Gray Report Newsletter: November 30, 2023

Light at the End of the Tunnel Gets Brighter for Multifamily

Continued updates on housing starts and permits shows multifamily construction starts down sharply even as single family construction continues to grow. The seasonal cooldown in rent growth is less pronounced than last year but remains a challenge for owners and operators continuing to deal with high expenses and the pressure of persistent high interest rates. At the same time, positive economic signals, continued investor confidence in the multifamily sector, and improving balance of apartment supply and demand point to strong longer-term prospects for multifamily investments.

Multifamily, the Nation, and the Economy

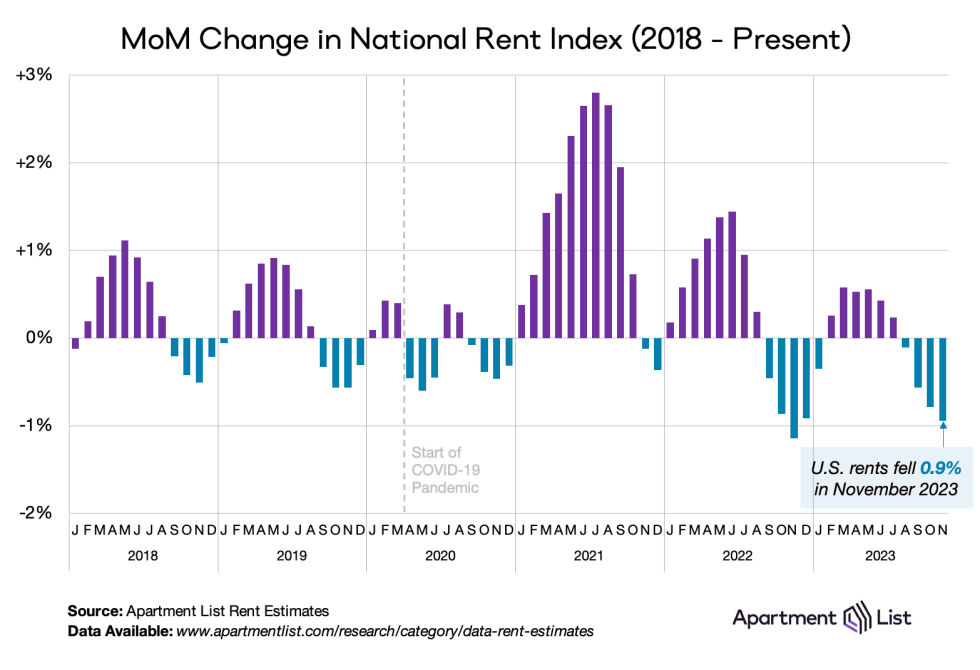

2023 Rent Cooldown Less Dramatic Than 2022, Rebound Likely in 2024

Apartment List: Year-over-year rent growth is at negative 1.1%, declining 0.9% in November, which was slightly less severe than the 1.1% drop in November of 2022. As this report notes, “Seasonal trends suggest that monthly rents will continue to dip through the remainder of the calendar year, before we see a potential rebound in early 2024.”

- The red-hot economy is growing even faster than we thought, with GDP surging 5.2% last quarter (Fortune)

- 3Q CRE Update; Performance Trends to Watch (Marcus & Millichap)

- Rental Housing’s Key Trends Heading Into 2024 (GlobeSt)

