Gray Report Newsletter: June 6, 2024

CRE Sales Plummets, Rent Growth Sluggish, but Prospects Are Good

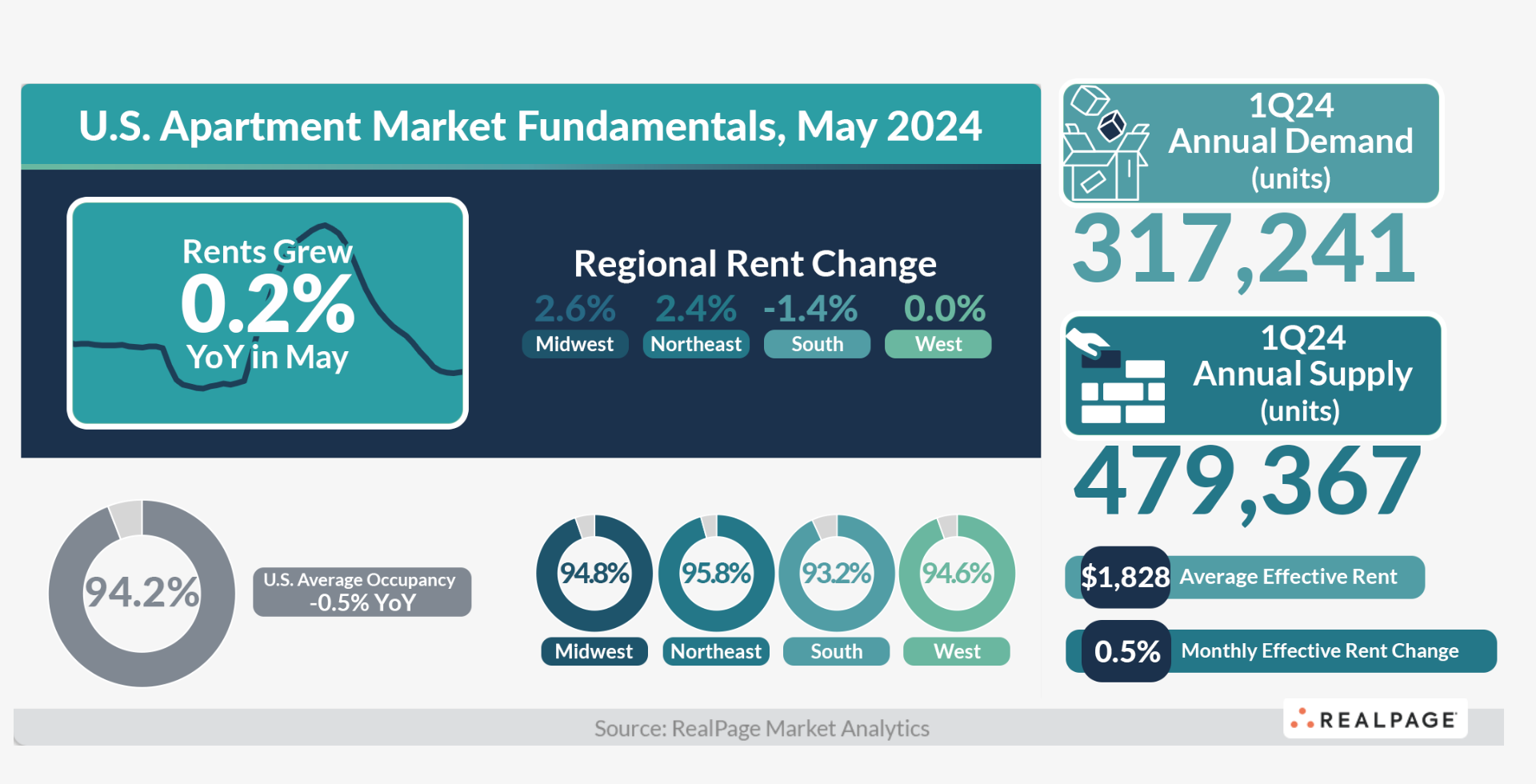

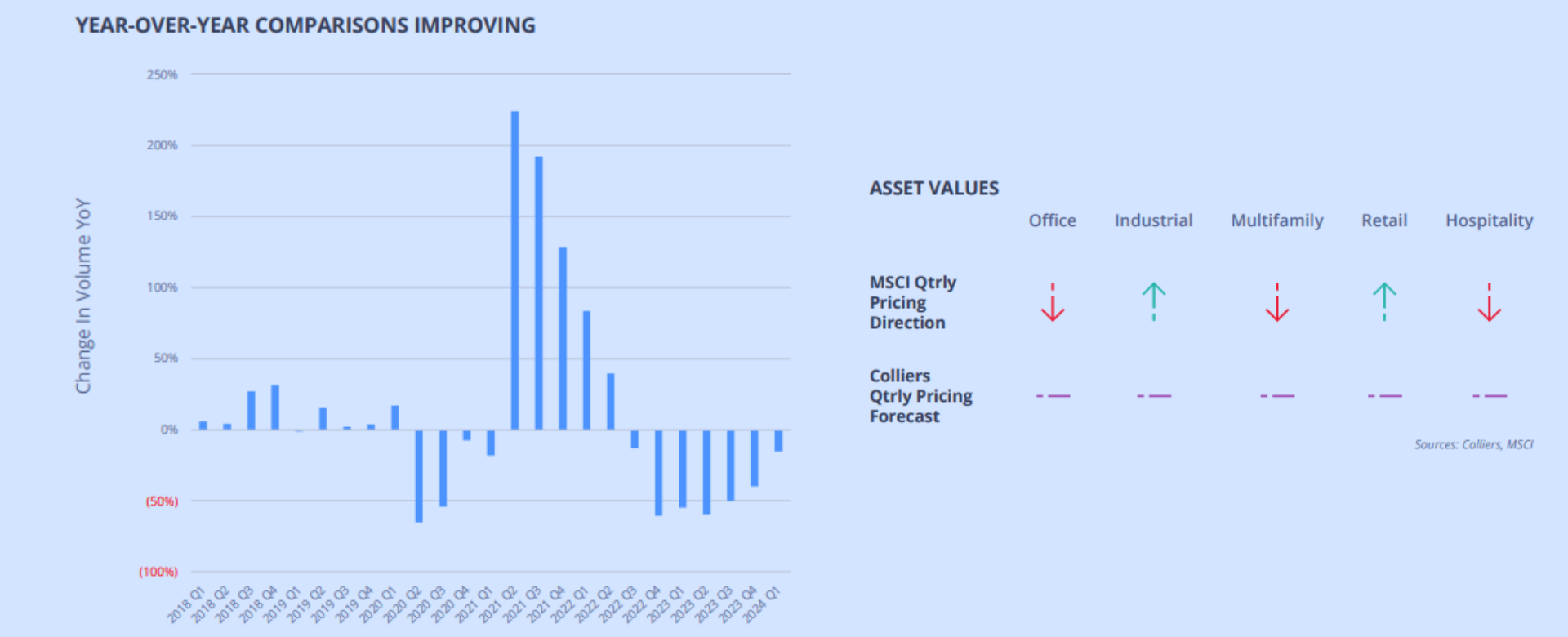

Investment sales for commercial real estate properties continues to decline year-over-year, and recent data on the multifamily market shows weaker rent growth than expected for this time of year. That being said, evidence continues to build that points to improving multifamily performance in the wake of the current wave of apartment supply. Alongside construction slowdowns, absorption numbers have been extremely high, but not high enough to match the record amount of apartments entering the market. Currently, strong demand has been a much-needed bulwark against multifamily headwinds, and given the longevity and magnitude of housing demand trends, multifamily prospects are looking positive in the years to come as apartment supply rebalances.

Multifamily, the Nation, and the Economy

Multifamily, the Nation, and the Economy

U.S. Apartment Occupancy Demonstrates Resilience Amid Historic Supply

Via RealPage: “After softening throughout most of 2022 and 2023, . . . May 2024 marked the seventh straight month in which occupancy has held at or above 94.1%, further solidifying the idea that the nation has reached a point of stabilization.”

