February 2024 Rental Report: Renting a starter home is more affordable than buying one in all 50 metros

In every single one of the metros that Realtor.com tracks—every single one—the cost of home ownership is higher than renting.

There’s a little bit of strangeness in the title here… “Renting a starter home”? What kind of rent are they measuring here?

- I’ll cut to the chase here: The title isn’t the best. The rent that they measure is a combination of apartment, townhome, and single-family homes.

- The cost of buying, however, is a little more straightforward in that it’s the cost of a 0-2 bedroom home. No bigger! Then it gets to be a little more than a starter home!

- Replacement title: February 2024 Rental Report (no changes there!): Buying a starter home is more expensive than renting in all 50 metros we measured

- I added “we measured” at the end just to avoid giving the impression that there is only 50 metros in existence.

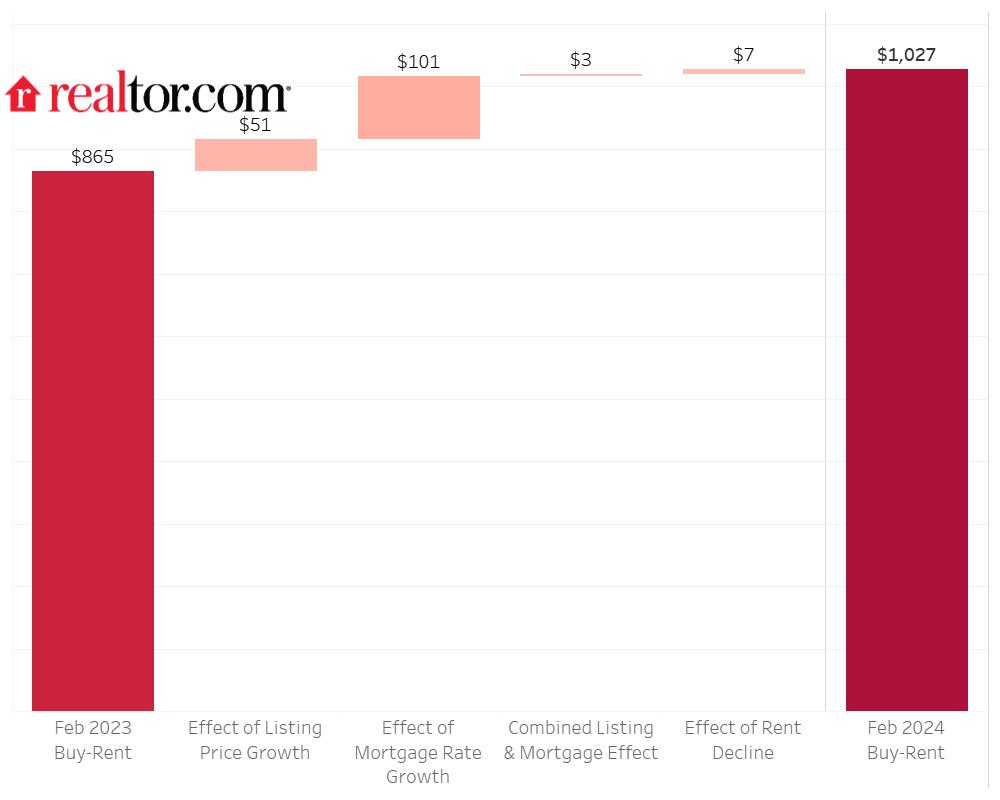

The findings: “In February 2024, the cost of buying a starter home in the top 50 metros was $1,027 (60.1%) higher than renting one.”

In our previous coverage of this issue, I mentioned that these comparisons of home ownership costs to rental costs do not typically take into account that rental housing like apartments has a lower average square footage compared to single family homes.

- On a cost-per-square-foot basis, renting is much closer to the monthly cost of mortgage payments:

- CoStar has rents at 1.89 per square foot, 883 square feet for the average apartment unit, and rent at $1,668/month

- According to Realtor.com data listed on the St. Louis FRED site, the average price per square foot for homebuyers is $224.

