Rent Hikes Loom, Posing Threat to Inflation Fight

Source – The Wall Street Journal: “Rent Hikes Loom, Posing Threat to Inflation Fight”

This review of the rent growth situation is more interesting than I expected. On the one hand, it might be easy to dismiss it as another article on elevated rent growth that ignores the disconnect between CPI-measured rent growth and the market rent growth measured by places like Apartment List, RealPage, Yardi Matrix, and others, but again, there’s some interesting points in here.

Here’s one: “In recent months, apartment buildings aren’t losing as many residents as they once were, market reports show, and available units are leasing fast.”

We’ll be going over an article from RealPage that puts some numbers to this situation, but it’s measurable uptick, 0.1%—and to put that in perspective, the difference between the highest national average occupancy and the lowest occupancy ever is like 3%, so that 0.1% does count for something.

But yeah, there’s a ground-level feeling that the demand for apartments is going up. There are a few quotes from multifamily operators here projecting 7% or 4% rent hikes this year, which is great for them, but I’m thinking that projections from places like Yardi Matrix, at 1.7% or Newmark at 2% rent growth are likely closer to what we’ll see by the end of the year.

That being said, this undercurrent of demand is a substantial signal of improving performance for the multifamily market. Unfortunately, they use this interesting point to make a more boring point about inflation.

The central argument of this article is that shelter inflation, of which rent growth plays a significant part, is still high and could be getting worse.

- The author acknowledges that there is some lag between rent growth and the measurements from the CPI, but they don’t go quite as far as to point out that, this lag means that rent growth’s impact could be increasingly deflationary.

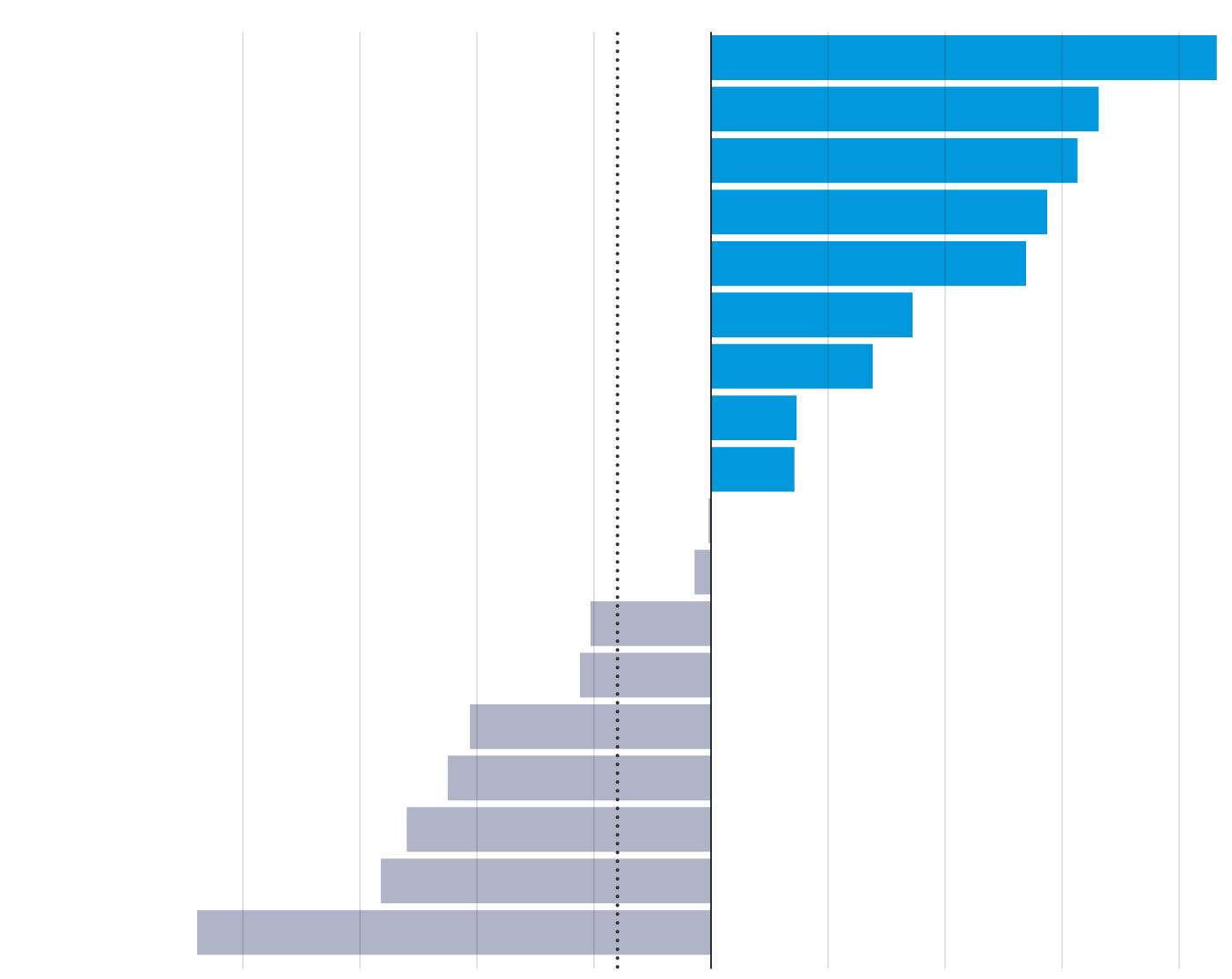

Note: As of May. Figures are estimates.

Source: Apartment List

- They use plenty of data from Apartment List in this article, but the one graph that they don’t include is the graph of rent growth. Right now, Apartment List shows negative rent growth. Right now the CPI does not show negative rent growth. That means that CPI-measured rent growth should continue to go down.

But! There could still be an effect of the rumblings of apartment demand that they’re reporting in here, but just not on the CPI measurements.