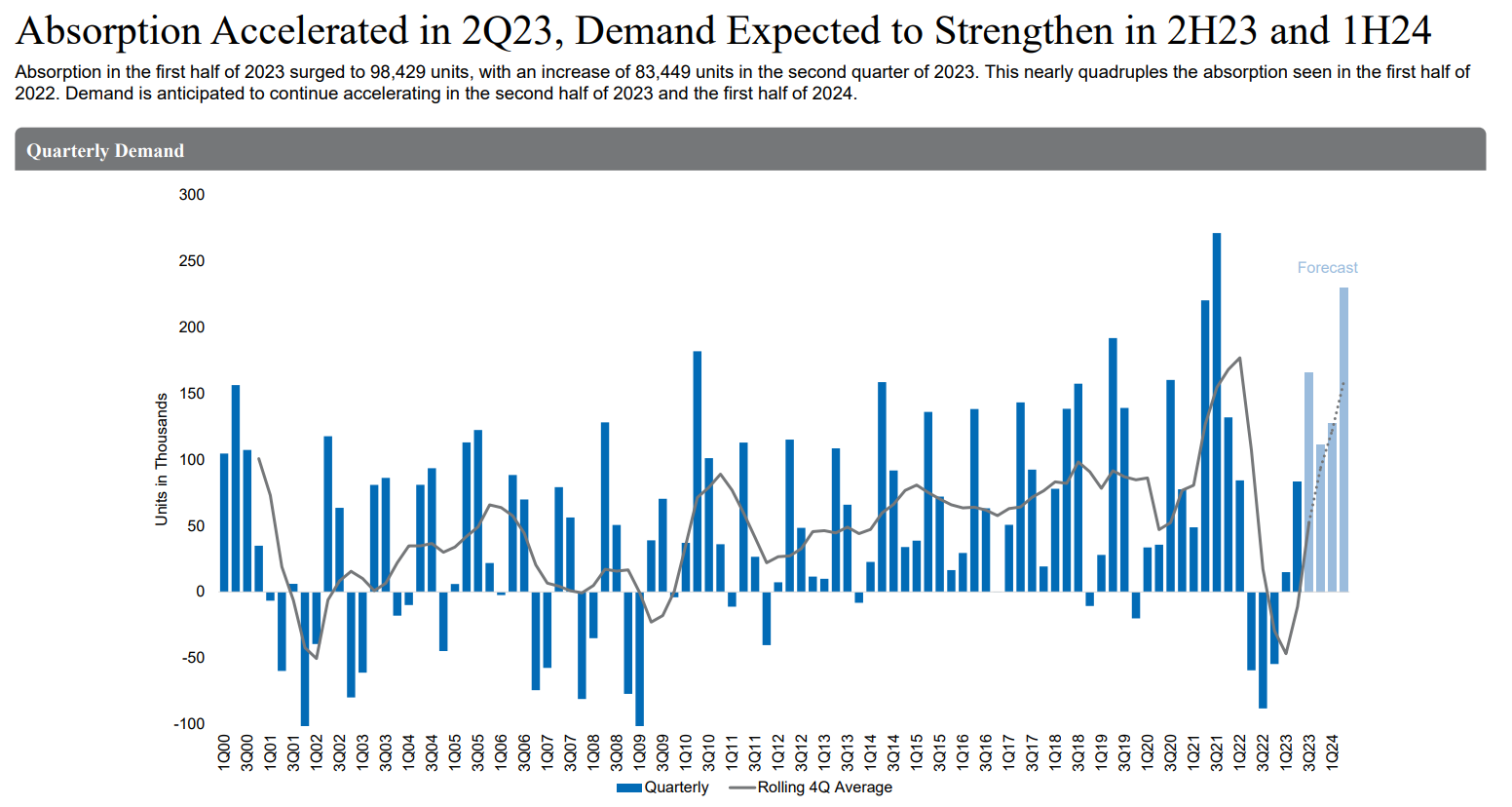

Via Newmark: “Absorption in the first half of 2023 surged to 98,429 units, with an increase of 83,449 units in the second quarter of 2023. This nearly quadruples the absorption seen in the first half of 2022. Demand is anticipated to continue accelerating in the second half of 2023 and the first half of 2024.”

- The Monthly Cost of Buying vs. Renting a House in America (Visual Capitalist)

- Real Estate Investors Pull Back, Buying 45% Fewer Homes Than a Year Ago (Redfin)

- Housing market inventory is so scarce that builders will be in the driver’s seat for years to come (Fortune)

Commercial Real Estate and the Macro Economy

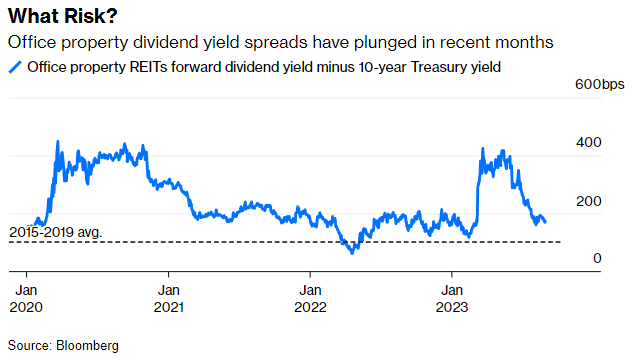

Office Market Panic Is Easing, But a Critical Period Looms

Via Bloomberg: “The office market isn’t out of the woods yet, and risks could loom over the market for years to come if interest rates stay anywhere near current levels.”

- Prices, uses, and (r)evolutionary change: the outlook for post-pandemic office investing (Moody’s Analytics)

- Shift Toward Pre-Pandemic Hiring Patterns Clearer, Aiding Fed Objectives (Institutional Property Advisors)

- Glass Half-Empty or Half-Full? Encouraging Signs in the Office CRE Sector (Trepp)

Other Real Estate News and Reports

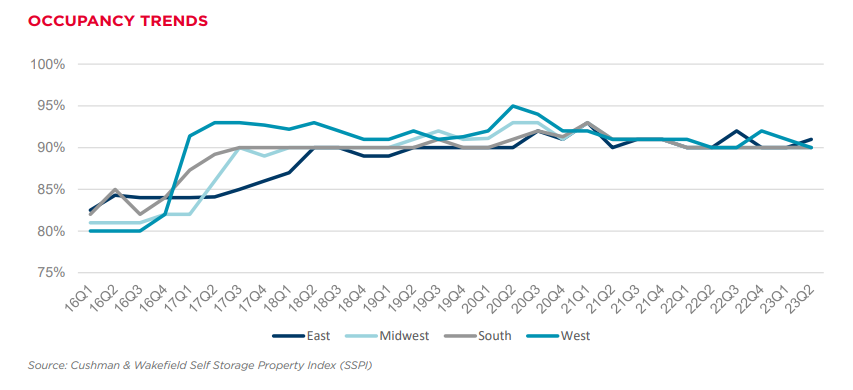

U.S. Self-Storage: Market Trends and Sector Outlook

Via Cushman & Wakefield: “Despite the rising cost of debt, capitalization rates for self storage remain relatively stable, averaging 5.1% in the second quarter of 2023, up only 10 basis points (bps) from all-time lows.”

- How Remote Work Trends Are Shaping Real Estate Demands (Entrepreneur)

- China’s Biggest Homebuilder Fights to Survive as Economy Slows (The New York Times)

- Latest Office Stats Offer Little Reason for Hope (GlobeSt)