Gray Report Newsletter: March 21, 2024

Fed Doesn’t Blink on Interest Rates

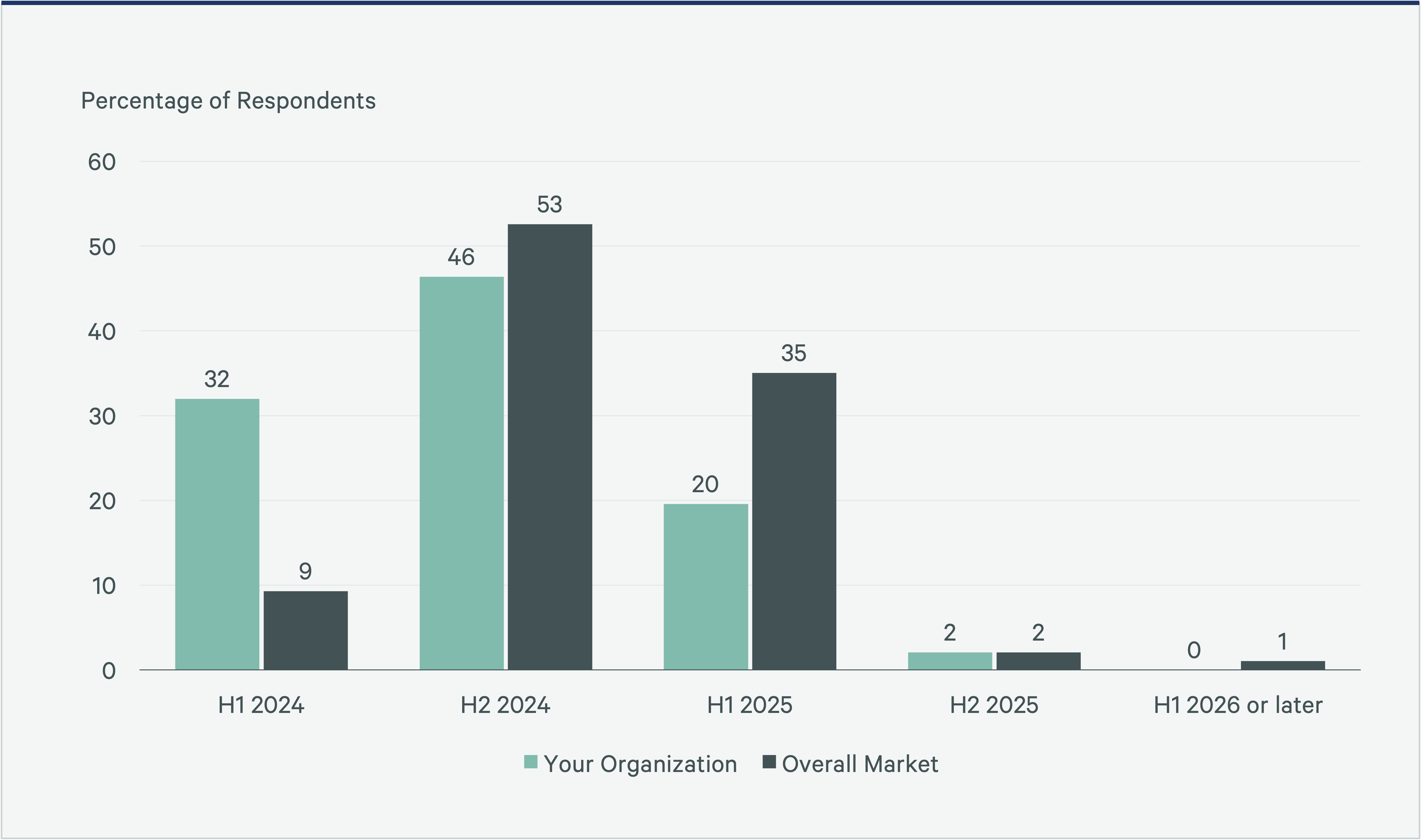

While the Federal Reserve has thus far not deviated from its projections of 3 federal funds rate reductions in 2024, it is in no hurry to begin these cuts this month. While current elevated rates are not ideal for multifamily borrowers, multifamily investors with a longer-term view of lower rates, a shift from the current supply-dominated market, and consistent housing demand have markedly increased their intentions to invest this year.

