Gray Report Newsletter: January 4, 2024

Hardened Investors in a Softening Year for CRE

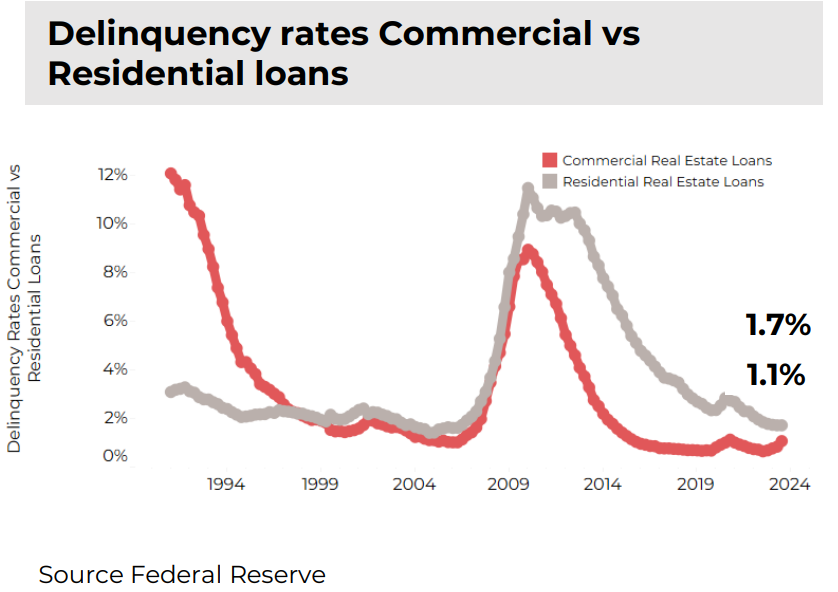

The view of multifamily market fundamentals continues to clarify, with near-universal expectations of elevated apartment supply that could extend the current rent growth stagnation through the end of the year. While there is little evidence that rent growth will trend lower in 2024 compared to 2023, an economic downturn could change things dramatically. Commercial real estate capital markets have spent the past year quietly building pent-up demand, but given the flat performance and softening valuations across different CRE sectors, it may require more than a simple promise of lower interest rates before investment activity picks up later this year.

Multifamily, the Nation, and the Economy

10 Critical Questions for CRE and the Economy in 2024

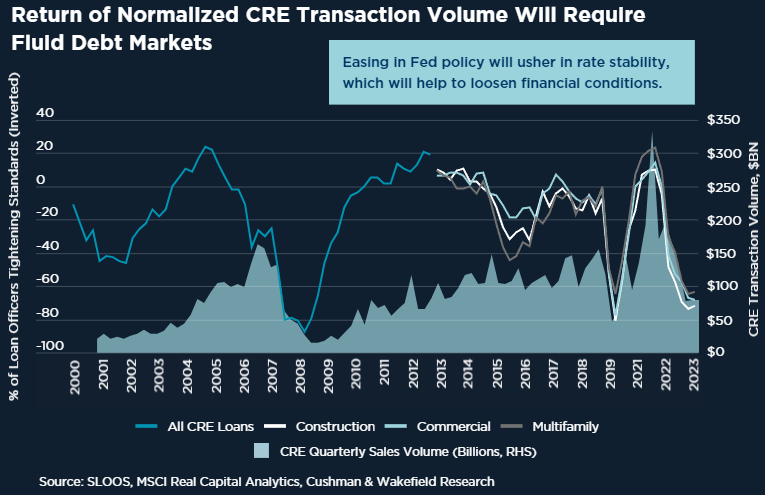

Cushman & Wakefield: Among their predictions for 2024, Cushman & Wakefield sees a recession in Q1, a Fed pivot in Q2 toward gradually lower rates, recovering sales volumes in H2, rising (but not overwhelming) property distress, and a continued surge in newly-constructed properties in the multifamily market through the end of the year.

- On The Horizon For CRE In 2024: All Eyes On Interest Rates, Ailing Office, Multifamily Supply Surge (Bisnow)

- Fed officials in December saw rate cuts likely, but path highly uncertain, minutes show (CNBC)

- Chill in the Housing Market Seeps Into Other Industries (The New York Times)

Multifamily Markets and Reports

December 2023 Apartment Market: Is Rent Growth Past It’s Lowest Point?

