Gray Report Newsletter: December 14, 2023

Federal Reserve: 3 Rate Cuts in 2024

On the heels of a CPI report showing inflation on the slow decline, Federal Reserve Chairman Jerome Powell announced that the FOMC would keep the federal funds rate at its current level, with 3 rate cuts expected in 2024. Stock markets reacted with the typical enthusiasm associated with the hope of lower interest rates, and some interesting buying opportunities could emerge in 2024 for investors tracking stronger long-term rent growth and lower financing costs in the multifamily market.

Multifamily, the Nation, and the Economy

2024 Outlook: Slight Apartment Oversupply Expected in 2024

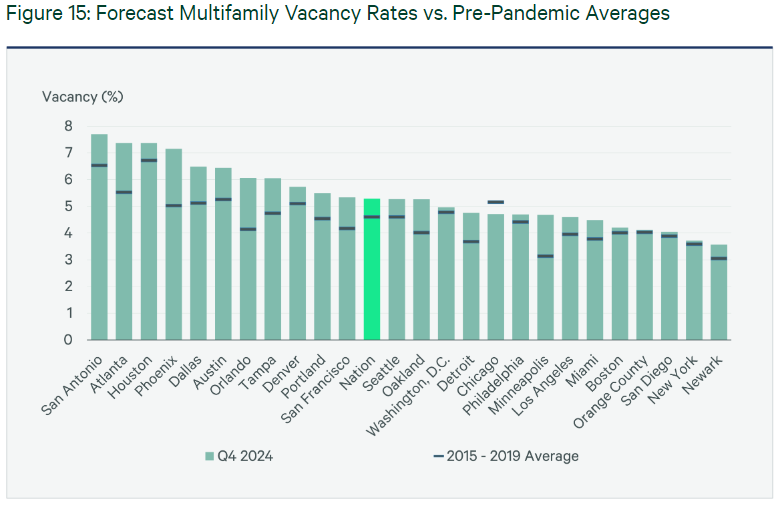

CBRE: “With delivery of 440,000 new units expected in 2024 and more than 900,000 currently under construction, the overall vacancy rate is expected to rise and rent growth to decelerate.”

- Nov. CPI: All items up 3.1%, core inflation up 4% year-over-year (Bureau of Labor Statistics)

- Fed holds rates steady, indicates three cuts coming in 2024 (CNBC)

- New Legislation Proposes to Take Wall Street Out of the Housing Market (The New York Times)

- Prediction: Multifamily Distress Will Start in H2 2024 (GlobeSt)

Multifamily Markets and Reports

Via Cushman & Wakefield: “Longer term, the multifamily market is poised for balanced growth in demand and supply. Despite the current pipeline, housing is likely to remain undersupplied for years and investor interest indicates a clear proclivity for multifamily development.”

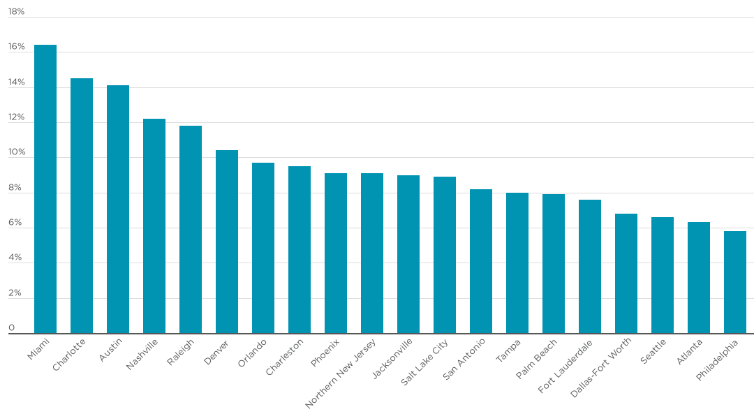

- 2023 Year-End Report: Miami Tops U.S. Hottest Markets, but the Midwest Heats Up the Competition (RentCafe)

- Comparing Suburban Apartments by Price Point (RealPage)

- Markets With the Most Pent-up Housing Demand (NAR)

Multifamily and the Housing Market

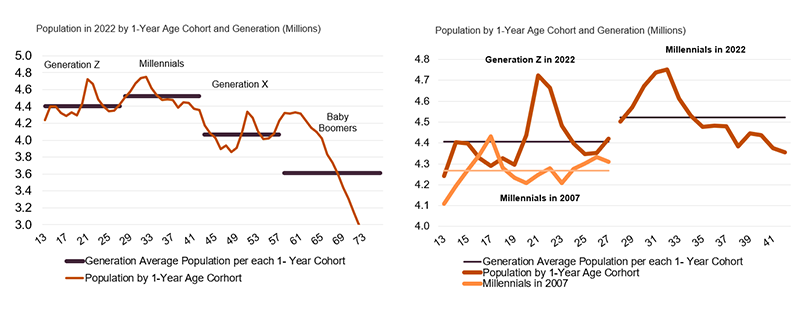

Move over Millennials, Gen Z Is Driving Rental Demand

Via Harvard Joint Center for Housing Studies: “Optimists see rental demand holding strong over the long run, and point to favorable demographics as a reason to remain optimistic. But are demographics truly favorable for rental housing? At first, the story seems negative,” but Gen Z is larger than one may think.

