Gray Report Newsletter: November 23, 2023

Market Adjustment to “Higher for Longer”

With forecasts of greater supply and continued pressure from high interest rates, predictions that we are in the early moments of CRE valuation adjustment are gaining prominence, but expanded interest in non-bank lending is helping multifamily borrowers looking to resolve challenges related to increased borrowing costs.

Multifamily, the Nation, and the Economy

Capital Markets Report: Apartment Supply on the Rise for 2024

Newmark: “Although still down in 2023, as a more defensive and less volatile asset type, multifamily has higher returns than the broader property index thus far in 2023.”

- Market Matters: CRE Markets in Early Stages of Adjusting to High Interest Rates (Cushman & Wakefield)

- Economic, Housing and Mortgage Market Outlook – November 2023 (Freddie Mac)

- Year-to-Date Multifamily Performance Review (Moody’s Analytics)

Multifamily Markets and Reports

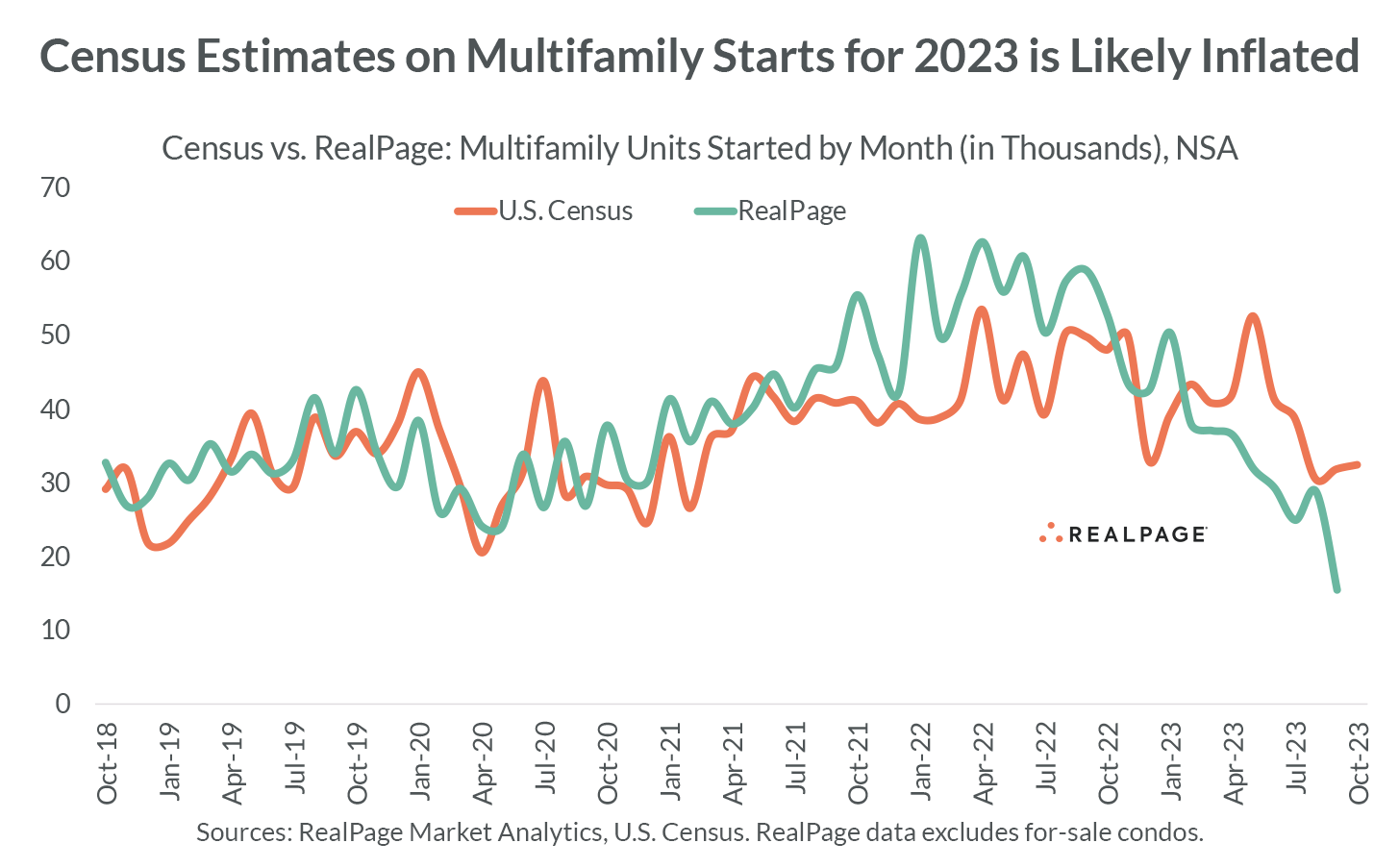

Census is Likely Overstating Multifamily Starts in 2023

