Gray Report Newsletter: March 28, 2024

Window of Opportunity for Multifamily Investors?

Undaunted by persistent high interest rates, last year’s sluggish rent growth, and projections of elevated supply through the end of 2024, multifamily investors are re-entering the market, buoyed by recent data on apartment fundamentals.

Multifamily, the Nation, and the Economy

Multifamily, the Nation, and the Economy

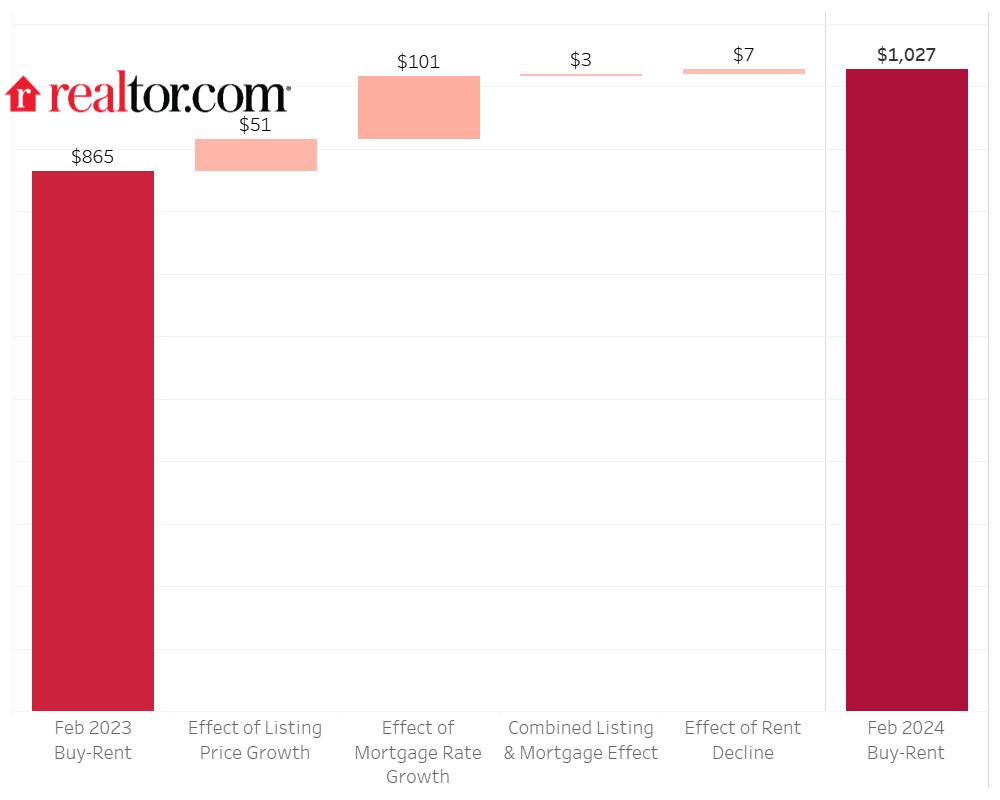

Owning a Starter Home Is More Expensive Than Renting in All Top 50 Metros

Via Realtor.com: “In February 2024, the cost of buying a starter home in the top 50 metros was $1,027 (60.1%) higher than renting one. In addition, renting is a more affordable option than buying in all of the 50 largest metros, whereas the number of metros favoring renting was 45 at the same time last year.”

- DOJ escalates price-fixing probe on housing market (Politico)

- FAU Housing Expert: NAR Settlement May Lead to More Complex Deals (Florida Atlantic University)

- Assessing Investor Sentiment: A Window Of Opportunity (CBRE)

