Gray Report Newsletter: December 28, 2023

New Year, Same Challenges—but an End in Sight

Recent forecasts and expectations for the 2024 CRE and multifamily markets are not very much different than the discussions heading into 2023: Economic uncertainty, expense burdens, high interest rates, and historic amounts of new apartment supply will be major factors for multifamily asset performance next year the same as they were this year, but interest rate cuts on the horizon, lower inflation, and an uptick in consumer confidence are key differences from last year and possible glimpses of an end to stagnation for the apartment market.

Multifamily, the Nation, and the Economy

US Commercial Real Estate Deterioration to Increase in 2024 (Will Investors Take Action?)

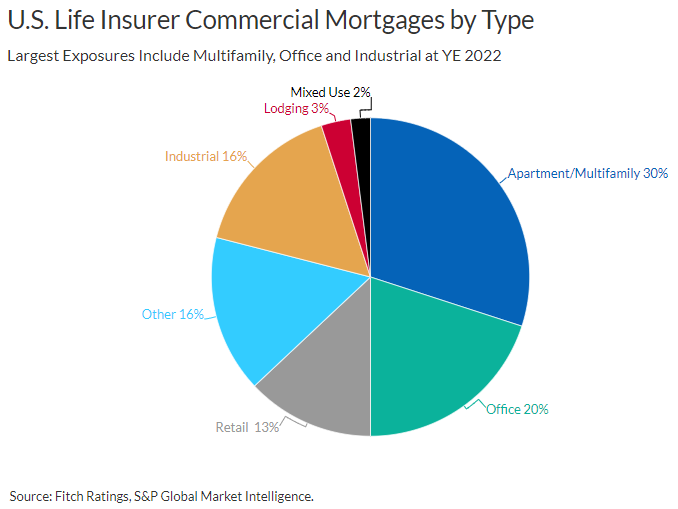

Fitch Ratings: “Deterioration will be led by office properties, with weakening also expected across retail, hotel, multifamily, and industrial properties . . . Fitch forecasts overall U.S. CMBS loan delinquencies to double from 2.25% in November 2023 to 4.5% in 2024.”

- Economists: 44% Of U.S. Office Loans Underwater, Threatening More Bank Failures (Bisnow)

- Low Multifamily Deal Volume Expected for Final Tally of Q4 2023 (GlobeSt)

- Morgan Stanley Hunts for Deals in Commercial-Property Upheaval (Bloomberg)

