Gray Report Newsletter: February 22, 2024

Apartment Fundamentals Are Improving

The apartment market is improving markedly from a renter’s perspective, and there are promising signs of long-term apartment market strength from an investor’s perspective as well. For renters, lower rent-to-income levels indicate that apartments are becoming increasingly affordable as wages outpace rents, and the increased apartment supply should continue this trend. From an apartment investor’s perspective, the wage growth within the renter population and the strong demand in the apartment market are solid signs of long-term strength in the multifamily market that will lead to improved asset performance as the massive apartment supply increase of 2023 and 2024 subsides.

Multifamily, the Nation, and the Economy

Multifamily, the Nation, and the Economy

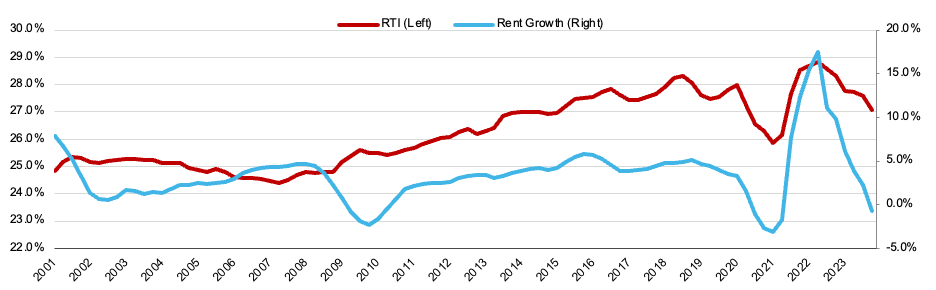

Apartments Get More Affordable as Rent-to-Income Shrinks

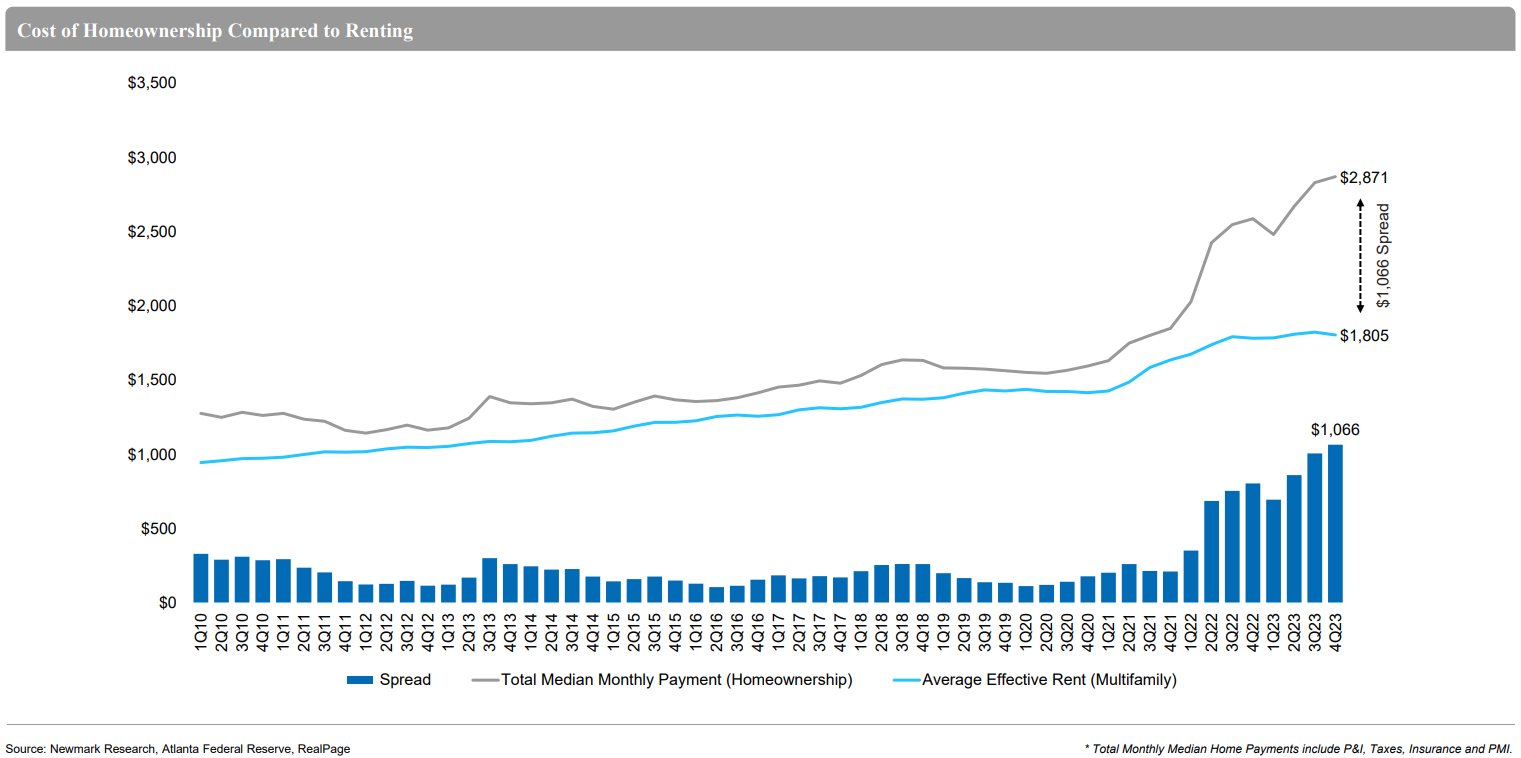

Via Moody’s Analytics: “Moderate- and low-income households enjoyed an above-average boost to incomes, particularly in 2022[, but] homeownership appears to be increasingly out of reach as both mortgage costs as well as overall home prices increased.”

- Incomes Grew Faster Than Rents in 2023 (RealPage)

- Supreme Court Declines To Hear 2 Challenges To Rent Stabilization Laws (Bisnow)

- Four Multifamily Loans to Watch As We Navigate Delinquencies & Market Moves (Trepp)

Multifamily and the Housing Market

4Q 2023 Multifamily Report: Demand Was Surprisingly Robust in ’23, (so was expense growth)

Newmark: “Following a below-average year for demand in 2022, demand was robust in 2023. 58,200 units were absorbed in the fourth quarter of 2023, totaling 233,741 units for the full year. On a nominal basis, markets throughout the South dominated the top markets for absorption, led by Houston, Phoenix and Austin.”

- Homeownership’s Link to Household Wealth (NAHB)

- America’s housing affordability crisis makes a comeback [in the single family home market] (Axios)

- Falling Mortgage Rates Lift Home Sales (John Burns Research and Consulting)