Via RealPage: “Newly released data from the U.S. Census Bureau shows multifamily construction starts are down only 12% year-to-date in 2023 compared to the same period in 2022. That is highly unlikely, and . . . the evidence points to a far more severe drop of 40%+.”

- November Rental Activity Report: Minneapolis Is Most In-Demand City, Two California Destinations Join the List (RentCafe)

- Fall 2023 Off-Campus Student Housing Update (Fannie Mae)

- US Annual Rent Growth Relaxes for the 17th Straight Month in September (CoreLogic)

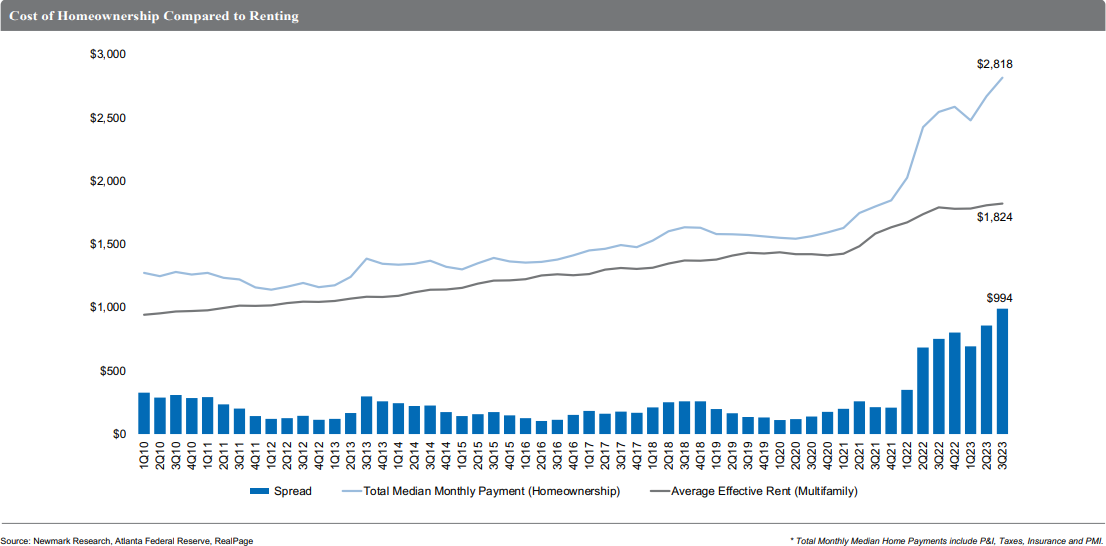

Multifamily and the Housing Market

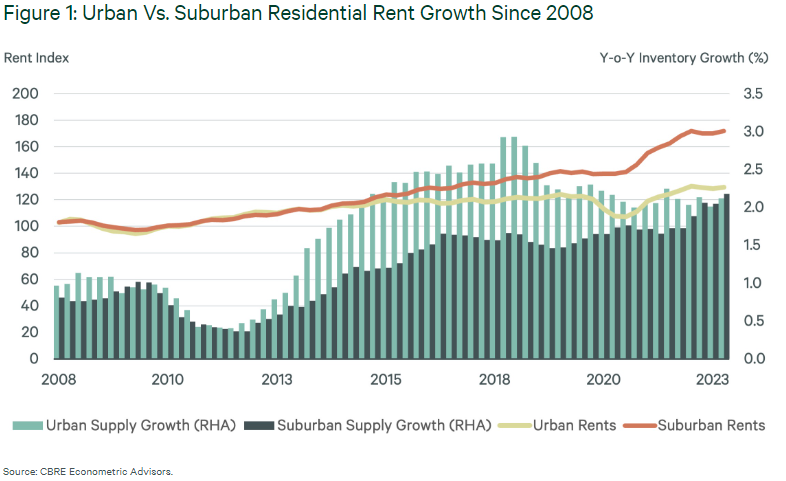

The suburbs never went out of style

Via CBRE: “More recently, suburban multifamily construction has picked up, stalling rent growth and likely setting up rents to fall in some submarkets. Nevertheless, suburban demand will be buoyed by the high mortgage rates that have chilled the for-sale market and likely will cause more young people to rent for longer, even after they marry and start families.”