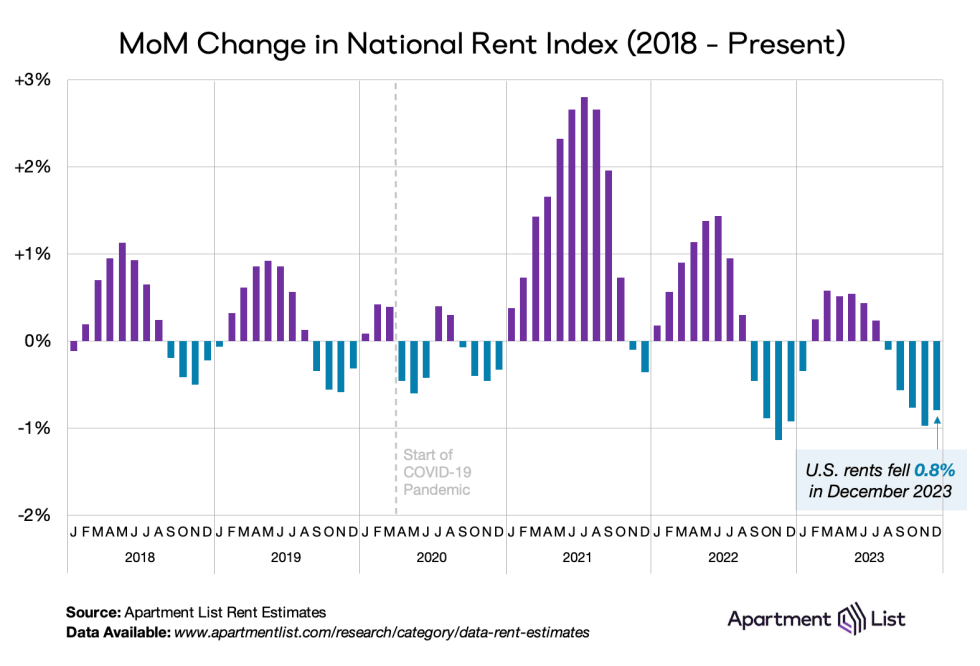

Via Apartment List: Rent declines were unambiguous in the latter half of 2023, with lower rents in 83 of the 100 largest cities, according to this report. That being said, the declines in late 2023 are less severe than the same period in 2022, but January rent growth numbers will be a crucial data point to determine whether the apartment market shifts away from the current cooldown.

- These U.S. Markets Added the Most Jobs in the Past Five Years (RealPage)

- Apartment Rent Relief Is Expected To Continue in 2024 (The Wall Street Journal)

- Here are top experts’ biggest predictions for the US housing market in 2024 (Business Insider)

Multifamily and the Housing Market

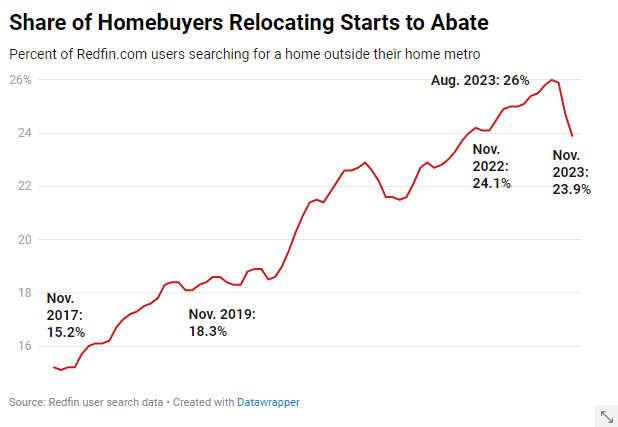

Migration Report: Share of Homebuyers Relocating at Lowest Level in 18 Months

Via Redfin: “The share of U.S. homebuyers looking to move to a different metro area declined for the third straight month in November, dropping to 23.9%, the lowest share in a year and a half. That’s down from 24.1% a year earlier–a tiny drop, but the first annual decline in Redfin’s records–and down from a record high of 26% over the summer.”

- ‘Rural real estate has really taken off’: 2024 Zillow housing forecast predicts affordable rural property (Yahoo News)

- Zillow’s Chief Economist’s 2024 Housing Market Resolutions (Zillow)

- Housing market predictions: Six experts weigh in on the real estate outlook in 2024 (USA Today)

Commercial Real Estate and the Macro Economy

Dec. 2023 CRE Report, and Optimistic 2024 Forecast

Via NAR: “[F]or most of the year, nearly every commercial real estate market segment encountered a continuous rise in vacancy rates and a deceleration in rent growth[, but t]he prospect of lower interest rates signals optimism for continued economic expansion in 2024, [and] could stimulate investments in the commercial real estate market.”

- Investment Trends in Focus: Five Key Themes for 2024 (MSCI)

- Apartment Rent Relief Is Expected To Continue in 2024 (The Wall Street Journal)

- Top CRE Predictions for 2024 (GlobeSt)

Other Real Estate News and Reports

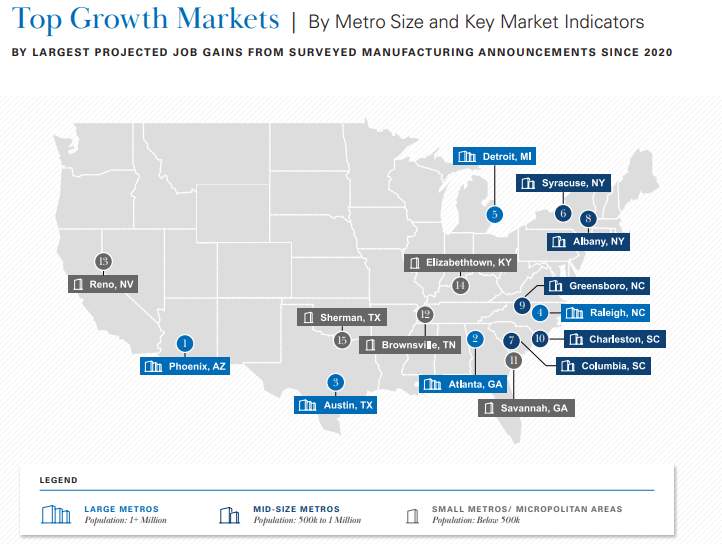

Report: Manufacturing Growth and Industrial and Logistics Markets

Via Newmark: “[T]he regions poised to benefit most from advanced manufacturing investments are predominantly secondary and tertiary metros near major markets with higher-than-average levels of preexisting advanced manufacturing talent, relatively lower-cost energy and abundant, affordable land.”

- Trouble Piles Up As NAR Faces ‘Extinction-Level Event’ (Bisnow)

- Two Prologis Bold Predictions for the Economy (GlobeSt)

- National Industrial Report, December 2024 (Yardi Matrix)