Gray Report Newsletter: March 14, 2024

Multifamily Market Warms Up

Positive rent growth is taking hold in 2024, with multiple sources reporting increased rent growth after a lengthy cooldown period. Elevated apartment supply is expected to put a limit on rent growth, but these early signs of strength in the multifamily market could bring apartment fundamentals much closer to pre-pandemic averages than they were in 2023, which could be a good sign for multifamily borrowers grappling with the prospect of extended high interest rates. The recent CPI print showed elevated inflation, but little evidence (yet) of a consistent trend.

Multifamily, the Nation, and the Economy

Multifamily, the Nation, and the Economy

Feb. 2024 National Multifamily Report: Multifamily Rents Inch Up Ahead of Spring

Via Yardi Matrix: From the report: “U.S. multifamily rents rose slightly in February, their first increase in seven months, in a sign that the market is stable[, but] The stability on the surface belies a host of changing trends that are keys to determining the direction the market takes from here.”

- Study: How new [market rate] apartments create opportunities for all (Minneapolis Federal Reserve)

- More Construction Projects Are Being Delayed Or Abandoned Entirely (Bisnow)

- CPI Report Shows Slight Uptick in Inflation (Bureau of Labor Statistics)

Multifamily and the Housing Market

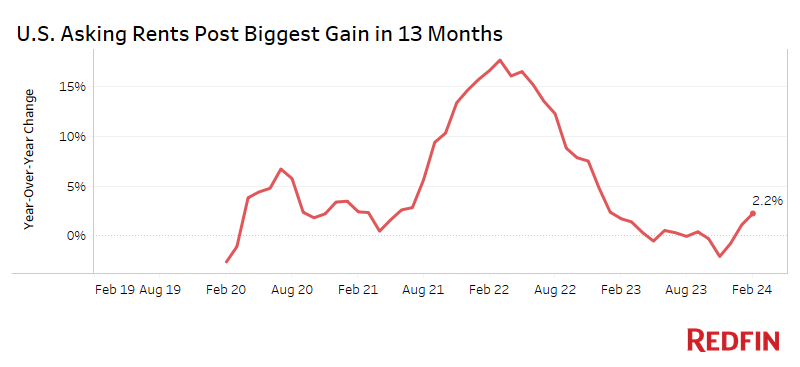

Asking Rents Climb 2% in February, Biggest Gain in Over a Year

Redfin: “An increase in rents in the Northeast and Midwest also contributed to the jump in asking rents in February . . . While rents jumped in February, they’re relatively stable compared to the past two years, when the pandemic sent the rental market on a rollercoaster ride.”

- The State of the Union and its Potential Ramifications on US Housing (Moody’s Analytics)

- Home-Selling Sentiment Moves Higher Ahead of Spring Homebuying Season (Fannie Mae)

- Where Are the Most Expensive US Places for Property Taxes? (CoreLogic)

Multifamily Markets and Reports

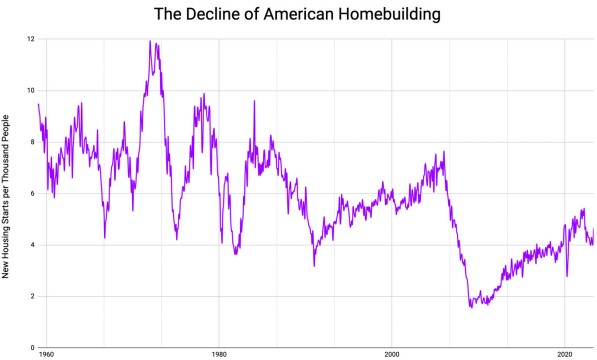

Harvard Joint Center for Housing Studies: Following a movement in 1970 “calling for returning control of urban government to the neighborhood level . . . the restrictions on urban development that marked the era of neighborhood liberalism set the stage for the severe housing shortages that New York and similar cities would experience in the twenty-first century.”

