Gray Report Newsletter: May 23, 2024

The Power of Affordability in Multifamily and Housing

For multifamily investors, lenders, property managers, and other industry professionals, affordability remains a pressing issue. As the CRE investment market adjusts to higher rates, rising insurance rates are another affordability headwind for multifamily operations. In the broader housing market, declining home sales could lead to higher apartment demand, but the current influx of newly-built apartments does represent some risk in the market. That being said, shrinking spreads from lenders and improving investor sentiment suggest that, amid the challenges and uncertainties of the current moment, confidence in the multifamily market is growing.

Multifamily, the Nation, and the Economy

Multifamily, the Nation, and the Economy

Report: Economics Continue to Favor Renting over Homeownership as Insurance Costs Surge

Via Newmark: “The spread between homeownership and apartments rental costs grew to $824 in the first quarter of 2024, increasing 18.4% year over year. Simultaneously, mortgage applications for home purchases have declined to a near-14-year low, and active listings remain well below pre-pandemic levels.”

- Inflation Eases in April, Bulls Grab the Reins (Berkadia)

- What Types of Activity Are Likely to Drive the CRE Market Throughout 2024? (Cushman & Wakefield)

- Multifamily Distress Rate Nearly Doubles In April (Bisnow)

Multifamily and the Housing Market

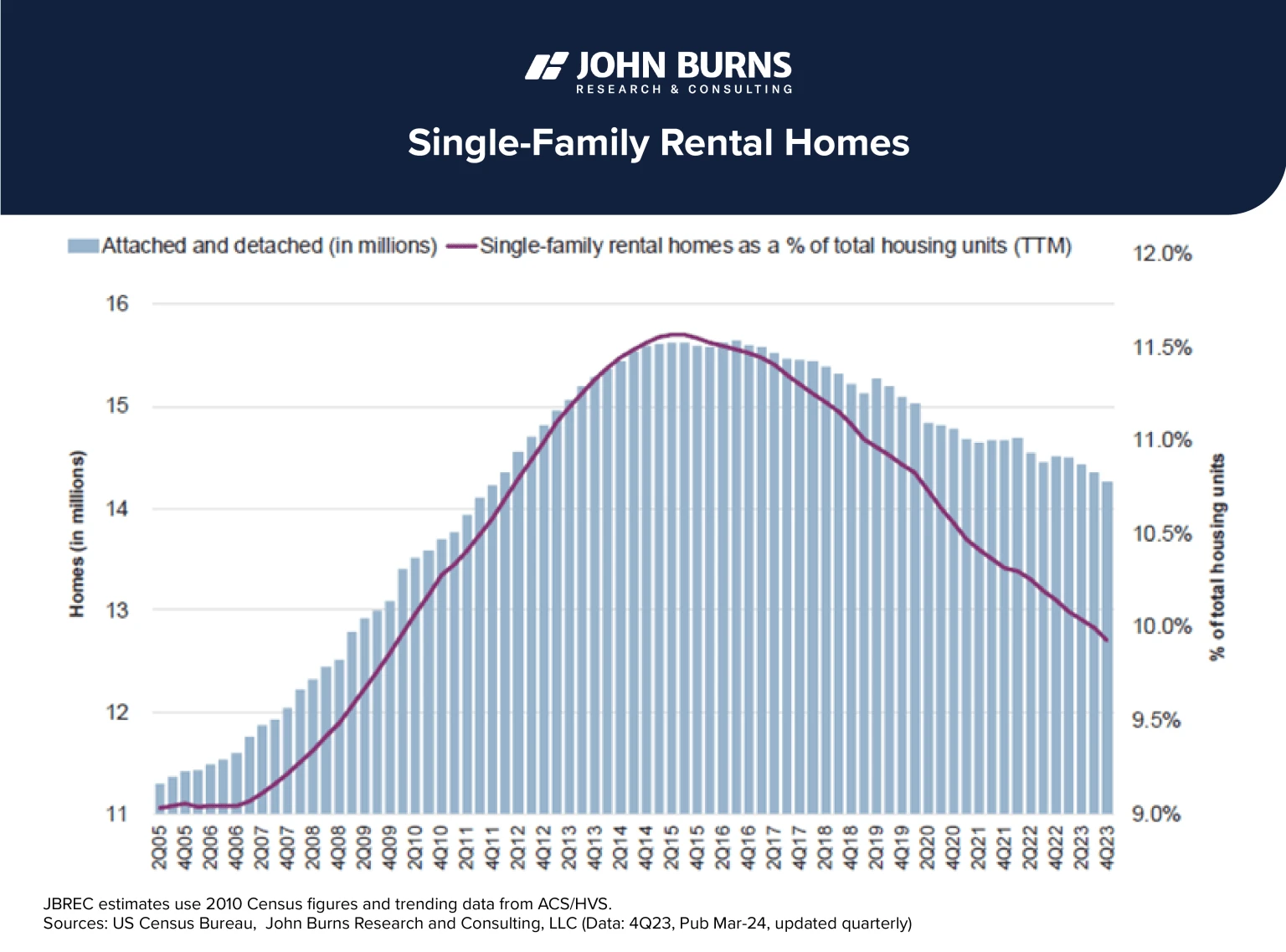

Charting a 22-year roller coaster of single family home investor activity

John Burns Research and Consulting: “Institutional investors (those who own 100 or more homes) are buying less than 2% of all homes—a much lower percentage than misleading headlines imply (see the third chart below).”

- New Single-Family Home Size Decline Continues (NAHB)

- Housing and Economic Outlook: High Inflation and Economic Resilience (Freddie Mac)

- Rural Areas Saw Disproportionate Home Price Growth During the Pandemic (Harvard Joint Center for Housing Studies)

Multifamily Markets and Reports

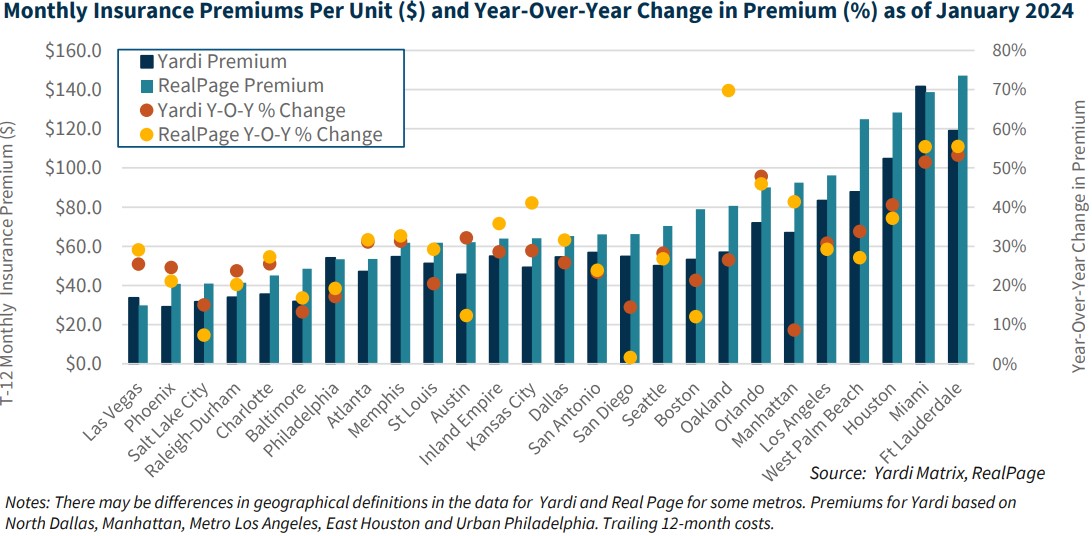

Higher Insurance Premiums Continue to Impact the Multifamily Sector

Fannie Mae: “As with market-rate properties, the annual property insurance premium remains at less than $600 per unit at Affordable properties in many markets that are not prone to natural disasters, such as Seattle and Indianapolis.”

- Does the U.S. Apartment Market Still have a Prime Leasing Season? (RealPage)

- US Single-Family Rent Index – May 2024 (CoreLogic)

- Existing Home Sales Recede in April (NAHB)

