Gray Report Newsletter: November 16, 2023

Paradigm Shift for Multifamily and CRE

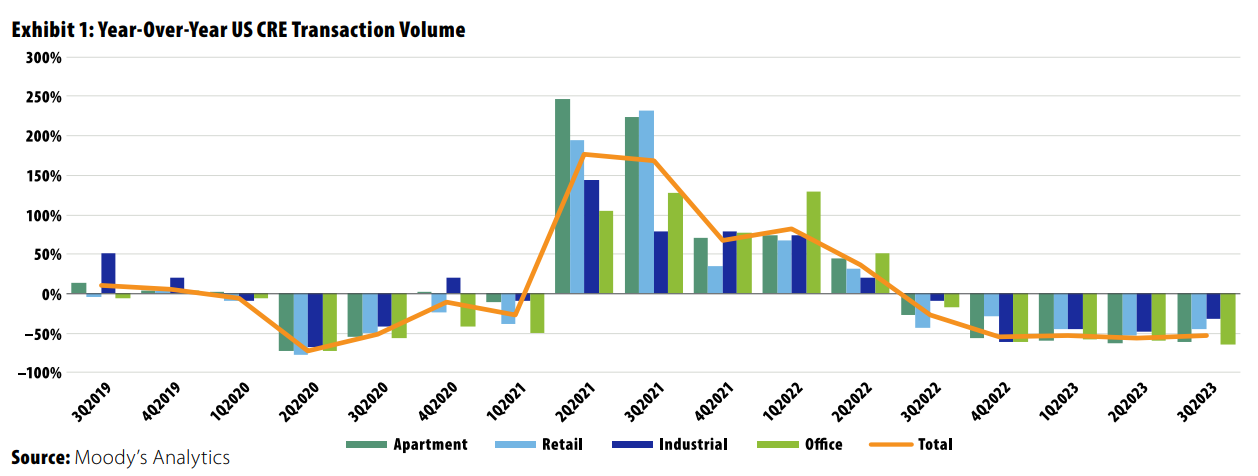

Stock markets rallied after this week’s CPI print showed lower inflation, but the path to lower interest rates may not be as quick or straightforward as some would hope. With continued low CRE property sales and a narrow cap rate-interest rate spread, investors looking for investment opportunities are turning to non-bank lending, preferred equity and other strategies in place of direct investment and acquisitions.