Multifamily Markets and Reports

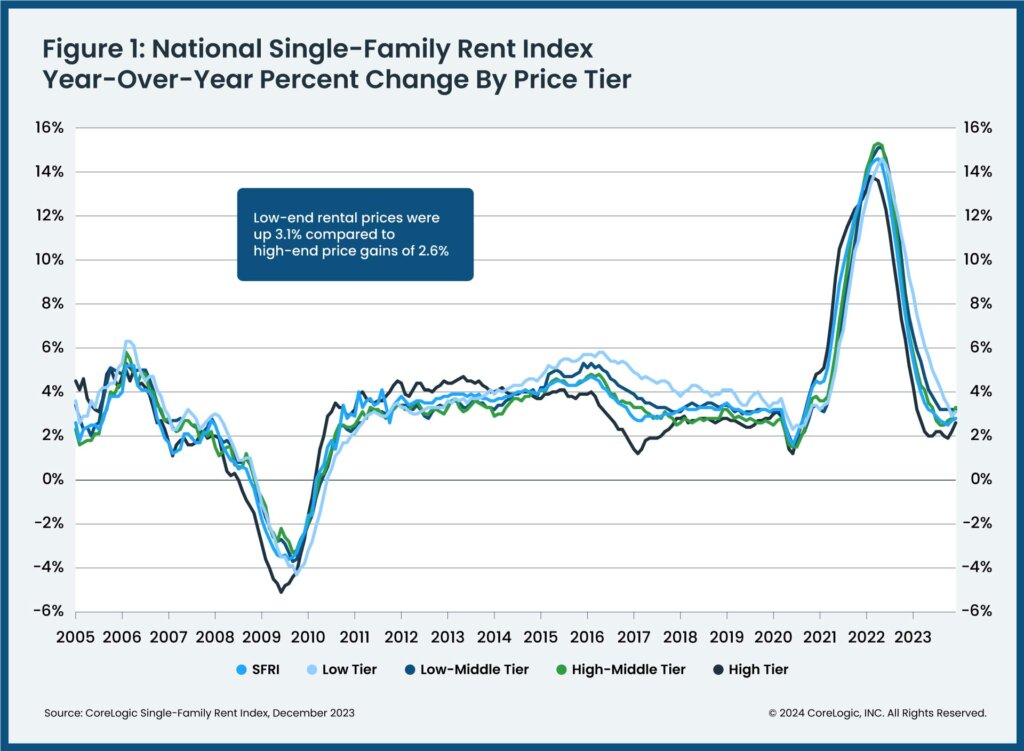

Single Family Rent Growth Remains Steady, Elevated over Apartment Rent Growth

CoreLogic: “Annual single-family rent growth remained in line with pre-pandemic trends in December. San Francisco posted the largest year-over-year gain at 6.2%” and also has the highest nominal rents for SFRs, pointing to a potential turnaround for a market that has seen lackluster apartment rent growth throughout the pandemic.

- Quality of Certain Bank Multifamily Loans to Deteriorate (GlobeSt)

- Rents are cooling, but not everywhere (Harvard Joint Center for Housing Studies)

- Rental Market Tracker: U.S. Asking Rents Flatten After Pandemic Rollercoaster Ride (Redfin)

Commercial Real Estate and the Macro Economy

Feb. 2024 U.S. Office Market Report: Office Valuations Slide Amid Turmoil

Via Yardi Matrix: “Falling demand and rising interest rates have impacted office valuations and consequently, prices. More than one in five properties sold since the start of 2023 traded at a lower price than their previous sale. And discounted sales are likely to rise this year.”

- United States Office Market Overview (Newmark)

- What Inflation Means for Investors (Marcus & Millichap)

- How zoning reform can improve dealmaking (CBRE)