Multifamily Markets and Reports

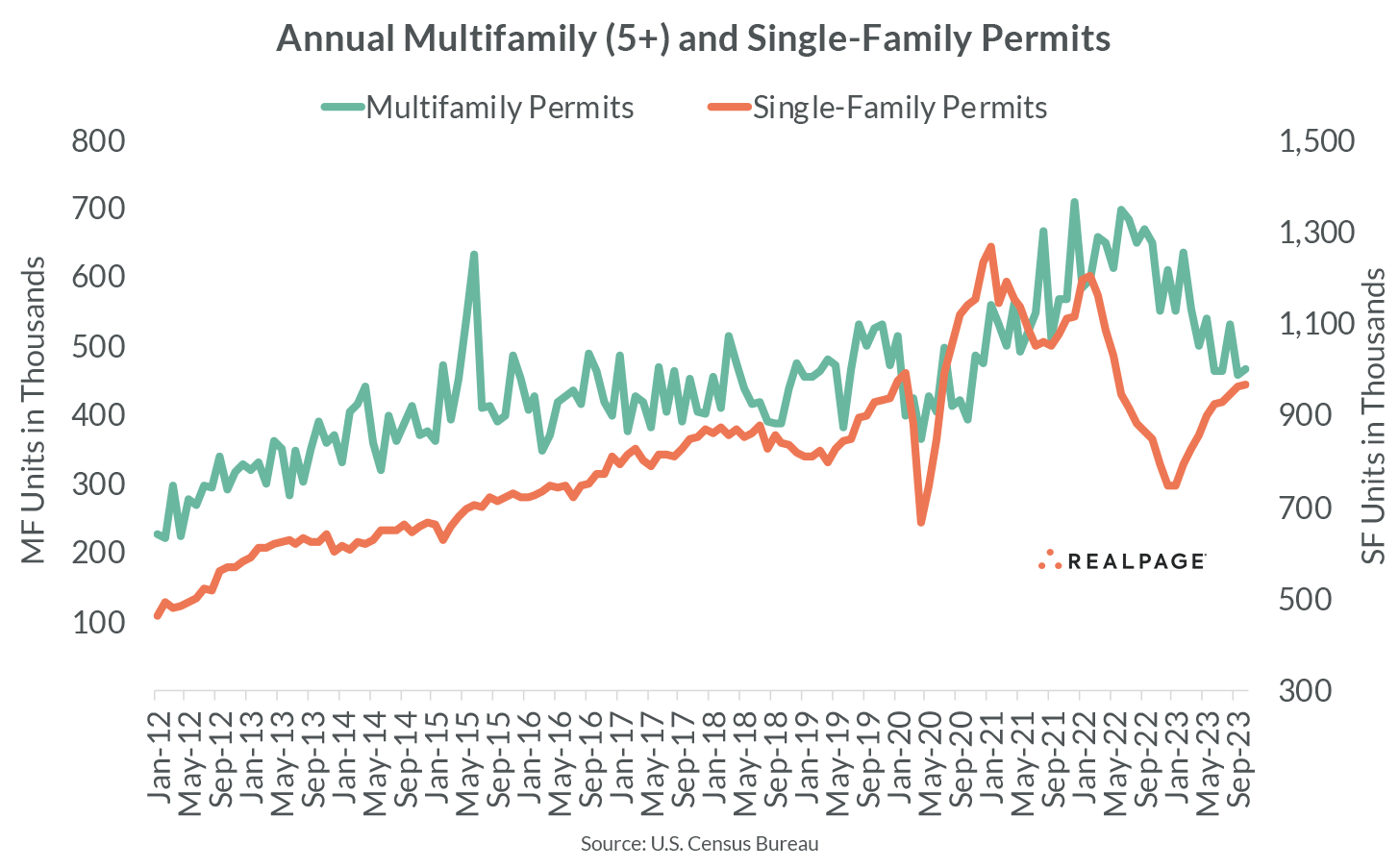

Single-Family Home Construction Growing Far Faster than Multifamily

Via RealPage: While multifamily permits and starts are down 27.8% and 31.8% respectively, “single-family permitting and starts . . . were about 13% higher from last year” and in the coming months could actually overtake the once-dominant activity in the multifamily market.

- 4 Ways Middle Schoolers Want to Expand Affordable Housing (John Burns Real Estate and Consulting)

- Uncertain CRE Job Market ‘Like A Middle School Dance’ — And No One Is Making The First Move (Bisnow)

- National Rent Report, November 2023 (Zumper)

Multifamily and the Housing Market

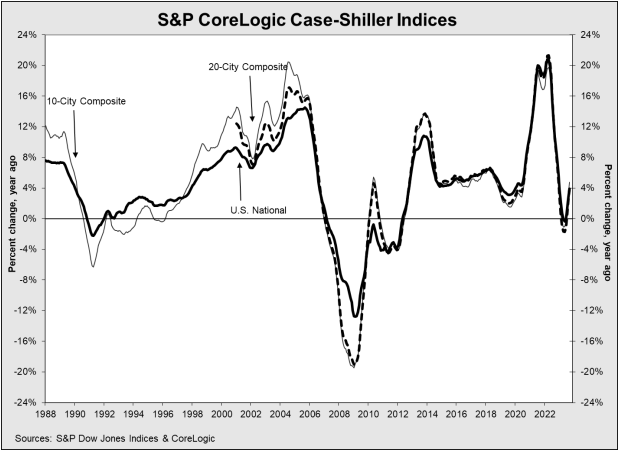

Home Price Index Shows Robust, Remarkable Price Growth

Via S&P Global: “We’ve commented before on the breadth of the housing market’s strength, which continued to be impressive.” This continued single-family home price growth in the midst of high interest rates and the tapering effects of inflation is a strong sign of housing demand that points to future growth and stability in the apartment market as well.

