The Cooldown before the Storm?

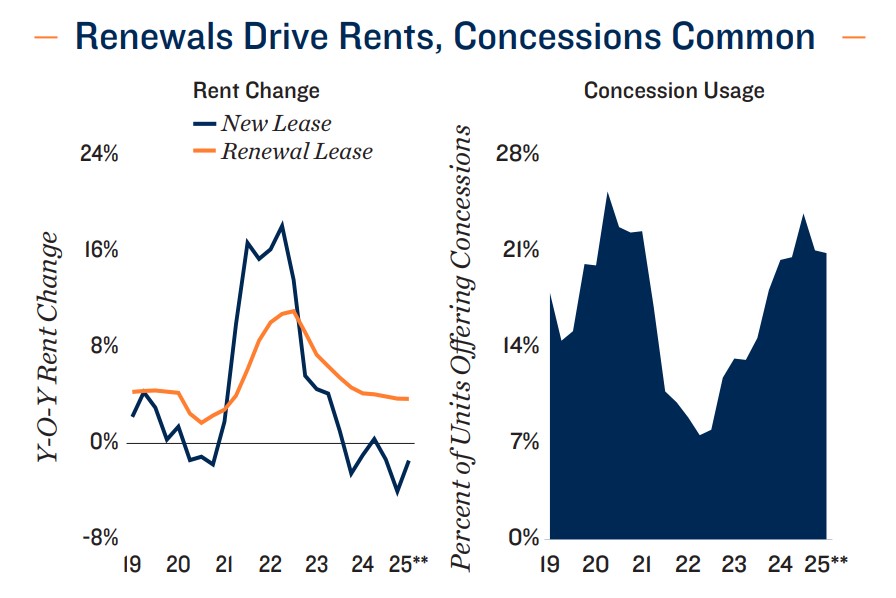

Inflation came in lower than expected in the Consumer Price Index, and at 2.3%, the annual inflation rate has dropped for the third month in a row. The recent pullback of most of the Trump administration’s tariffs on China was also received very well in the stock market, but uncertainty may not be dispelled so easily, with some expecting empty shelves and a shortage of consumer goods in the coming weeks. While these dramatic effects have not yet fully materialized, the hesitancy and uncertainty of the current moment have contributed to slightly lower rent growth in the apartment market and an increase in renewals as operators prioritize resident retention, but in many midwestern markets, rent growth has been robust as apartment supply trends normalize.

Multifamily, the Nation, and the Economy

- Q2 2025 Multifamily Report: Improving Fundamentals Position Multifamily Sector to Overcome Potential Volatility

- Marcus & Millichap: “Even in the face of elevated construction, vacancy compressed year over year in 48 of 50 major metros, with all three apartment classes noting reductions of 70 to 90 basis points[, but] . . . growing concerns over tariffs . . . may curb household formation, hiring activity and ultimately rental demand moving forward.”

- CPI Inflation Lower Than Expected, Dips to 2.3% Year-over-Year (Bureau of Labor Statistics)

- Rent Growth Evident in Markets Past Peak Supply Volumes (RealPage)

- Q1 2025 Capital Markets Report: Investment & Lending Activity Rise (CBRE)

Multifamily and the Housing Market

April 2025 National Multifamily Report: Positive Rent Growth Clouded by Uncertain Economy

Yardi Matrix: “Occupancy has been either flat or falling for nearly three years as the nation continues to contend with a record volume of supply delivered during the post-pandemic boom. The greatest pressure is felt in the Sun Belt.”

- “Multifamily remains CRE’s most defensive asset class” (Cushman & Wakefield)

- Washington, D.C., Leads Cities That Built Most New Downtown Apartments (RentCafe)

- Can the Integration of Capital Markets Spur Regional Economic Growth? (Harvard Joint Center for Housing Studies)