- Geography of Personal Income and Home building (NAHB)

- The Growing Case for Build-to-Rent (Cushman & Wakefield)

- Student Housing Pre-Leasing Hits Early High for Fall 2024 (RealPage)

Commercial Real Estate and the Macro Economy

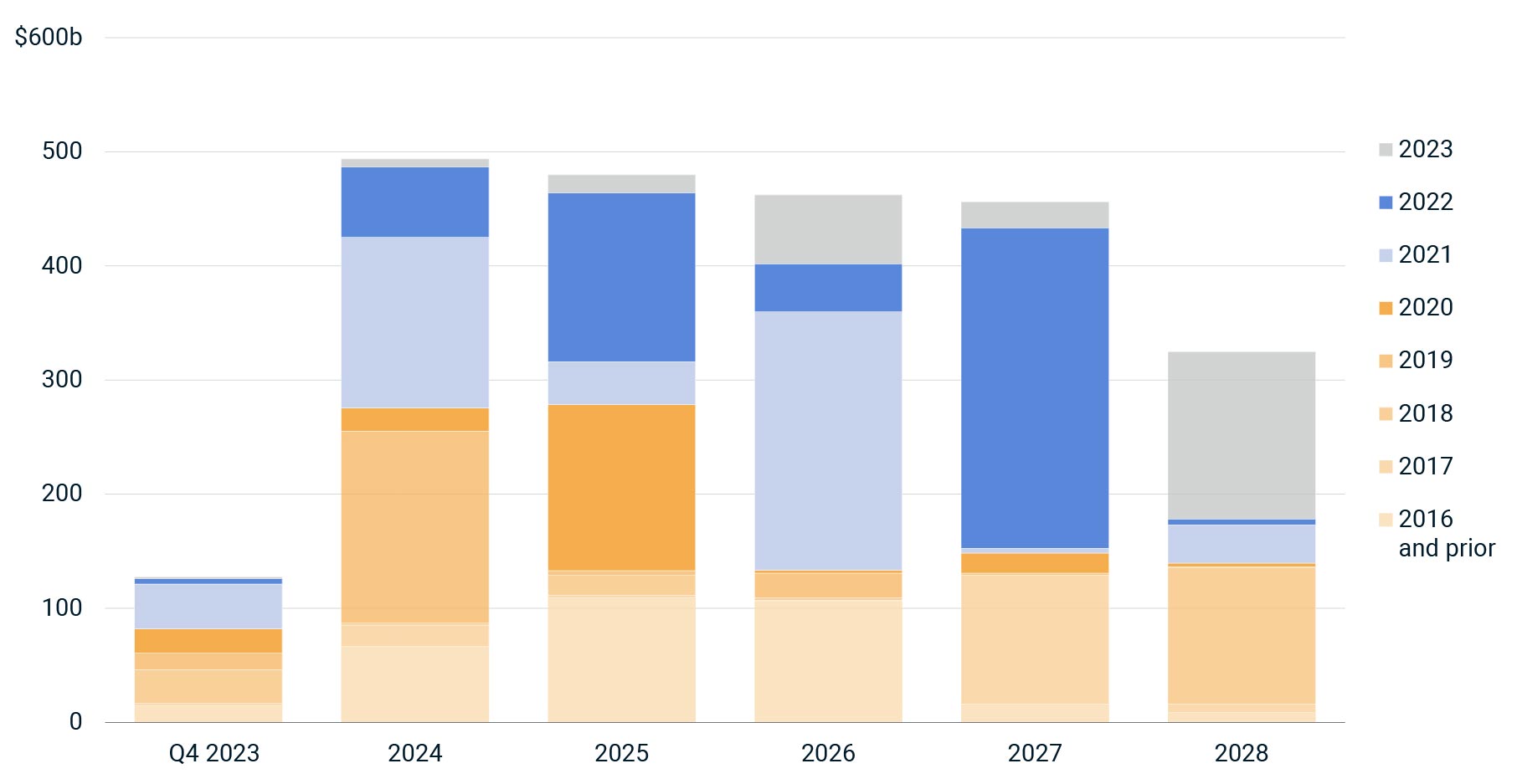

2024 Trends to Watch in Real Assets: #1 – Distress starts to bite.

Via MSCI: “The wave of loans facing maturity, and the timing of when these loans come due, could lead to additional forced selling. The most problematic loans are those originated at record-high property prices and record-low mortgage rates, which is the case for many of the loans originated in 2021 and 2022.”

- 2023 CRE Year in Review (Marcus & Millichap)

- Navigating Equilibrium, Distress, and Anticipated Policy Easing in Commercial Real Estate (Colliers)

- Investors Bank Billions, Setting Up CRE Secondary Spending Spree (Bisnow)

Other Real Estate News and Reports

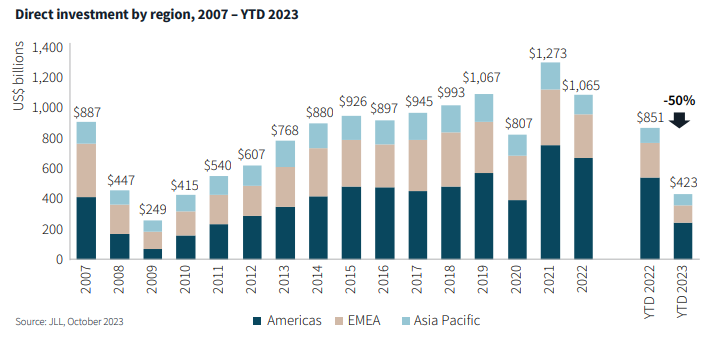

Higher rates and recession risk will shape investment through next year

Via JLL: “Asset prices have undergone significant adjustments as a result of shifts in the economy, rates and lending markets. The U.S. is furthest along in its price adjustments, with values down significantly from peak levels.”

- PODCAST: How AI is revolutionizing commercial real estate (JLL)

- Understanding the Nuances Behind the Office Market (GlobeSt)

- KKR And Alternatives Industry Race For Individual Investors (Forbes)