- Multiply that $224 by the 883 square foot size of average apartment unit, and you get 197,792.

- Plug that into the RocketMortgage calculator with a 7% 30-year mortgage rate and 6% down payment, and adding in a 1% annual cost for home maintenance: $1,665/month

- Why the discrepancy? — apartment units are typically smaller than single family homes, and I can see how not adjusting for square footage can reflect reality a little bit more closely, but it’s well worth noting that renting and owning costs are roughly the same if you’re adjusting for square footage.

- That being said, I could very likely be missing a portion of costs or savings here, and please, please set me straight in the comments about an obvious thing I’m missing here.

Even if I try to undercut it by adjusting for costs per square foot, it doesn’t do much to diminish the fundamental point of this Realtor.com report: Home ownership costs have grown faster than rental costs.

Using Case-Shiller and CoStar data on rents and home values, the trend is glaringly obvious: I’m using June 2014 as a decent starting point that’s far enough away from the great financial crisis to give some context to the last ten-or-so years of price growth.

- Rents went up 38%.

- Home values went up 87%

- Home values increased at roughly 2.3x the rate that rent prices increased in that same period.

- If we measure from June of 2020, home values went up 41% and rents went up 17%, which also has home values increasing at about 2.3x the rate of rent prices.

This is not a new trend, as the numbers from 2014 show, and this is not a newly-reported phenomenon either, but once you get outside the more industry-specific material from places like CoStar or Realtor.com or RedFin or what-have-you, there’s a lot less discussion about this extreme divergence between rents and home prices.

- More often than not, for articles in major newspapers and publications, rent growth trends are covered without much comparison to home price trends. Articles on housing affordability will cite high rent growth, they’ll use CPI data that lags current rent trends by over year, and they’ll have all they need to inveigh against the individuals and companies that are making this high rent growth happen.

- That’s not to say that there aren’t plenty of articles on rising home prices, but they don’t usually note that rents have risen much more slowly than home prices.

- This recent article from the New York Times actually does note that rents have more affordability than home buying price trends, but in the past few years, the articles on home price growth were much more similar to this other New York Times article from 2 years ago, which pointed to high home buying costs as a source of pain and also noted high rent growth as a source of pain, without doing much to differentiate between the two.

This Realtor.com article is a worthwhile reminder of these different pricing trends for home ownership and renting, and there’s also some really great information on how individual markets stack up:

- Austin, for example has the biggest savings for renters, with home ownership costs 2.4x the cost of renting.

- Seattle, Phoenix, San Francisco, LA, San Jose, Nashville, Portland, Sacramento, and Houston round out the top ten markets where rent is cheaper than buying. A few former Sunbelt rent growth all stars in this mix, but outside of Houston as an outlier, these markets are better understood as high home price markets, and all of them except for Houston have home prices above the national average. Sure, Seattle and San Fran didn’t have great rent growth in the past 3-4 years, but it’s really the high home prices that are the determining factor vs. low rents.

- On the other end of the spectrum, the markets with a much smaller gap between home ownership costs and rent prices, these are markets with monthly home ownership costs well below the national average, Pittsburgh, Memphis, St. Louis, Baltimore, and Birmingham.

For multifamily investors, the upshot to this persistent trend of home prices leaping ahead of rents is to view this as a positive sign of housing demand. It’s tough to say how much effect high mortgage rates or high home values have in driving up demand for rentals, but it’s far more clear that a sign of demand for one type of housing is a sign of demand in another. Additionally and perhaps more meaningfully, looking at these trends shows just how much more stable rent prices have been relative to home prices. Sure, home prices have been volatile in a positive direction, but the great financial crisis and crash of the housing market in 2009 is an indelible reminder that it is possible for home prices to crash, but it’s also likely that rent prices will be much more stable in such a circumstance.