- Housing Rent Increases in Feb., Slightly Less than Pre-Pandemic Average, but not by Much (Zillow)

- Study: Housing Premiums Shrink, Signaling Good News for Homebuyers (Florida Atlantic University)

- A Look at the Tightest Apartment Market in the US (GlobeSt)

Commercial Real Estate and the Macro Economy

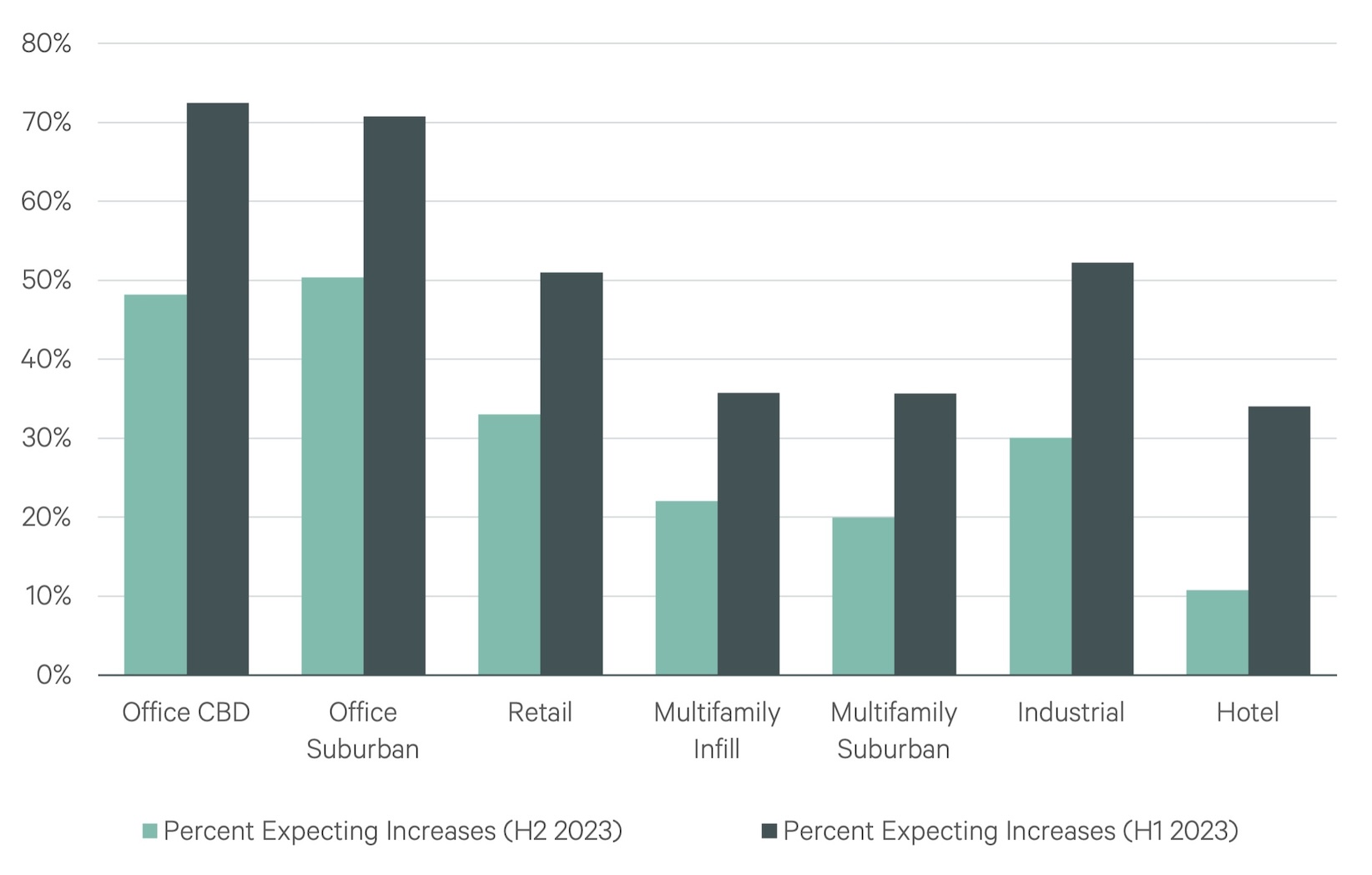

CBRE Cap Rate Survey Suggests That the Market is Finding a Floor

Via CBRE: “As you can plainly see, far fewer industry participants think cap rates will increase today than did so six months ago. In fact, ‘no change’ was the most common answer across all property types in our most recent survey.”

- Inside the “standoff” over what office buildings are worth (Axios)

- ‘You Can Imagine The Pressure’: Commercial Appraisers At The Center Of CRE’s Price Reckoning (Bisnow)

