Gray Report Newsletter: July 6, 2023

Does the Federal Reserve Expect CRE Distress?

New guidance from the Federal Reserve indicates increased attention to the issue of property distress in the commercial real estate market, even as the larger economy shows more positive signs and decreasing inflation. While the office sector is a prominent focus for potential distress, the Fed includes multifamily properties and other CRE property types in its guidance, suggesting that Powell and company are not planning for a rapid decrease in rates and are instead preparing lenders for an interest rate plateau that will bring more property distress the longer it continues.

Multifamily, the Nation, and the Economy

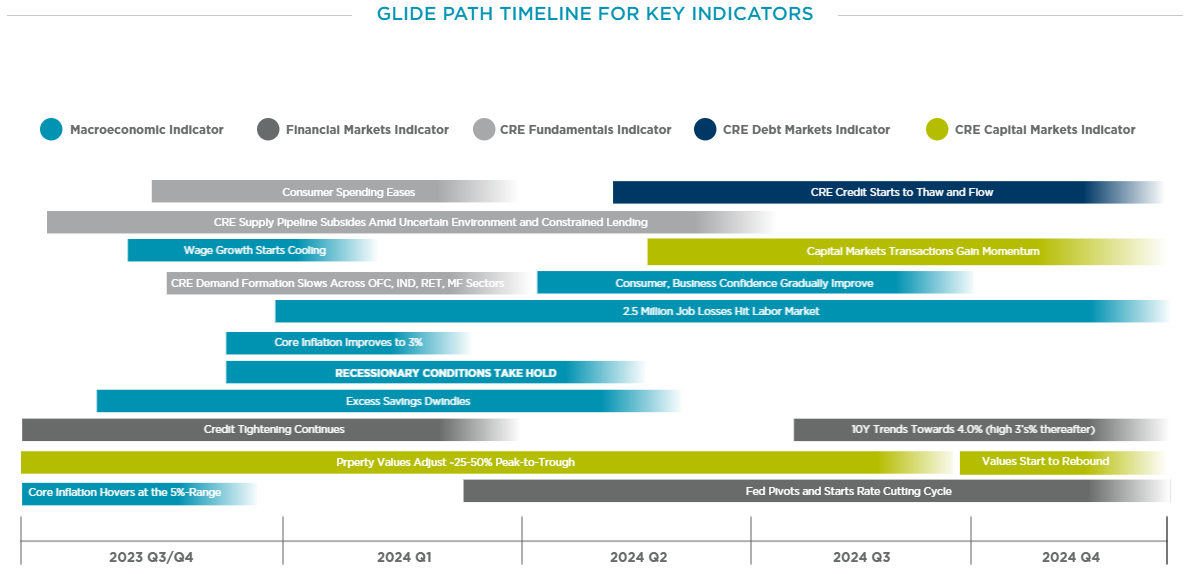

Capital Markets Glide Path Report

Via Cushman & Wakefield: This review of major factors shaping CRE capital markets includes notes on the debt market, macroeconomic trends, and investment activity.

- US Regulators Asks Lenders to Help Firms With Commercial Real Estate Stress (Bloomberg)

- Policy Statement on Prudent Commercial Real Estate Loan Accommodations and Workouts (Federal Reserve Bank of the United States)

- NAR, NAA Among Groups Pushing For Supreme Court To Strike Down Rent Control (Bisnow)

Multifamily and the Housing Market

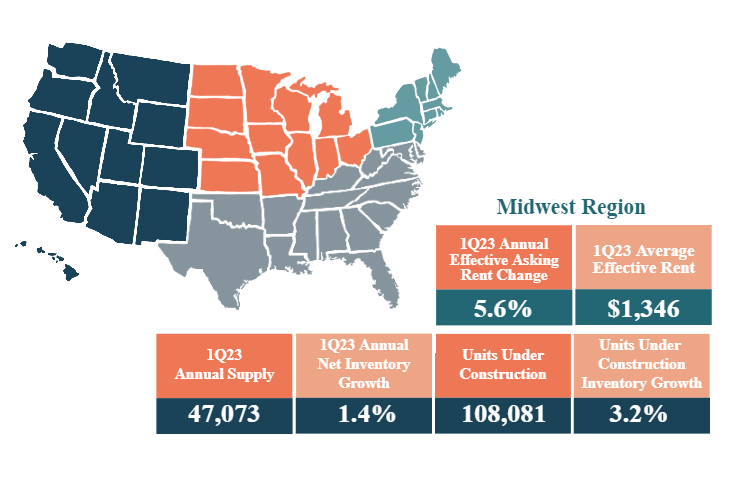

Ranking U.S. Apartment Rent Growth by Geographic Region

Via RealPage: This rent growth report pairs well with the recent RealPage article on apartment supply that helps to explain strong Midwestern rent growth as a product of lower overall rent costs and lower incoming apartment supply.