Other Real Estate News and Reports

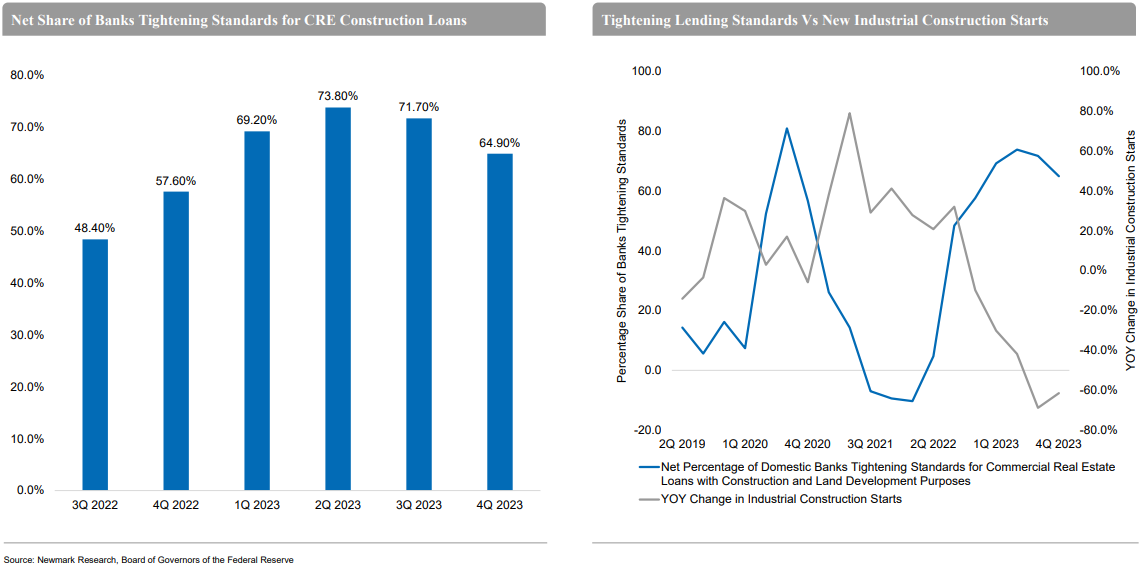

National Industrial Market Report: Resilient but Muted Demand Expected in 2024

Via Newmark: “Unpredictability in the global supply chain will drive long-term demand for U.S. industrial space due to the need for diversified sourcing and ports of entry to control for cost and speed. The immediate impact of acute global supply chain developments on leased industrial space is likely to be a mild but net positive in 2024.”

- Some Real Estate Professionals Say US Office Market May Still Have Room to Fall (CoStar)

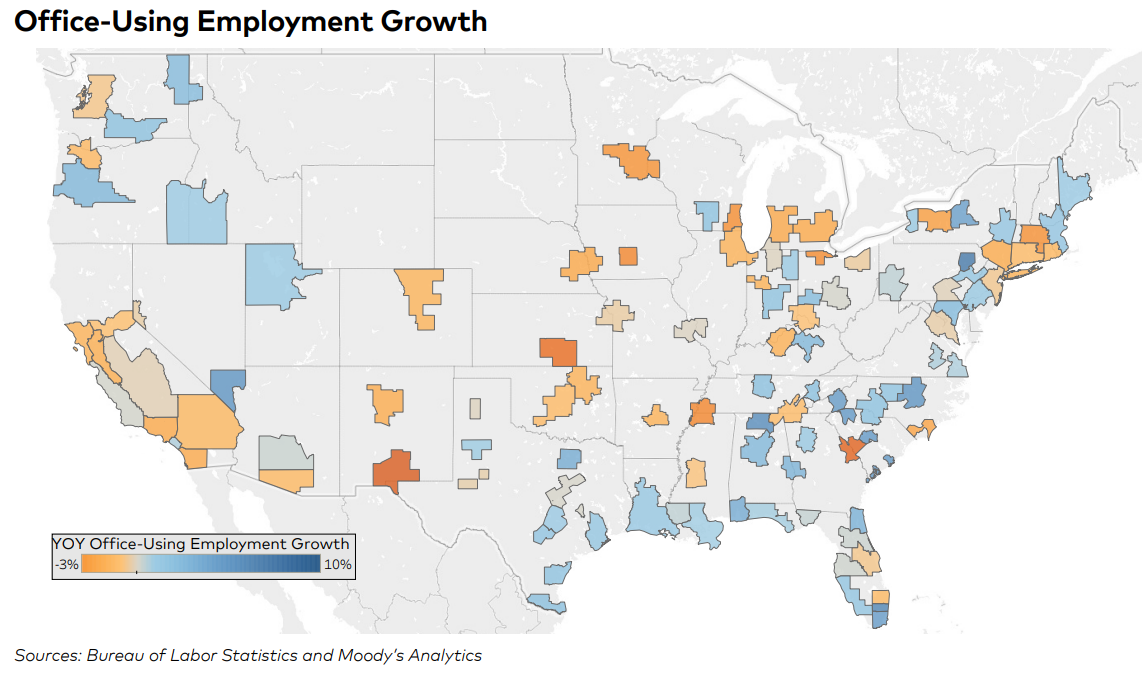

- “I’m Going to Need Those TPS Reports ASAP.”: An Update on Office Space (Moody’s Analytics)

- Global Tech Talent Guidebook 2024 (CBRE)