Multifamily Markets and Reports

What We Got Right – and Wrong – About the Apartment Market in 2023

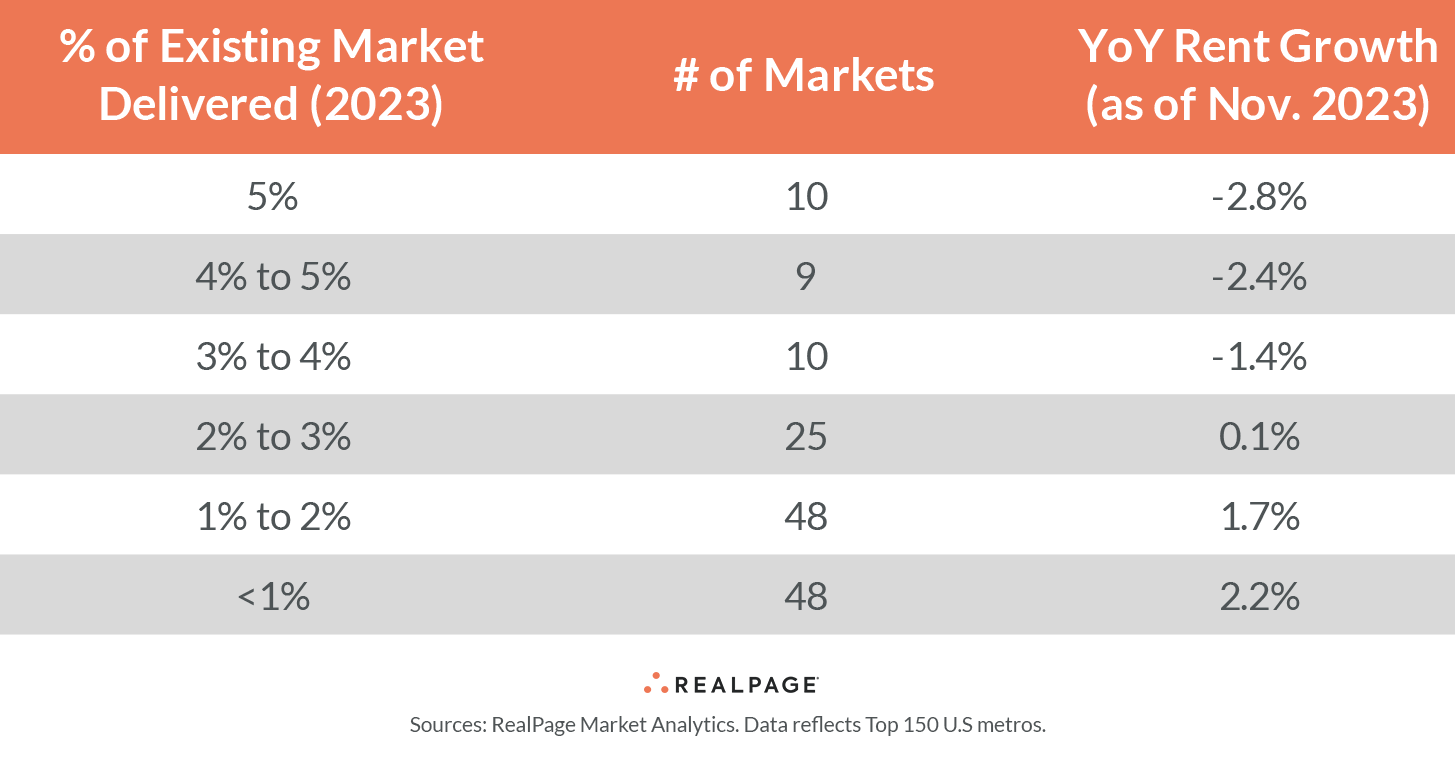

Via RealPage: In this review of their previous forecasts for markets that would be poised to grow (or struggle) this past year, there are some instructive insights applicable to the state of multifamily market in 2024.

- Office to Multifamily Conversions in 2023 (CoStar)

- Outstanding multifamily mortgages across all lenders increased $24.2 billion in Q3 2023 (Trepp)

- Advice for Prepping Your 2024 Apartment Operations Budget (Multi-Housing News)

Multifamily and the Housing Market

US Single-Family Rent Growth Continues to Soften

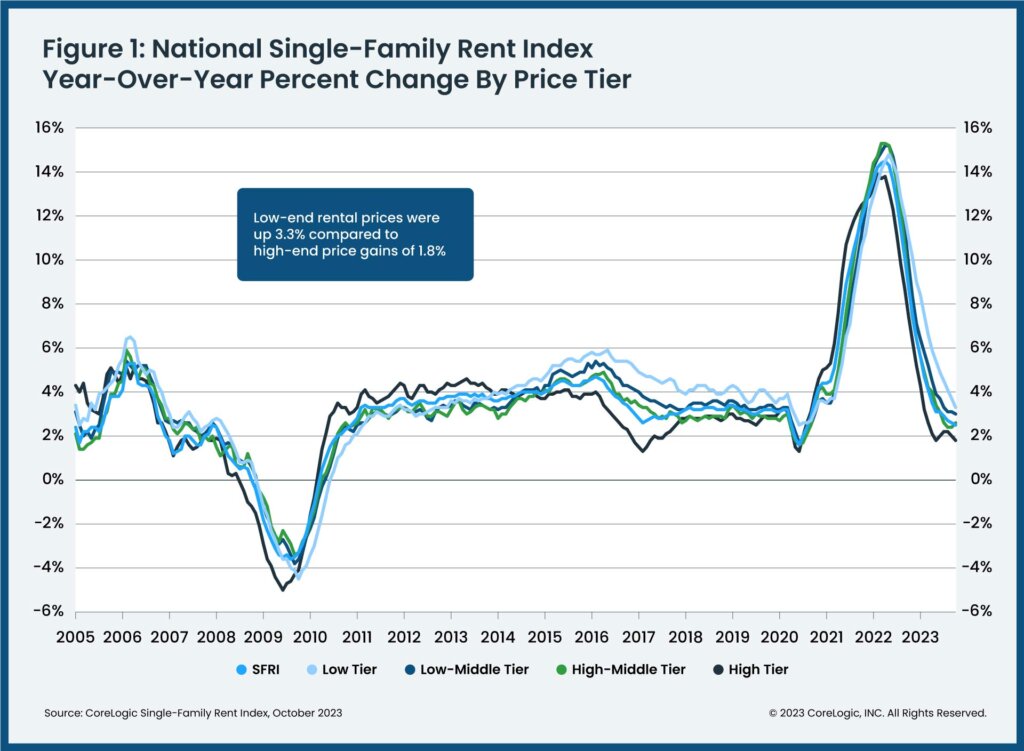

Via CoreLogic: “U.S. year-over-year rent growth continued its slow cooling in October, slipping to 2.5% and marking a year of single-digit annual increases. Though October’s rent price growth was the lowest since the summer of 2020,” they are up over 30% since February of 2020.

