Gray Report Newsletter: September 21, 2023

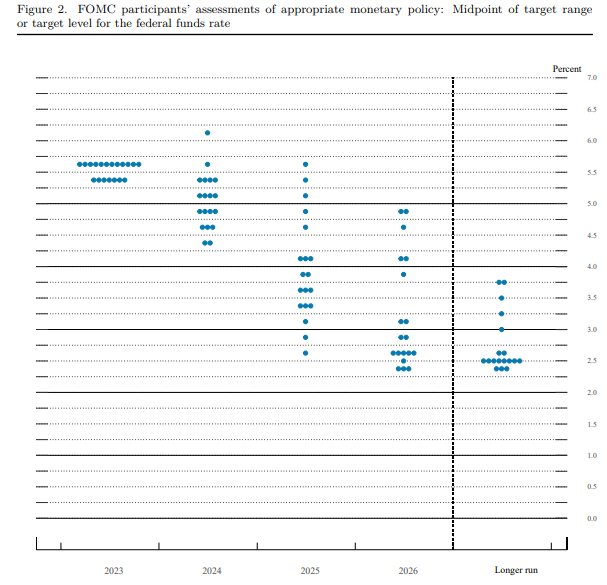

Fed’s 2024 Projection: Funds Rate at 5.1% by End of Year

The Federal Reserve decided this week to maintain the current Federal funds rate without an increase (or decrease), but their updated economic projections suggest that the Fed is more driven to sustain these elevated rates through 2024, increasing their end-of-year 2024 projection from 4.6% in June to 5.1% now. While CRE pricing has been trending down since the start of this elevated interest rate regime, these extended projections of lasting high rates could accelerate further price discovery, especially in the context of the dramatic increase in loan maturities coming due in Q4 2023 and early 2024.

Multifamily, the Nation, and the Economy

Summary of Economic Predictions, September 2023

Via The Federal Reserve Bank of the United States: Along with shifted projections for the Federal Funds Rate, some unemployment and GDP projections have changes, moving the expectations of an economic downturn further into the future.

- Chicago Is The Nation’s Leader In Distressed CMBS Debt (Bisnow)

- Dry Powder Circles Multifamily Deals (GlobeSt)

- Will the 2024 Election Impact Interest Rates? (Marcus & Millichap)

