Gray Report Newsletter: January 25, 2024

Where Will Apartment Supply Hit Hardest?

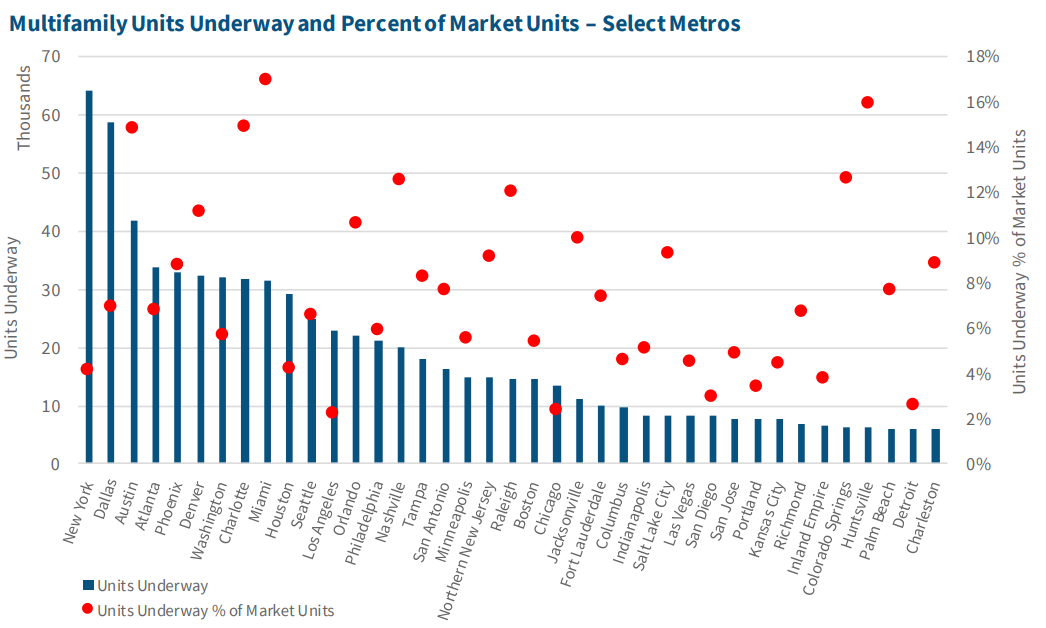

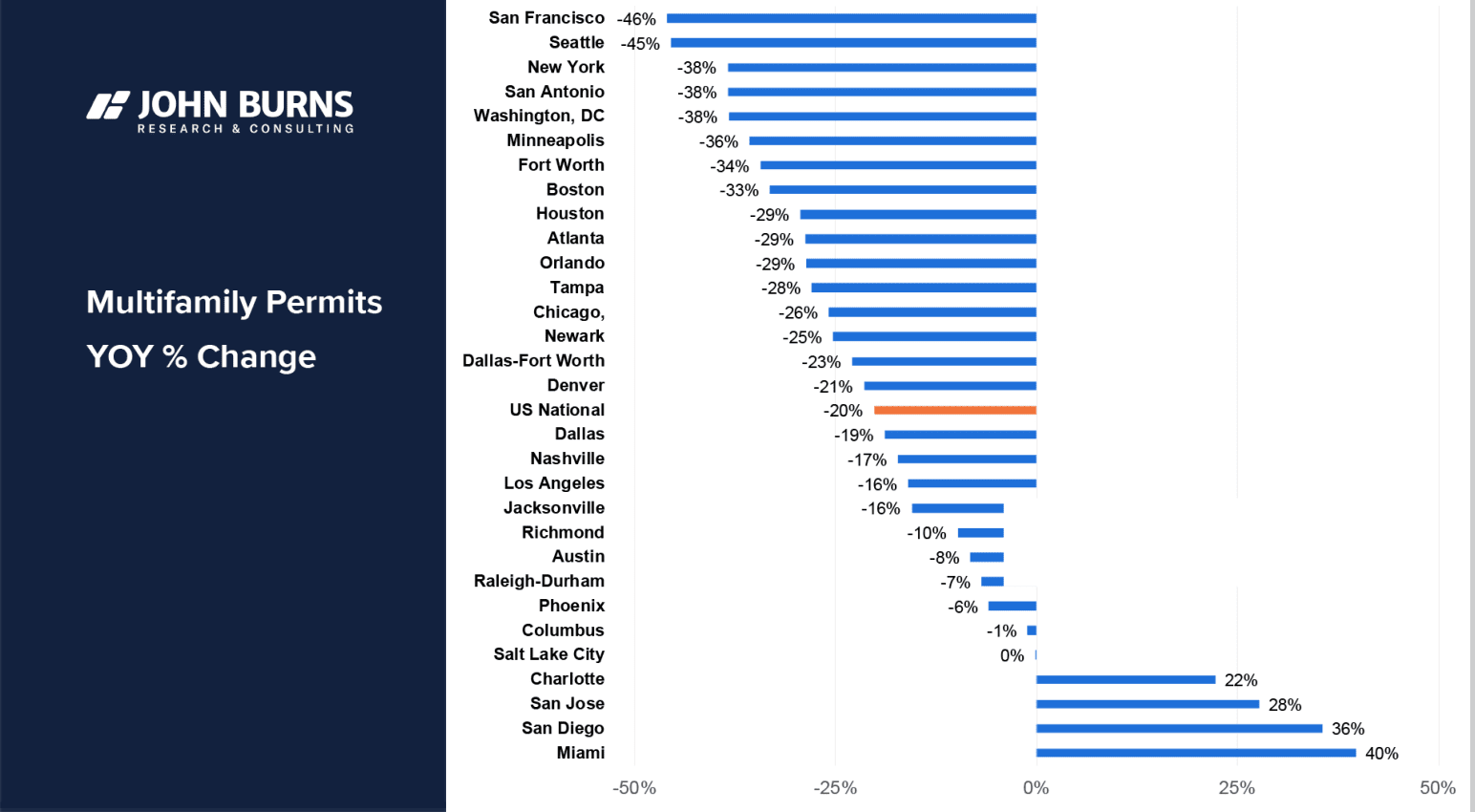

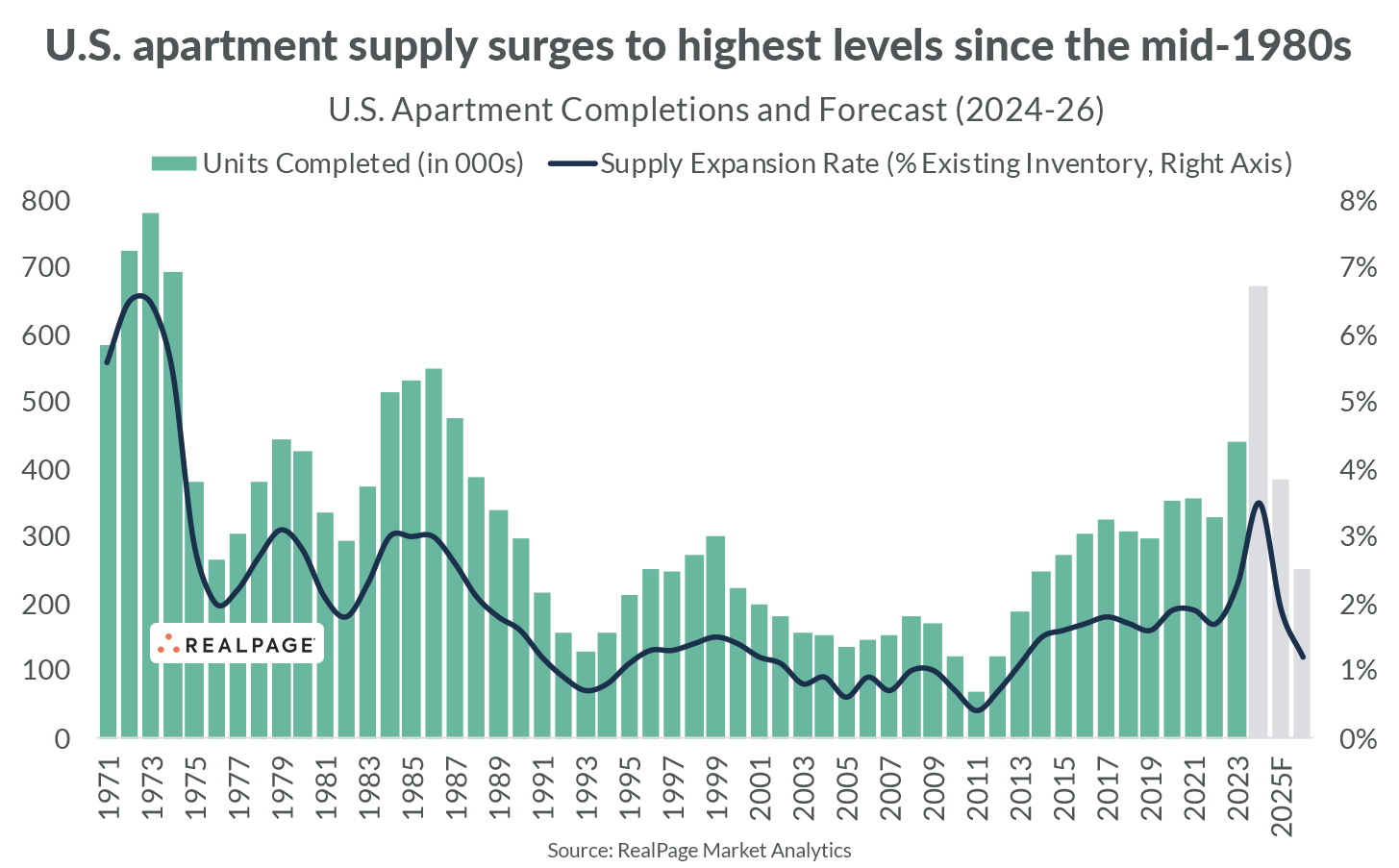

With record levels of new apartment supply a near-certainty for 2024, finding the markets with the most attractive balance of supply and demand will be a priority for multifamily investors. Asset valuations remain in flux given the sluggish apartment sales market, but greater optimism and clarity on interest rates should lead to more investment activity. While recent migration and employment data highlights the continued growth of the Sunbelt, the massive amount of newly-built apartments in Sunbelt markets far outweigh the effects of demand drivers like population or job growth. Given this dynamic, investors may find higher-performing assets in multifamily markets in the Midwest and Northeast that have not seen as much apartment construction.

Multifamily, the Nation, and the Economy