- 3 Multifamily REITs Downgraded Amid Concerns About Rent Growth, Interest Rates (Bisnow)

- An In-depth Look into Rising Housing Prices (Harvard Joint Center for Housing Studies)

- Will the Housing Market Roar Back in 2024? Our Fearless Predictions for the Year Ahead (Realtor.com)

Commercial Real Estate and the Macro Economy

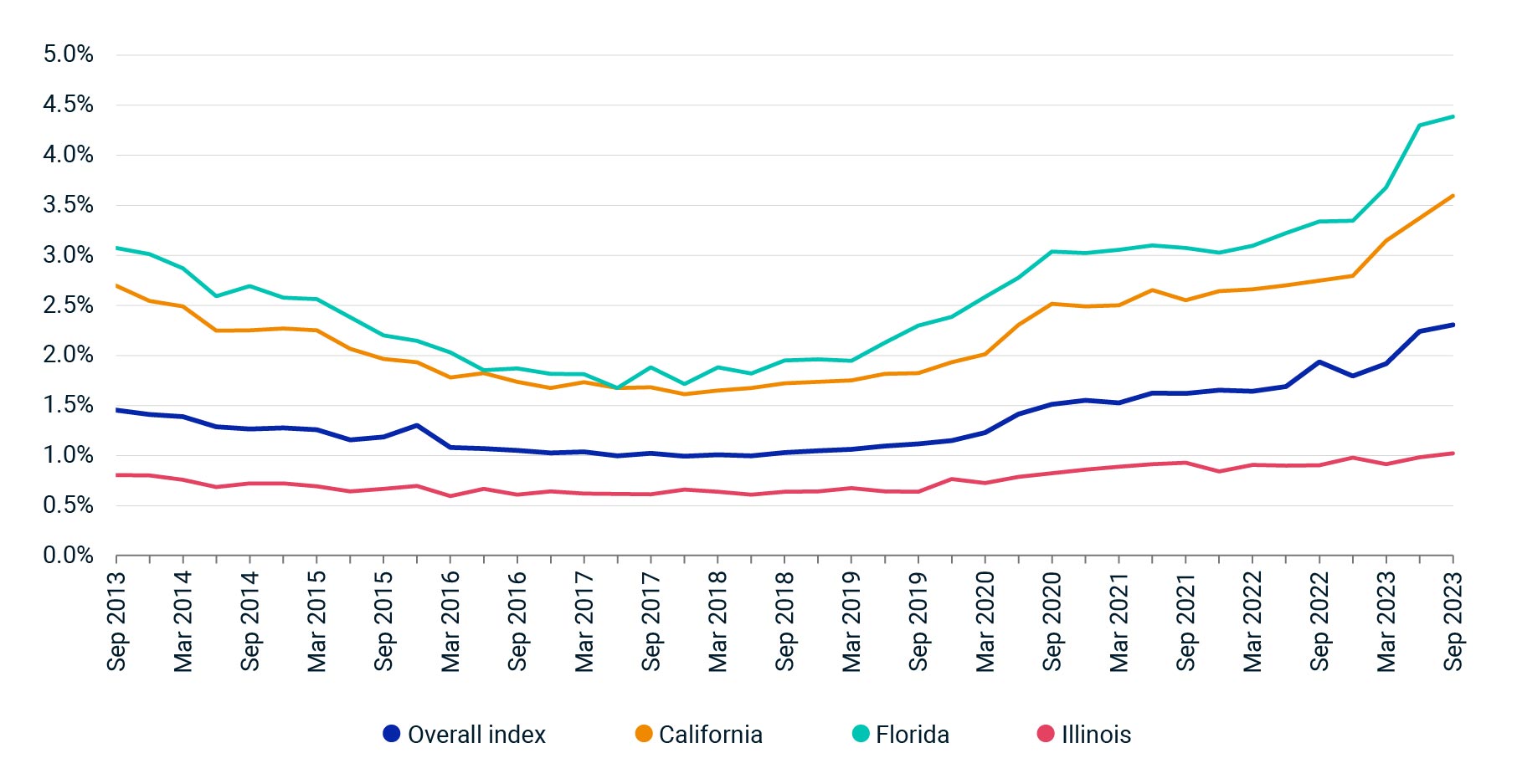

The Climbing Costs to Insure US Commercial Real Estate

Via MSCI: From the article: “Data from the MSCI U.S. Quarterly Property Index shows that insurance costs as a percentage of income receivable more than doubled to 2.3% from 1.0% over the five years between September 2018 and September 2023. These increasing costs have been attributed to the growing number, and increased severity, of extreme weather events, and higher reinsurance rates.”

- Don’t Count on Commercial Real Estate Prices Bottoming Out Any Time Soon (CoStar)

- Winter 2023 Retail Report (Colliers)

- Is A Commercial Real Estate Crash Coming? What Industry Leaders Can Do (Forbes)

Other Real Estate News and Reports

National Office Report, November 2023

Via Yardi Matrix: With a special focus on office-to-residential conversions, this report highlights its challenges, finding that “[e]ven a building perfectly suited for a conversion requires significant capital, meaning that interest rate increases and tight capital markets further limit the pool of opportunities. Unless the office sector sees unprecedented loss of value, conversions will require public support to thrive.”

- 2024 Global Investor Outlook (Colliers)

- How One Major Bank Plans to Grow its Real Estate Lending Market Share as Rivals Pull Back (WealthManagement.com)

- AI’s Influence on Multifamily Is Spreading (Multi-Housing News)