- Home Size Trending Lower (NAHB)

- CCan Mortgage Forbearance Help Stabilize the Economy? (Harvard Joint Center for Housing Studies)

- Where Inexperienced Multifamily Investors Rushed In, ‘Generational Opportunities’ Await (Bisnow)

Commercial Real Estate and the Macro Economy

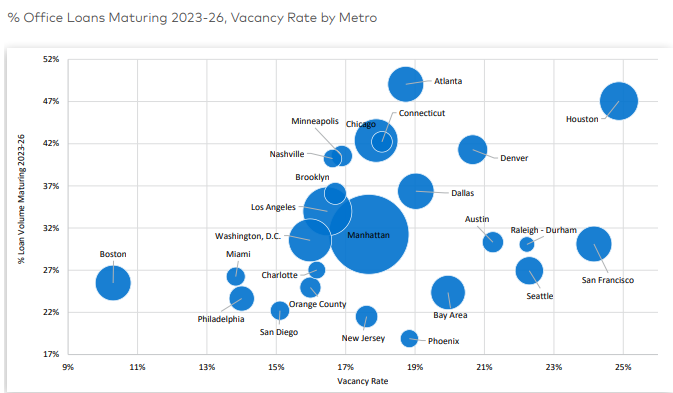

Office Loans Mature into Headwinds

Via Yardi Matrix: “The maturity wave is likely to lead to increasing distress, thanks to reduced demand due to hybrid work arrangements and capital constraints as lenders and investors attempt to reduce exposure to the sector.”

- Why private investors are shopping for retail real estate (JLL)

- CRE Investors Are Cautiously Optimistic For Now, except Office Investors (John Burns Research and Consulting)

- The Fed Says Best Not to Get Too Optimistic Right Now (GlobeSt)

Other Real Estate News and Reports

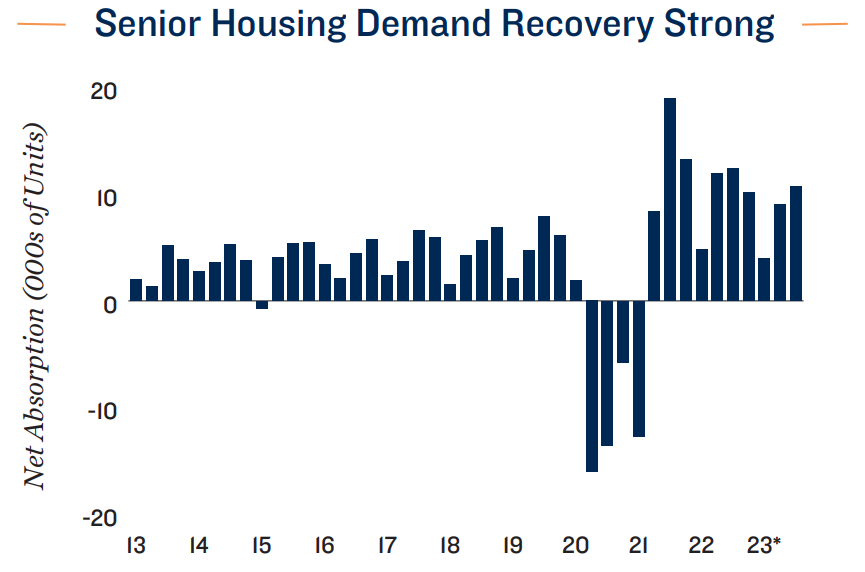

Senior Housing National Report: H2 2023

Via Marcus & Millichap: “Demand for senior housing options continued unabated during the first nine months of 2023, extending a robust recovery that has been underway since spring 2021. In the 10-quarter span between April of that year and September 2023, more than 103,000 units were absorbed on net.”

- National Self Storage Report, November 2023 (Yardi Matrix)

- Multifamily Loans Pose Risk to Regional Banks (GlobeSt)

- Renters are getting more perks as increased construction adds to housing market supply (Business Insider)