How to Ride the Apartment Supply Wave

Via John Burns Research and Consulting: Historic levels of new apartment supply will drive investors to redouble their attention on multifamily permits, construction, and deliveries data, and this report points to promising markets in the Midwest like Columbus, OH and Minneapolis, MN.

- New Research: Rent Control/Regulation Worsens Unaffordability, Benefits Higher-Income Renters, and Limits Mobility (NMHC)

- Prime Multifamily Metrics Continue to Increase in Q4 (CBRE)

- Multifamily Housing Trends To Watch In 2024 (Forbes)

- Interest Rate Optimism: Debt Financing Index Surges from 9 to 66 (NMHC)

Multifamily and the Housing Market

2024 Multifamily Market Outlook: Instability Expected as Skies Remain Cloudy

Fannie Mae: “[S]ome metros could be undersupplied, including New York, Los Angeles, Chicago, Houston, the Inland Empire, Portland, and San Diego, all with about 4% or less of inventory underway.”

- [Apartment Demand Driver?] Home Price-to-Income Ratio Reaches Record High (Harvard Joint Center for Housing Studies)

- Renter Migration Report: 2024 (Apartment List)

- Sunbelt, West with Top Markets for Jobs Gains (RealPage)

- Home Builders’ Top Challenges for 2024 (NAHB)

Multifamily Markets and Reports

Our Economists’ Picks for Favorite Apartment Markets in 2024

RealPage: “Among the early favorites set to lead the nation in the near term, most are stable Midwest markets like Chicago, Cincinnati, Cleveland and Columbus, with Northeast metros Boston and New York also included.”

- Report: Student housing rent growth “remains above all other property sectors” (Yardi Matrix)

- Study: Is the Rental Crisis Coming to an End? (Florida Atlantic University)

- Declining affordability led borrowers to pay more discount points to buy down rates, but our research suggests it may not be worth it (Freddie Mac)

- From Boardrooms to Bedrooms: A Record 55K Office-to-Apartments Expected in Major Cities (RentCafe)