Multifamily and the Housing Market

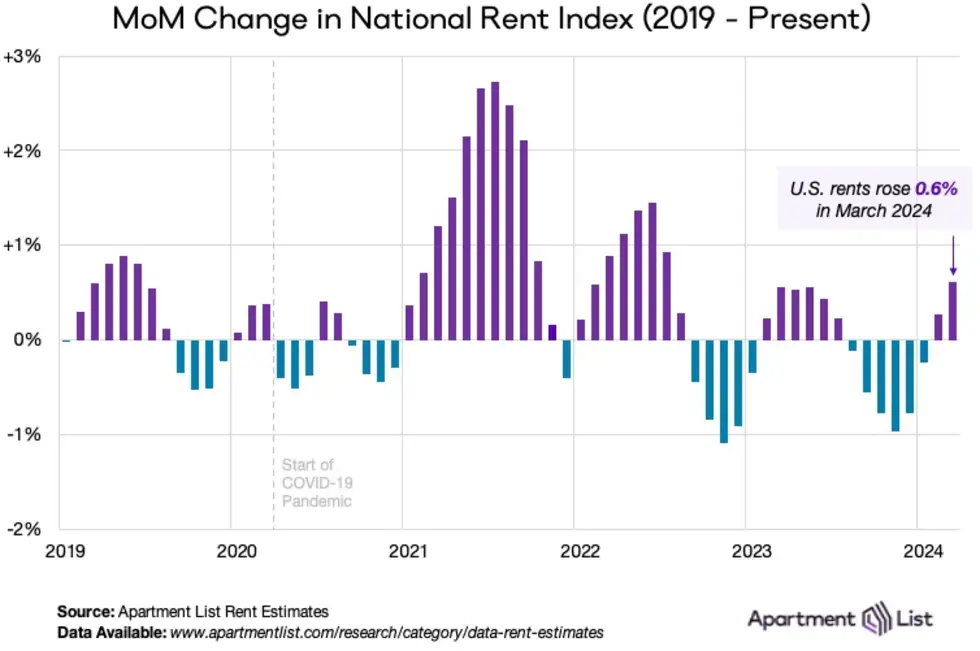

March 2024 Rent Report – Rent Growth Spike: Up 0.6% in One Month

Apartment List: “Year-to-date, the national median rent is up by a total of 0.9% so far in 2024, which is slightly faster than the 2017 to 2019 average (+0.7%). This may indicate that the market is starting a modest bounceback after a period of sluggishness.”

- What Comes Next for the Housing Market (The New York Times)

- Rental Housing Unaffordability: How Did We Get Here? (Harvard Joint Center for Housing Studies)

- Gen Z by Age 30: Renting Becomes the Go-To Housing Option With a Total Cost of $145,000 (RentCafe)

Multifamily Markets and Reports

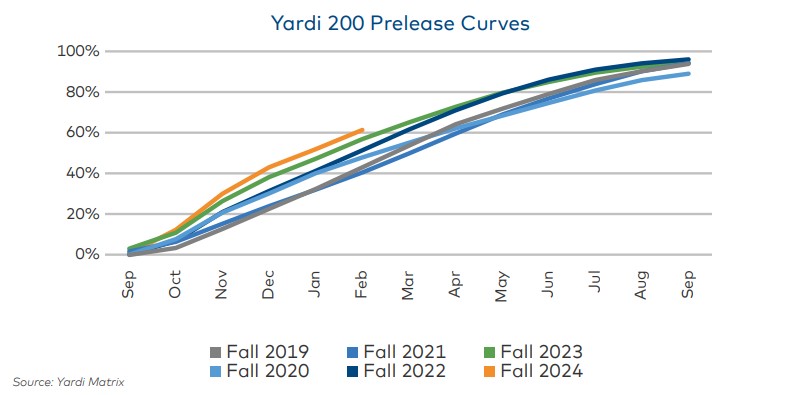

March 2024 Student Housing Report: Preleasing “moving at a historically fast pace”

Yardi Matrix: “The 2024-2025 leasing season is starting to look more like last year, although it’s still moving at a historically fast pace. Rent growth has slowed as we get into the heart of the leasing season.”

- Multifamily Momentum Special Report (Institutional Property Advisors)

- This Time is Different: A Counter to the Urban Doom Loop Narrative (Moody’s Analytics)

- South Florida Rents Rise Dramatically Since COVID, While Bay Area Stagnates (RealPage)