- Loan Modifications Then and Now – Extend & Pretend in the Office Sector (Trepp)

Other Real Estate News and Reports

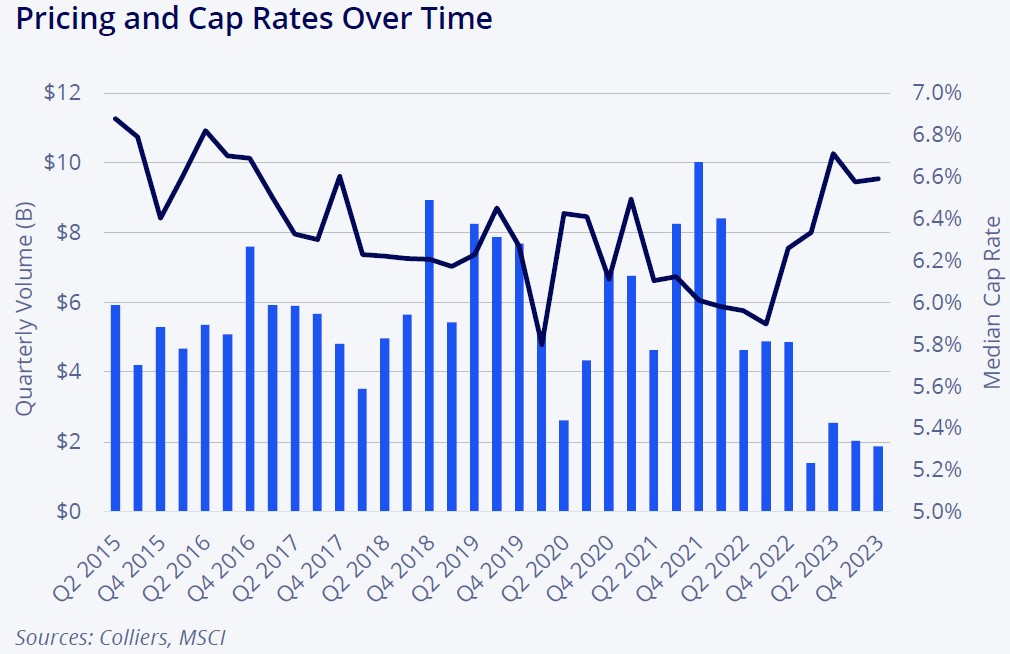

Report: Single-Tenant Net Lease Sales Remain Restrained

Via Colliers: “A volatile capital markets backdrop led to restrained volume in single-tenant net lease (STNL) sales, with 2023 posting the weakest figures since 2012, and it’s no wonder why. The 10-year Treasury peaked around 5% in October, while the Fed didn’t announce its plans to pivot until December, resulting in restricted lending and a pullback in activity.”

- U.S. Hotels State of the Union March 2024 Edition (CBRE)

- How Nearshoring Could Impact CRE (Marcus & Millichap)

- The Surprising Left-Right Alliance That Wants More Apartments in Suburbs (New York Times)