Commercial Real Estate and the Macro Economy

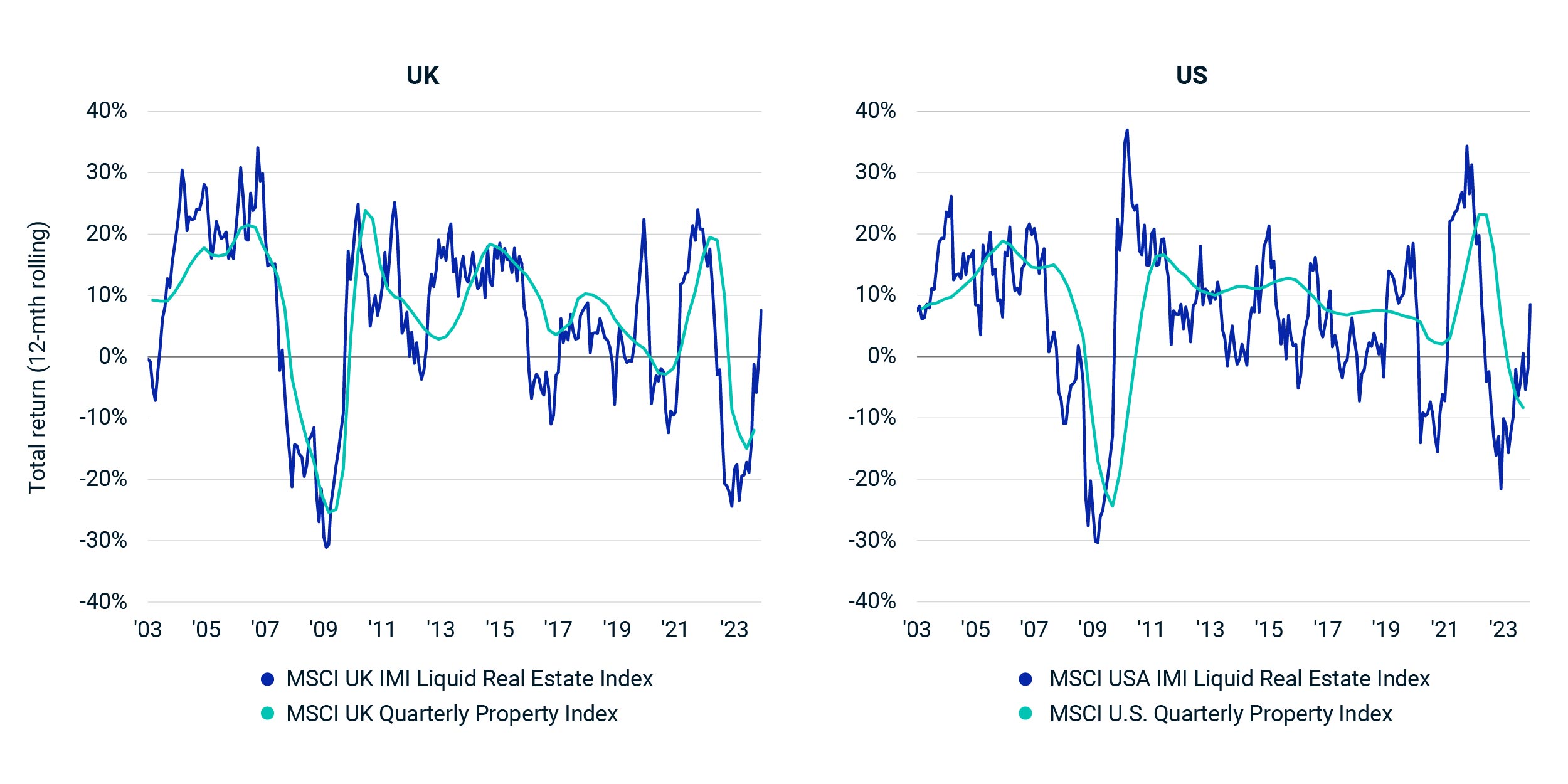

Publicly Listed Real Estate Markets Turned Postive, Are Private Real Estate Markets Next?

Via MSCI: “Does the recent improvement in public-market performance mean that private real estate will turn the corner soon? If you believe that public-market pricing will lead private, you may harbor some optimism for private markets in 2024.”

- Income Is King: Midwest Industrial Investor Perspective (Cushman & Wakefield)

- National Self-Storage Report, Jan. 2024: Cautious Optimism (Yardi Matrix)

- How Private Credit Became One of the Hottest Investments on Wall Street (CNBC)

- What Retail Sales Trends Mean for CRE (Marcus & Millichap)

Other Real Estate News and Reports

Jan. 2024 Office Market Report: Outlook Remains Turbulent

Via Yardi Matrix: “In 2024, we expect an acceleration of less desirable office buildings being removed from the marketplace. So far, there hasn’t been a wave of foreclosures, but we anticipate distress on these buildings to ramp up at varying rates between markets, submarkets and property quality.”

- Fed Stays Steady but Multifamily Cap Rates Keep Climbing (GlobeSt)

- Blackstone and Brookfield Real Estate Income Trusts Post Their Worst Annual Performances (CoStar)

- 20-Year-Old Tax Shelter May Be The ‘Way Of The Future’ For America’s Aging Property Owners (Bisnow)

- The World’s Largest Passive House Office (Moody’s Analytics)