- Will Financial Issues In Commercial Real Estate Impact Affordable Housing? (Forbes)

- Higher-Wage Households Renting as Home Prices Get a Summer Sizzle (Marcus & Millichap)

- Move over, office loans. Apartment lending is also feeling the pinch. (American Banker)

Multifamily Markets and Reports

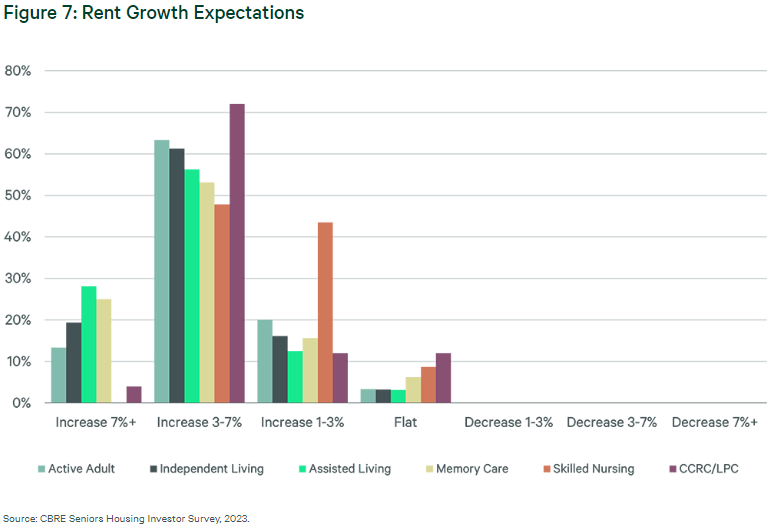

U.S. Seniors Housing & Care Investor Survey 2023

Via CBRE: “More than 75% of respondents expect rental rate increases of 3.0% or more over the next 12 months across all classes except Skilled Nursing. No respondents expected rent decreases for any asset class.”

- Tides Equities Could Ask Investors For More Money To Cope With Its Multifamily Debt Load (Bisnow)

- National Rent Report, June 2023 (Zumper)

- Miami Is Nation’s Hottest Renting Spot as Florida Shines Again This Rental Season (RentCafe)

Commercial Real Estate and the Macro Economy

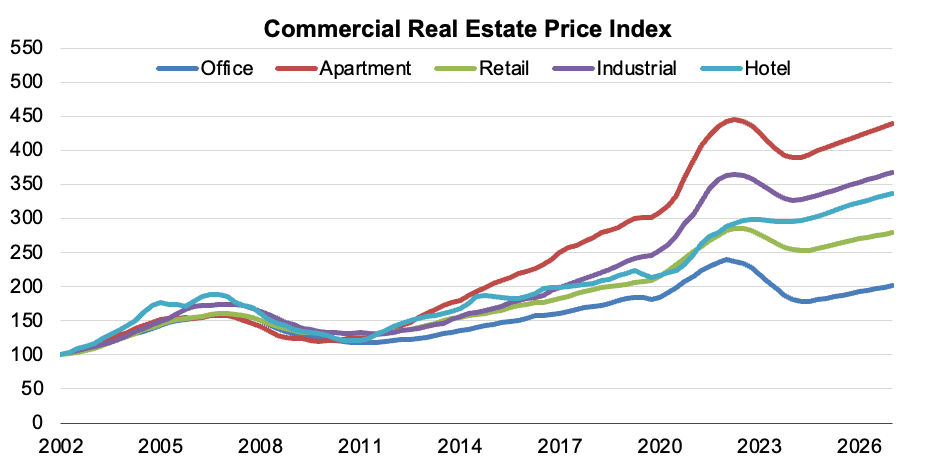

Banks Survive Stress Test, but CRE Still Poses Idiosyncratic Risk

Via Moody’s Analytics: Key passage from this useful review of CRE trends: “We have mentioned this before, but as more buyers and sellers get on board with this, and accept “higher for longer”, the greater the likelihood of some deals being pushed through and price discovery occurring. Clarity is of utmost importance.”

- Are Rate Locks the Negotiation Key for Lenders to Secure Loans in this Economy? (CoreLogic)

- Private Residential Construction Spending Rises in May (NAHB)

- The Contrarian Investors Betting on Commercial Real Estate (The Wall Street Journal)

Other Real Estate News and Reports

National Industrial Report, June 2023

Via Yardi Matrix: “A one-quarter increase does not make a trend, but the bump in both e-commerce sales volume and its share of core retail sales is welcome news for a sector that ran hot in 2020 and 2021 but has cooled since.”

- A top NYC commercial real estate CEO says the buildings hurting from remote work are the same ones he warned about 6 years ago (Fortune)

- Artificial Intelligence: Real Estate Revolution or Evolution? (JLL)

- Andrew Kimball, New York City’s Economic Development Chief, On Filling Empty Offices (Commercial Observer)