Multifamily Markets and Reports

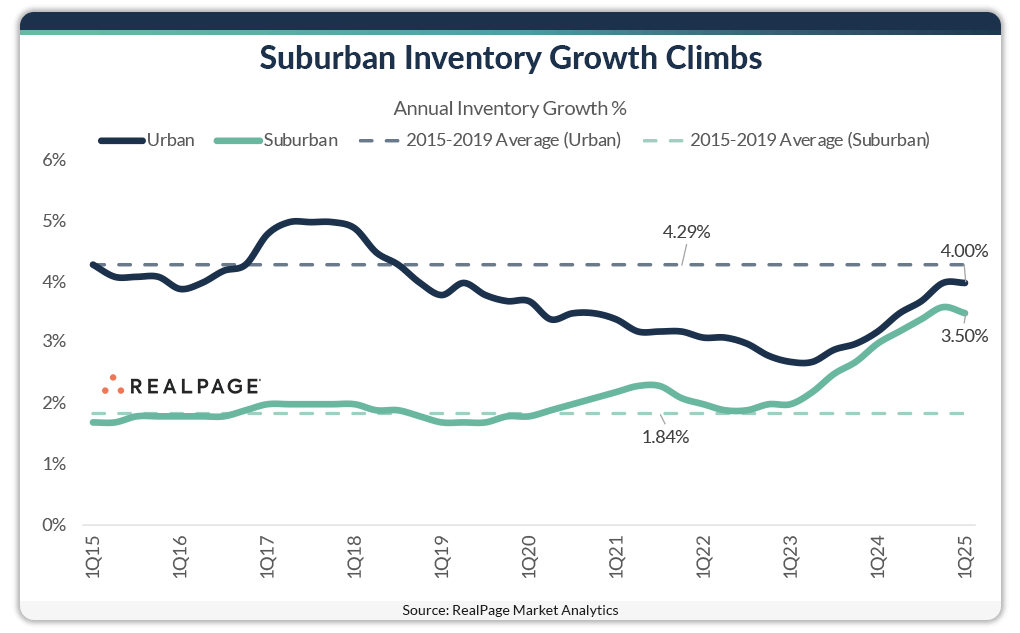

Suburban Apartment Inventory Growth Nearly Doubles This Cycle

RealPage: “What stands out is how substantially suburban supply has increased over these past two years. Suburban inventory growth has traditionally averaged below 2% per year but that pace has almost doubled since early 2023.”

- Housing Permit Activity Declines in March 2025 (NAHB)

- New Build-to-Rent Survey: spring brings modest rental growth amid regional and product differences (JBREC)

- May 2025 Student Housing Report: “Fundamentals Softening” (Yardi Matrix)

- Home Sellers Are Pricing Too High and Not ‘Listening to the Market,’ Experts Warn (Realtor.com)

Commercial Real Estate and the Macro Economy

What To Do With All Those Old Malls?

Via CBRE: “Larger format retail was significantly overbuilt in the Midwest and South, especially during the 1980s and 1990s. In recent decades, these larger formats have been victimized by sales cannibalization and growing consumer preference for convenience and experiential retail.” Maybe build apartments?

- 1Q25 U.S. Life Science Market: Biosciences Drive Stable Demand (Newmark)

- Strategic Perspectives in Uncertain Markets, A CIO Outlook (CBRE)

- Repositioning and redevelopment strategies for at-risk assets and portfolios (JLL)

Other Real Estate News and Reports

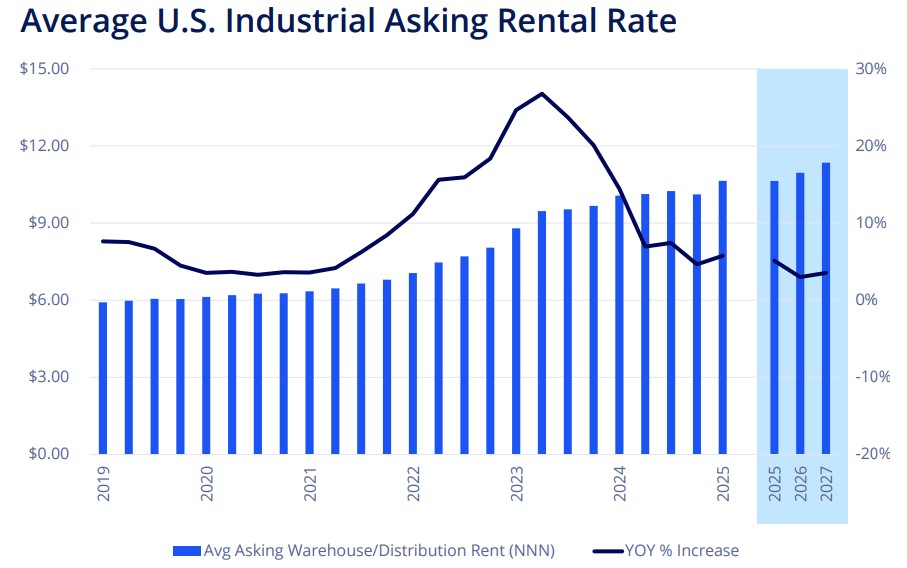

Q1 2025 Industrial Market Outlook

Via Colliers: “New supply has outpaced demand during the past 11 quarters, pushing the average U.S. industrial [vacancy] rate up 351 basis points during that time, to 7.1% —the highest level since 2015.”

- Retail CRE Positioned to Withstand Potential Headwinds (Marcus & Millichap)

- Retail Resilience: U.S. Investment Market Surges in Q1 2025 (JLL)

- Spring 2025 Retail Report: The Real Retail Reality: Stores Thrive Amid Uncertainty (Colliers)