Multifamily, the Nation, and the Economy

Multifamily, the Nation, and the Economy

Via CBRE: “For the first time in this survey’s eight-year history, multifamily was the most preferred sector in all three main global regions (Americas, Europe and Asia-Pacific)[,] . . . [and a]lmost 60% of survey respondents expect to see small or no price discounts for multifamily assets this year, up slightly from 2023.”

- Why Aren’t We Seeing More CRE Distress? (Marcus & Millichap)

- FACT SHEET: President Biden Announces Plan to Lower Housing Costs for Working Families (The White House)

- Deciphering Today’s Debt Market (Cushman & Wakefield)

Multifamily and the Housing Market

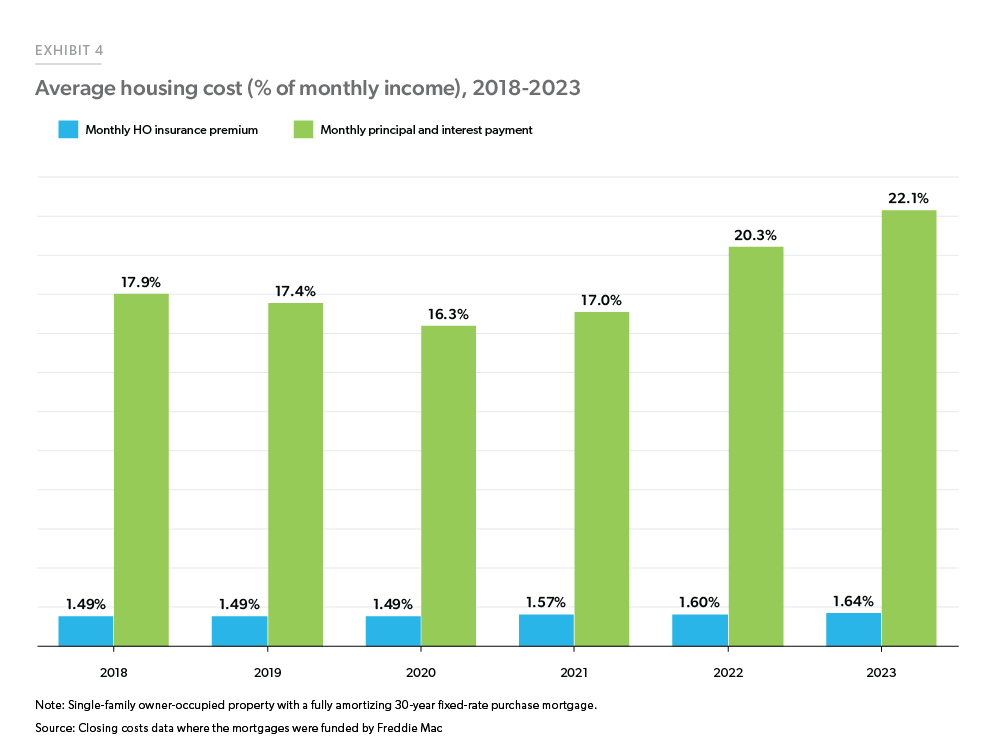

Housing and Mortgage Outlook: Insurance Expenses and Housing Costs

Freddie Mac: “The cost of homeownership has risen significantly in recent years. This is largely driven by high mortgage payments fueled by elevated mortgage rates, but homeowners’ insurance (HO) costs also have a part to play – although at a smaller scale compared to mortgage principal and interest payments.”