- Home Prices Overvalued in 88% of the U.S. (GlobeSt)

- Consumer Confidence, Homebuying Sentiment Up Sharply in Dec. (NAHB)

- Immigration, Population Growth, and the Housing Market (John Burns Research and Consulting)

Commercial Real Estate and the Macro Economy

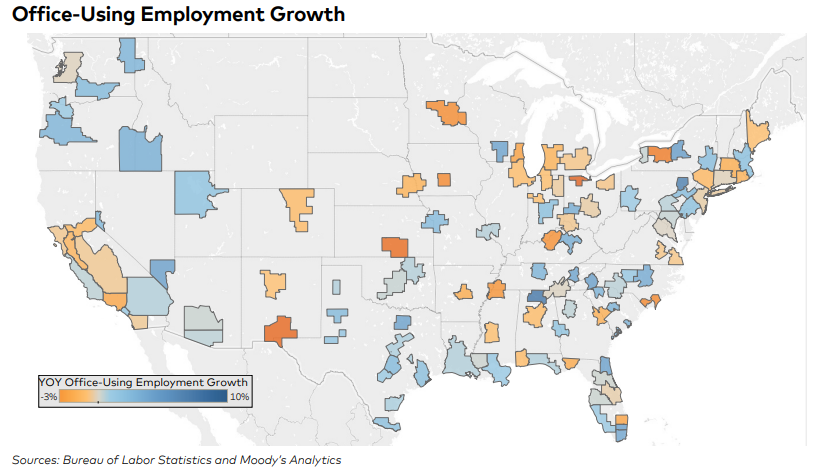

Office Market, National Report: Dec. 2023: Tricky Time for Office Loan Maturities

Via Yardi Matrix: “Demand for office space has partially rebounded in recent quarters, but most metrics indicate utilization has plateaued at around 50-60% of pre pandemic levels. Many tenants have downsized footprints, and although some companies are taking a tougher stance on return-to-office policies, we remain a couple of years away from a post-pandemic equilibrium.”

- Spotlighting CRE Servicers’ Approach to Rising Default Environment in U.S. CMBS (Fitch Ratings)

- Interest Rates: 2024’s Biggest Unknown (GlobeSt)

- Growth of Office Effective Rents Limited by Record-High Concessions (CBRE)

Other Real Estate News and Reports

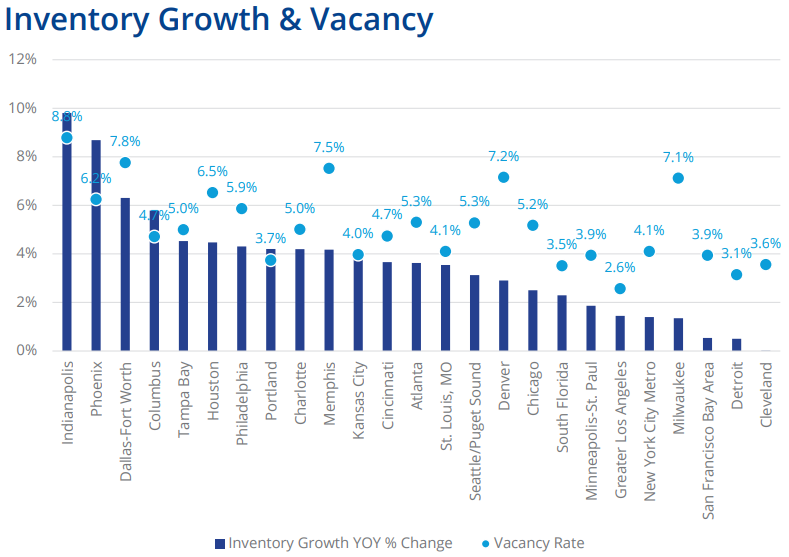

U.S. Logistics Market Report, Q3 2023

Via Colliers: “The U.S. industrial market has started to normalize following 10 quarters of rapid expansion since the end of 2020, although the 25 largest markets covered in this report have proven more resilient than others. Record speculative construction completions have pushed vacancy rates higher in nearly all markets while net absorption has normalized to pre-pandemic levels.”

- MA CRE Office Loan Maturity Monitor: Strong Total Payoff Rate Masks Weak Overall Month (Moody’s Analytics)

- Inside the Lucrative Land-Constrained Logistics Markets (GlobeSt)

- Why the Pool of Accredited Investors Keeps Growing: New SEC Report (ThinkAdvisor)