Multifamily, the Nation, and the Economy

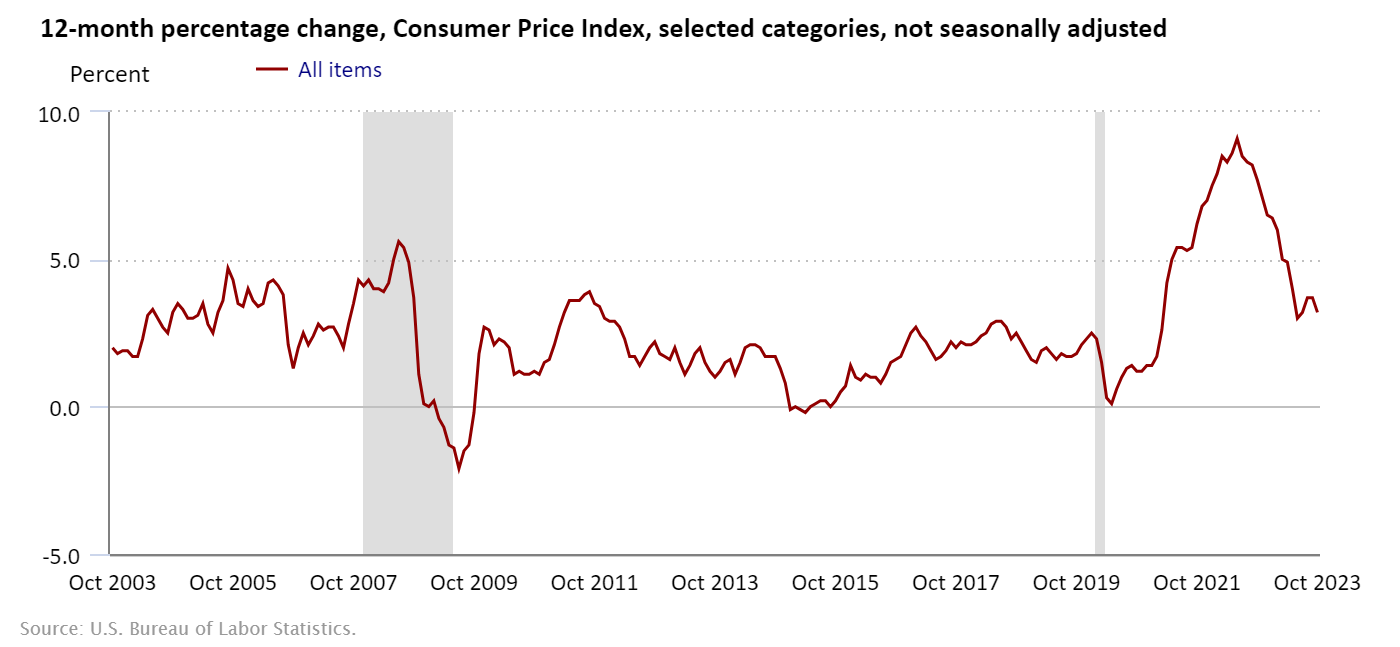

Oct. 2023 CPI Shows YoY Inflation Down from 3.7% to 3.2%

United States Bureau of Labor Statistics: Year-over-year inflation fell by 0.5% in October, and monthly inflation was flat, driven by a sizeable 5.7% monthly decrease in gas prices. Shelter costs, and rent specifically remain high but are expected to fall as CPI-measured rents fall in line with the cooldown in market rents in 2023.

- Private Debt Was Supposed to Collapse When Rates Rose. Instead It Is Everywhere. (The Wall Street Journal)

- Video: How Much Stress Is on the Road to Distress (CBRE)

- New Nonbank Regs and What They Might Mean for CRE Lending (GlobeSt)

Multifamily Markets and Reports

Via Moody’s Analytics: “Many of these maturing loans will see extensions, modifications, and various delay tactics as lenders wait for the CRE capital markets to stabilize. However, these loans will need to be worked out, and some will be sold into a soft market, further depressing prices. Whatever the scenario, 2024 will likely be rocky for lenders as they buckle up and ‘survive until ’25.'”

- Where Are the Most and Least Affordable US Single-Family Rental Markets? (CoreLogic)

- New Report: Burns Apartment Developer and Investor Survey (John Burns Research and Consulting)

- National Multifamily Report, October 2023 (Yardi Matrix)

Multifamily and the Housing Market

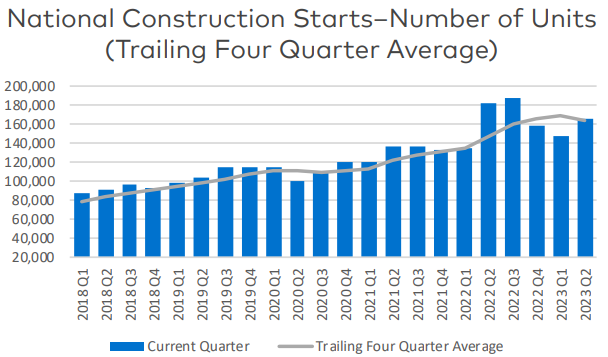

Multifamily Supply Forecast: Q4 2023

Via Yardi Matrix: With 2023 projections at 487,512 newly-built apartment units, 536,145 for 2024, 450,000-425,000 projected for 2025, and 378,000-335,000 projected for 2026, the dramatic influx of new apartment supply may have a longer tail than some have anticipated.

- The U.S. has more spare bedrooms than ever before (Apartment List)

- Learning from State Efforts to Encourage Accessory Dwelling Units (Harvard Joint Center for Housing Studies)

- A Risk Assessment of the Multifamily Market: Through the Lens of Bank CRE Loans (Trepp)