- After Leading a Back to the City Movement, Many Millennials Moved to the Suburbs (Harvard Joint Center for Housing Studies)

- Moderating Interest Rates, Pent-up Demand Push Single-Family Starts Higher (NAHB)

- What are some innovative ways to rethink new home communities? (John Burns Research and Consulting)

Multifamily Markets and Reports

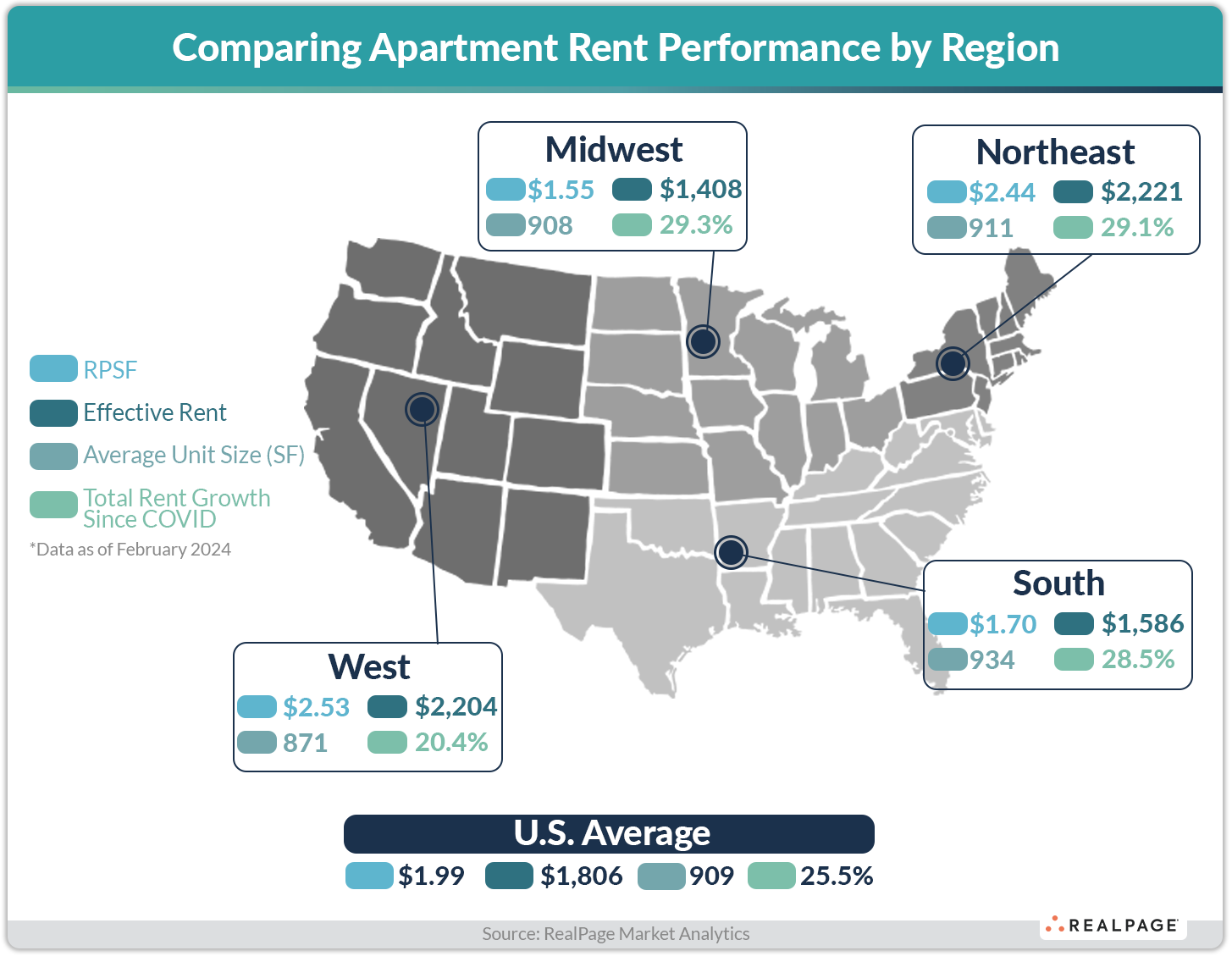

West Region Records Nation’s Slowest Apartment Rent Growth Since Pandemic

RealPage: “Over the last four years, rents in the West have climbed from an average rate of $1,831 in February 2020 to $2,204 in February 2024 – an increase of about 20%, according to data from RealPage Market Analytics. That is by far the slowest rate of growth nationwide. Meanwhile, rents in the South, Midwest and Northeast have climbed approximately 29% since February 2020.”