Multifamily Markets and Reports

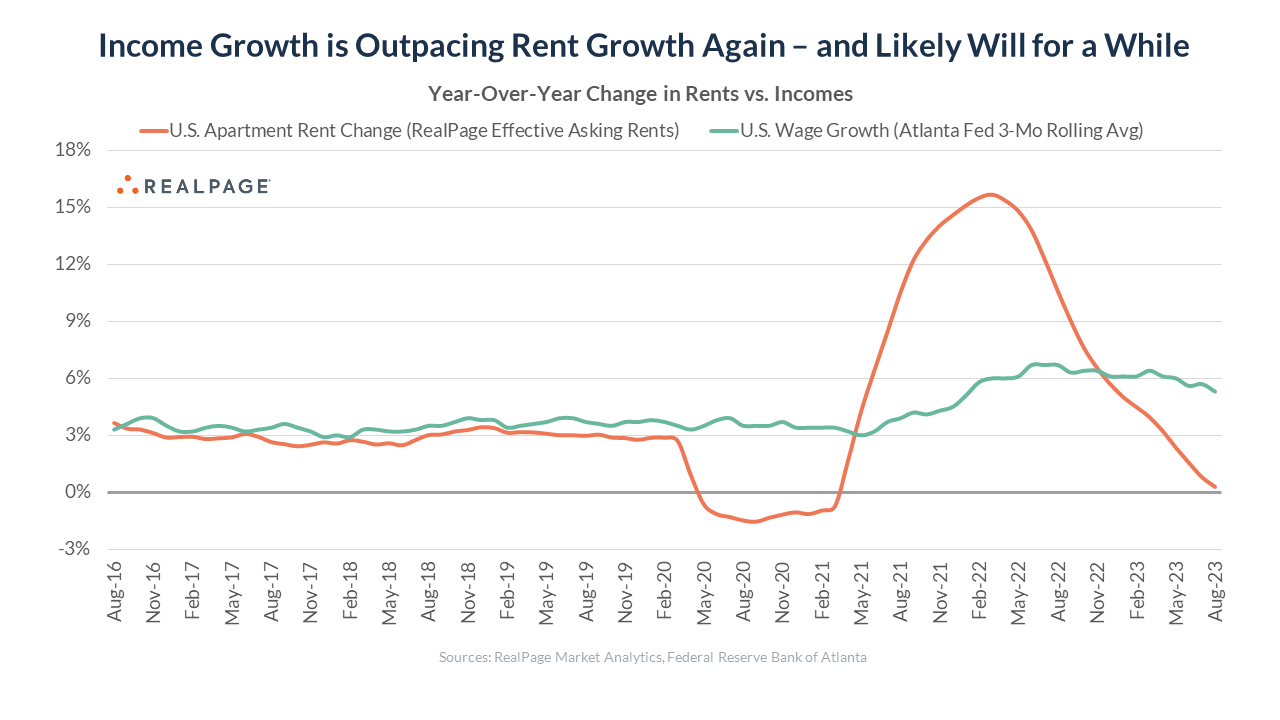

Flip the Script: Wage Growth Is Outpacing Rent Growth Again

Via RealPage: “[N]o matter your preferred methodology, the narrative shift is undeniable: Incomes are outpacing rents again, and likely will through at least 2024.”

- Class A Rent Performance Weighing Down Some Apartment Markets (RealPage)

- Multifamily Rent Forecast Update: 3.1% Rent Growth by Year-End 2023 (Yardi Matrix)

- These Are the Riskiest Housing Markets in America Right Now (Realtor.com)

Multifamily and the Housing Market

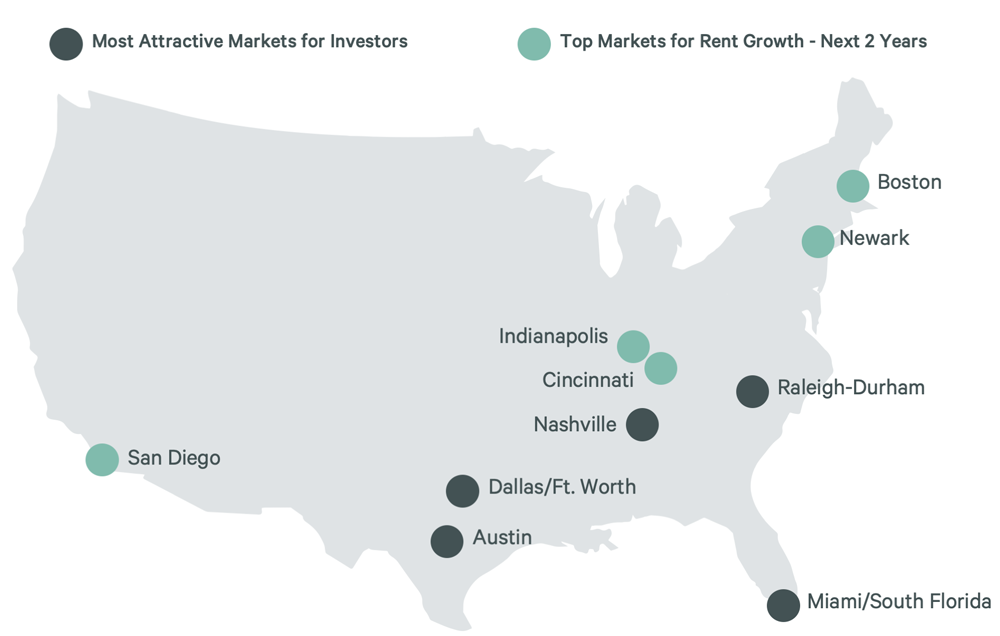

Midyear Pulse Check: U.S. Multifamily Market

Via CBRE: “As for new opportunities, there are several Midwest and Northeast markets, including Indianapolis and Boston, that provide near-term rent growth potential since they did not have a glut of new construction. These markets offer significant cost savings relative to other areas of the country.”