- FBI Searches Office Of Apartment Developer Cortland In Connection With Antitrust “Price Fixing” Probe (Bisnow)

- May 2024 CRE Market Insights: Absorption more than doubled compared to last year (NAR)

- Construction Delays and Cancelled Projects: Developers Sit on Empty Lots After Historic Apartment Boom (The Wall Street Journal)

Multifamily and the Housing Market

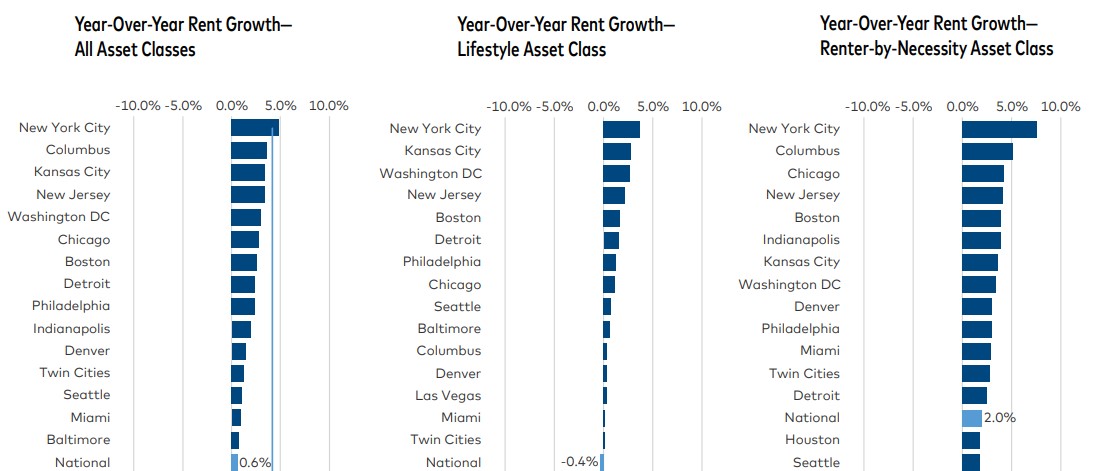

May 2024 Multifamily Report: “Modest” Growth for May

Yardi Matrix: “[Multifamily] headwinds . . . [are] led by the rapid supply growth in Sun Belt markets. Looking at the Matrix top 30 metros, there are nine with year-over-year rent growth of -1.5% or worse, all of which are high-growth Sun Belt markets with an extensive delivery pipeline that we forecast will persist through the end of 2025.”

- “We believe housing is permanently more expensive.” (John Burns Research and Consulting)

- US Home Price Insights: Prices up 5.34% YoY in April, “Set to Cool by Spring 2025” (CoreLogic)

- Home Prices and Borrowing Costs Climb, Further Constricting the Market (Marcus & Millichap)