- Seniors Housing Sector Recovery Slowed, Though Demand Remained Strong in 2023 (Fannie Mae)

- February Rental Activity Report: Minneapolis Is the Most Coveted City, Western Cities Dominate the Top 30 (RentCafe)

- Predicting and Navigating Student Housing Investment Sales (Cushman & Wakefield)

Commercial Real Estate and the Macro Economy

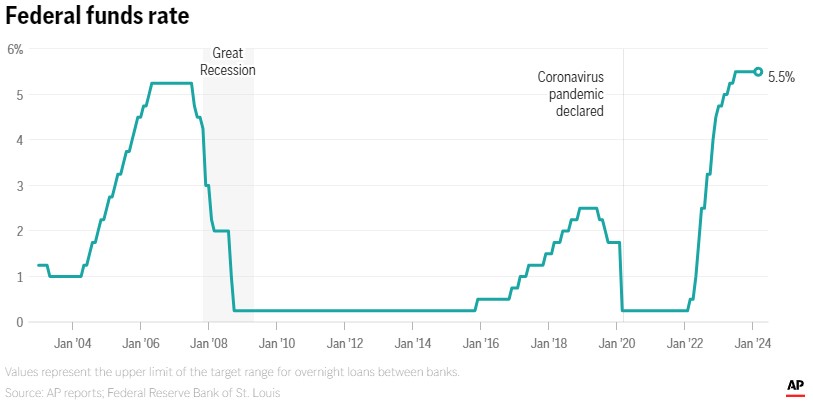

Federal Reserve still foresees 3 interest rate cuts this year despite bump in inflation

Via Associated Press: “Speaking at a news conference, Chair Jerome Powell said the surprising pickup in inflation in January and February hadn’t fundamentally changed the Fed’s picture of the economy: The central bank still expects inflation to continue to cool, though more gradually than it thought three months ago.”

- Stagflation Is a Real Possibility to These Analysts (GlobeSt)

- A Multi-perspective View on Cap Rates (CBRE)

- Retail Sales Research Brief (Institutional Property Advisor)

Other Real Estate News and Reports

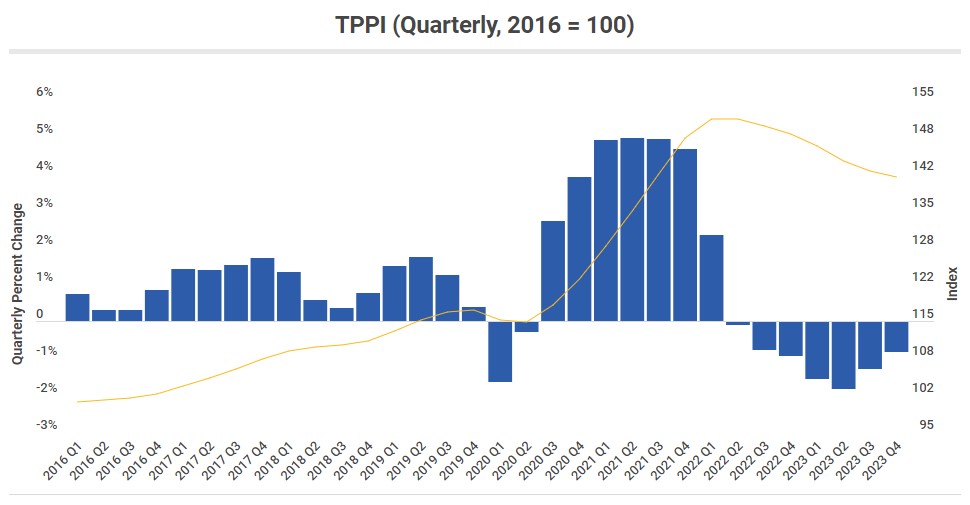

Via Trepp: “While the overall CRE market has experienced a downward trend in recent periods, the magnitude of this decline varies across different property types,” and price declines are recovering more rapidly than the initial drop.

- Nearly 300 Banks Are Vulnerable Because Of Their CRE Loans, Study Finds (Bisnow)

- The CRE CLO Problem Is More Grim Than It Seemed (GlobeSt)

- U.S. Lodging Overview – Year-End 2023 (Cushman & Wakefield)