Commercial Real Estate and the Macro Economy

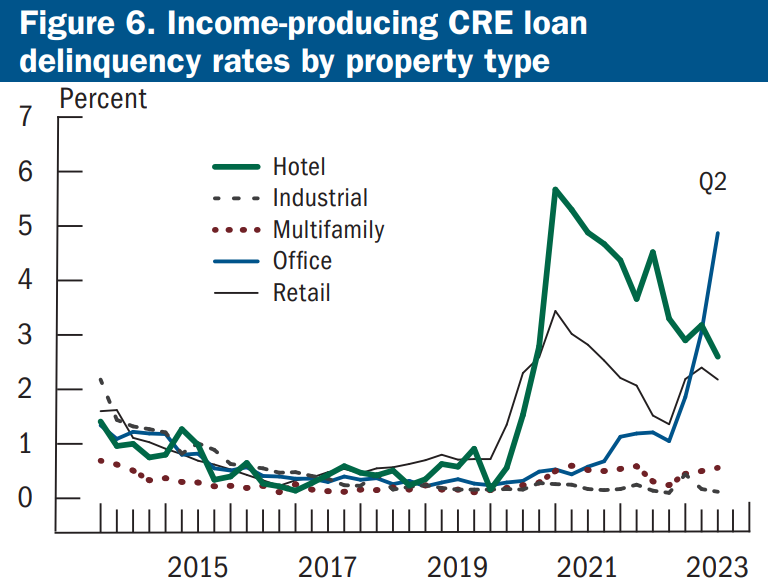

Supervision and Regulation Report, November 2023

Via The Federal Reserve Bank of the United States: “The Federal Reserve is also monitoring for potential credit deterioration, particularly within the consumer and commercial real estate (CRE) lending segments. Additionally, the Federal Reserve has implemented a new novel bank supervision program to improve oversight of banks engaged in nontraditional and financial technology-related activities.”

- Commercial Real Estate International Business Trends (NAR)

- Self Storage National Report, November 2023 (Yardi Matrix)

- The Clearest Sign Yet That Commercial Real Estate Is in Trouble (The Wall Street Journal)

Other Real Estate News and Reports

The National Industrial Market: Conditions & Trends, 3Q 2023

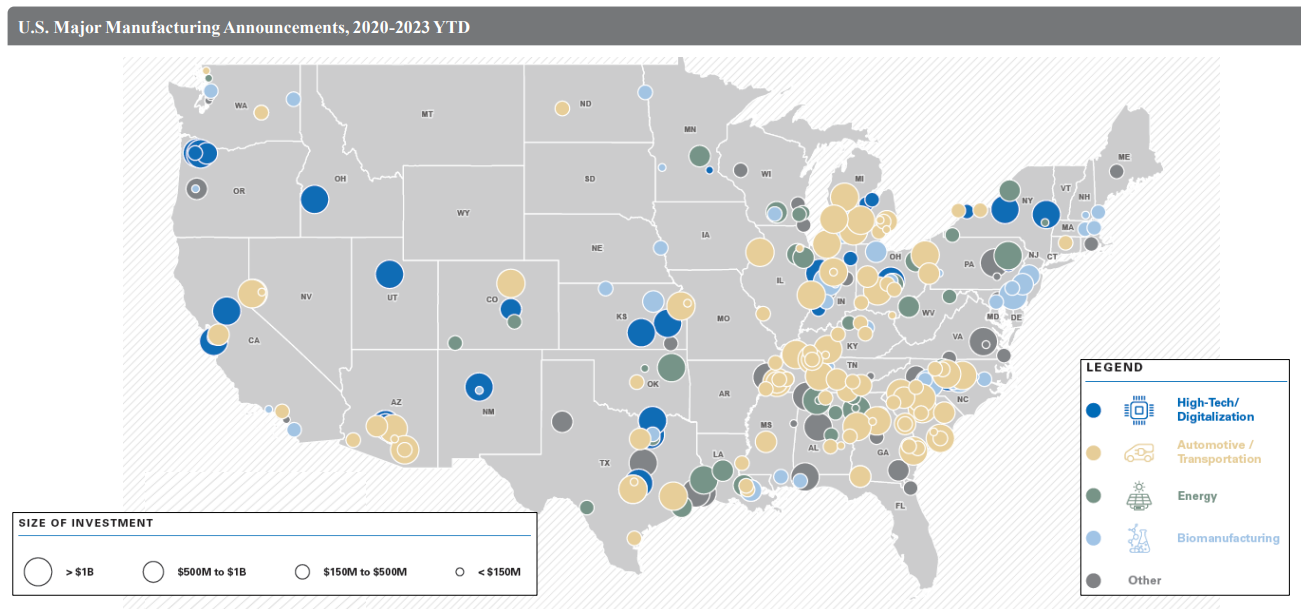

Via Newmark: “While many firms are pausing or slowing capital investments, advanced manufacturers are investing heavily in new construction. A snapshot of recent major investments reveals approximately $400 billion pledged, 210,000+ new jobs and a minimum of 250 MSF of new industrial projects to come between now and 2030.”

- Investing Beyond the Major CRE Asset Types (Cushman & Wakefield)

- Generative AI can change real estate, but the industry must change to reap the benefits (McKinsey)

- Supply Chain Solutions | State of the Industry Report Q3 2023 (Colliers)