- There is $436B of Multifamily Debt That is Potentially Troubled (GlobeSt)

- September 2023 Multifamily Market Commentary, Focus on Manufactured Housing (Fannie Mae)

- Housing Starts Lower on Rising Mortgage Rates (NAHB)

Commercial Real Estate and the Macro Economy

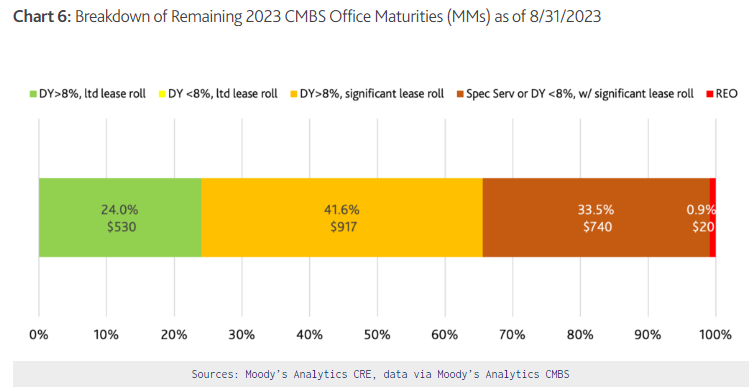

CRE Office Loan Maturity Monitor: Remainder of 2023 Looks No Better

Via Moody’s Analytics: “Office payoffs have significantly lagged all other property types. Retail has also seen struggles, however most of those struggles are related to regional malls. When mall properties are excluded, the payoff rate for retail properties jumps to over 90%.”

- Inflation Research Brief (Institutional Property Advisors)

- Exploring the Challenges and Factors Driving Onshoring and Nearshoring (Cushman & Wakefield)

- The Missing Resale Market (John Burns Research and Consulting)

Other Real Estate News and Reports

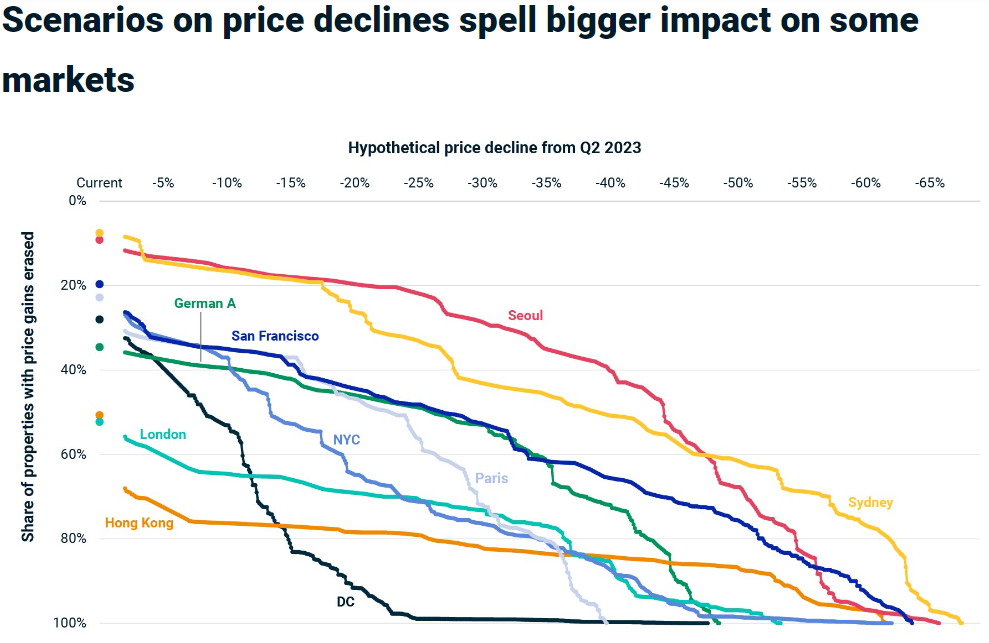

Loss Aversion and Property-Market Liquidity

Via MSCI: “There are outliers among the global markets analyzed; but, broadly, the more properties estimated to be in the red, the less liquid the transaction market.”

- Global capital flows impacted by interest rate shifts (Colliers)

- Tides Equities Says Firm Has Secured Help For Array Of Troubled Loans (Bisnow)

- America’s Biggest Landlords Can’t Find Houses to Buy Either (The Wall Street Journal)