Commercial Real Estate and the Macro Economy

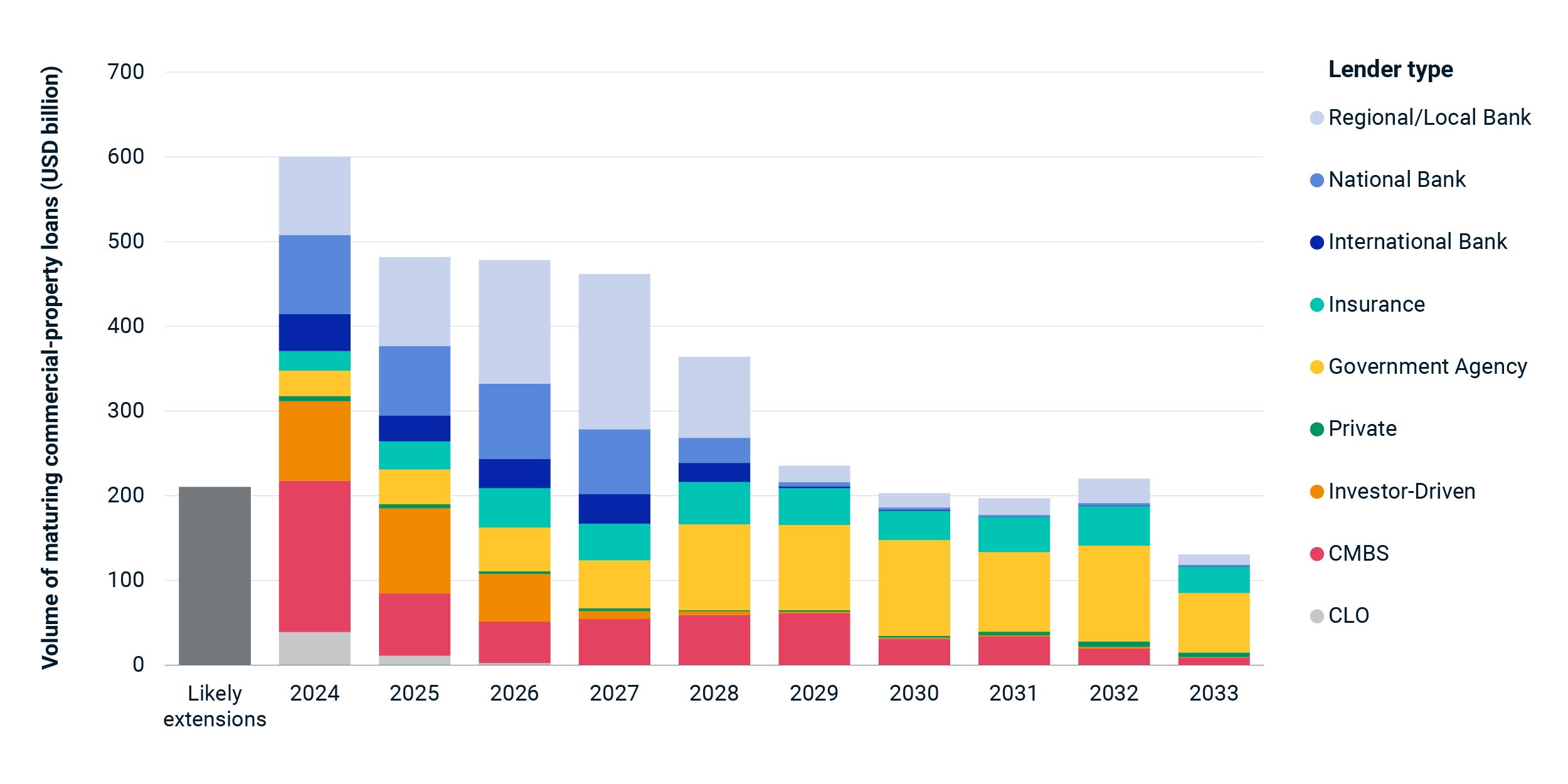

Wave of Property-Loan Maturities Amplified by Extensions

Via MSCI: “CMBS lenders have the single largest exposure to loans maturing in 2024, accounting for nearly 30% of the outstanding balance. Later in the maturity schedule, banks dominate. Bank lenders are behind at least 45% of the loans scheduled to come due in 2025, 2026 and 2027.”

- Report: 2024 Self Storage Outlook Faces Headwinds (Yardi Matrix)

- 2024 Global Investor Intentions Survey Shows U.S. Multifamily Clear Favorite (CBRE)

- March 2024 CRE Report: Multifamily Recovery Well on Its Way (NAR)

Other Real Estate News and Reports

Via Marcus & Millichap: “A resilient economy, paired with public policy support, has strengthened the outlook for industrial commercial real estate. While recent substantial development has contributed to higher vacancy among some properties, these headwinds appear temporary.”

- With Debt Harder To Get, CRE Finance Is Facing A ‘New Reality’ (Bisnow)

- 2023 Year-End National Life Science Market Overview (Newmark)

- Office Market Report, March 2024: Remote Work’s Varied Impact on Markets (Yardi Matrix)