Multifamily Markets and Reports

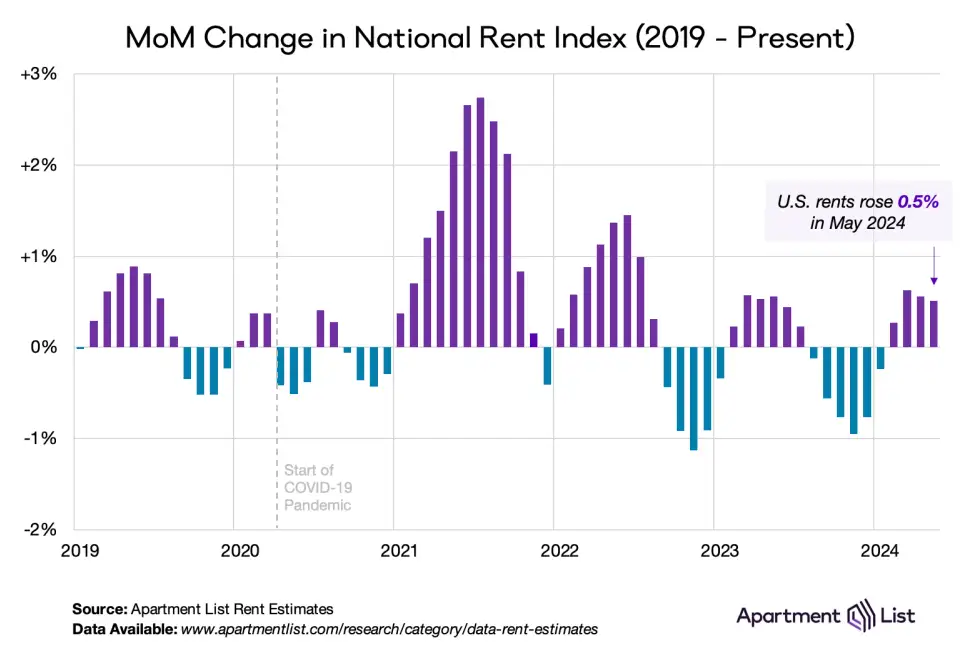

May 2024 Rent Report: “Sluggish” Rent Growth, Particularly in the Sunbelt

Apartment List: “After prices skyrocketed in 2021 and 2022, the pendulum has since swung back a bit as price growth has been kept in check by sluggish demand colliding with a robust supply of new inventory hitting the market[,] . . . [although rent growth] is still 22 percent higher than it was at the start of 2021.”

- Single-Family and Multifamily Production Headed in Opposite Directions Across Geographies (NAHB)

- National Apartment Size Rebounds as More 2- & 3-Bedroom Rentals Are Built (RentCafe)

- “There are roughly one million fewer workers in the construction trades than there were at the time of the last housing boom in 2007” (Harvard Joint Center for Housing Studies)

Commercial Real Estate and the Macro Economy

Q1 2024 Capital Markets Snapshot: “Precarious” CRE Sales Down YoY for 7th Straight Quarter

Via Colliers: “Volume continues to fall year-over-year, with Q1 volume on par with 2013 levels[, but] . . . [t]he pace of sales decline has eased, and the typical drop-off from Q4 to Q1 was not as substantial as it has historically been.”

- What’s the Long Term CRE Outlook? (Marcus & Millichap)

- The Pros and Cons of a Strong Economy for CRE (Moody’s Analytics)

- Agency CMBS trading spreads reach multiyear tight levels (Berkadia)

Other Real Estate News and Reports

Office Submarkets Bucking the Trend

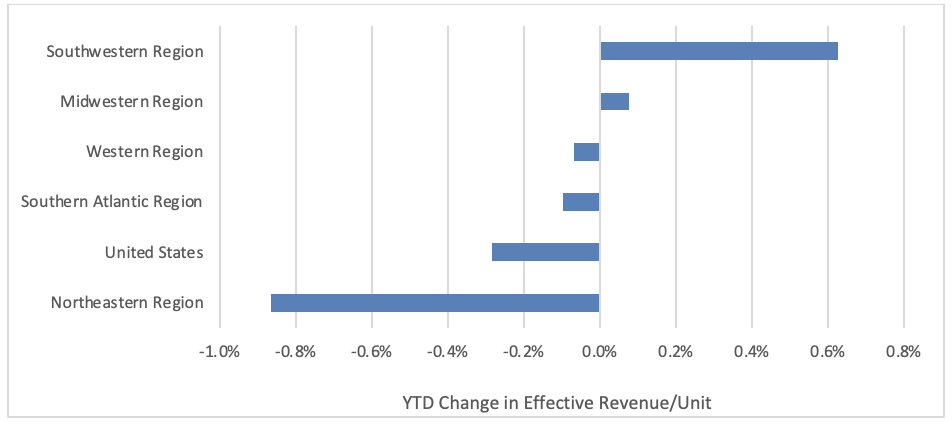

Via Moody’s Analytics: “Among our five regions, while the Northeast was the top ranked region for the multifamily sector, its office sector performance ranked last given its effective revenue declined by 87-bps during the quarter.”

- The Level of Criticized Bank CRE Loans Across Major Metros: By Property Type (Trepp)

- 2024 Global Data Center Investor Intentions Survey (CBRE)

- These Banks are Overexposed to CRE (GlobeSt)