Commercial Real Estate and the Macro Economy

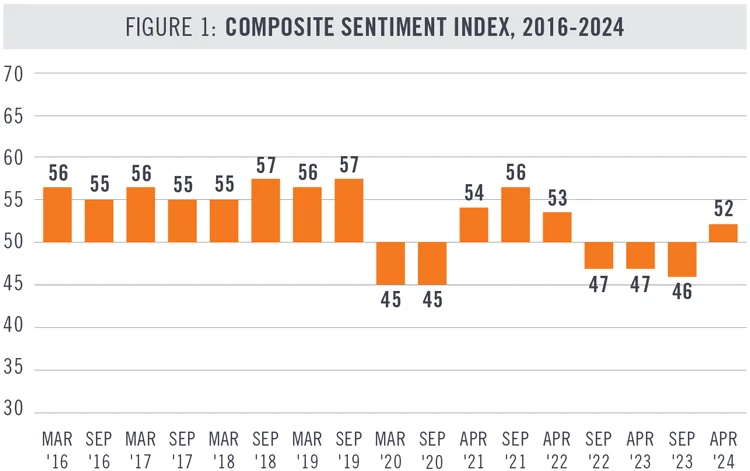

CRE Sentiment and Optimism Increases

Via NAIOP: “Respondents are now much more optimistic about capital market conditions than they were in September. The outlook for the availability of debt, the availability of equity and first-year cap rates improved more than for other measures. This shift is likely due to an expectation that interest rates will fall over the next 12 months.”

- Report: Storage operators expect busy season to boost slowing performance (Yardi Matrix)

- CRE Lending Spreads Shrink as Rates Increase (Trepp)

- U.S. Retailer Industry Foot Traffic Analysis | April 2024 (Colliers)

Other Real Estate News and Reports

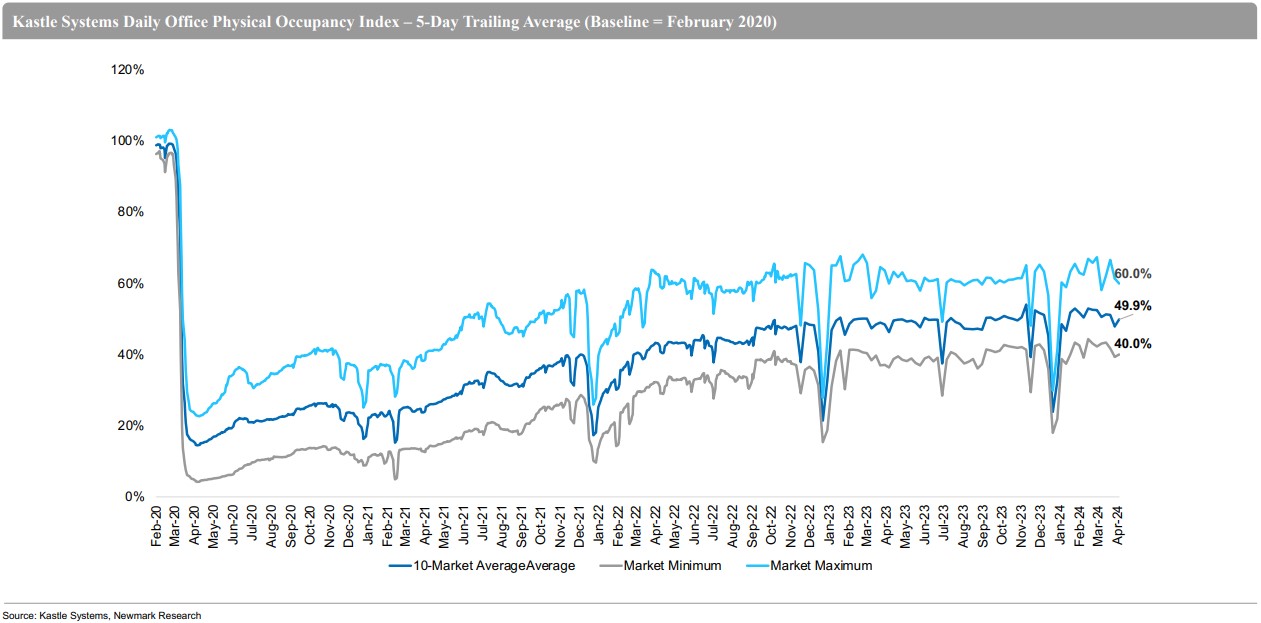

Office Report: Economics Continue to Favor Renting over Homeownership

Via Newmark: “In the two decades prior to 2020, the full paid days worked from home by all employees averaged 5.2%. This metric grew significantly in the first quarter of 2020, reaching a maximum of 61.5% in May of 2020. Since then, this metric has declined at a decelerating pace and stands at 27.5% as of March 2024.”

- How Capital Allocations to the Office Sector Are Changing (CBRE)

- U.S. Office Market Outlook Report | Q1 2024 (Colliers)

- Office Loan Maturity Monitor: Is April an Indication of What’s To Come? (Moody’s Analytics)

- May 2024 Office Report: Office Struggles to Cover Debt Obligations (Yardi Matrix)