Strong Fundamentals, Weak Investment Activity

Across a range of different measurements, apartment fundamentals are remarkably strong: Rental housing continues its extreme affordability compared to homebuying costs; apartment absorption has skyrocketed to levels close to the heady, white-hot apartment market of 2021; and multifamily construction activity is lower, coming into balance with demand. Despite the positive implications of these trends for multifamily investors, apartment sales activity remains relatively low, and rent growth is also below historical averages. This summer could bring additional price discovery to the multifamily market, but in this current environment, investment prospects will vary significantly depending on the general region and specific market of investment.

Multifamily, the Nation, and the Economy

- Q1 Multifamily Capital Markets Report: Strong Fundamentals, Weak Investment Activity

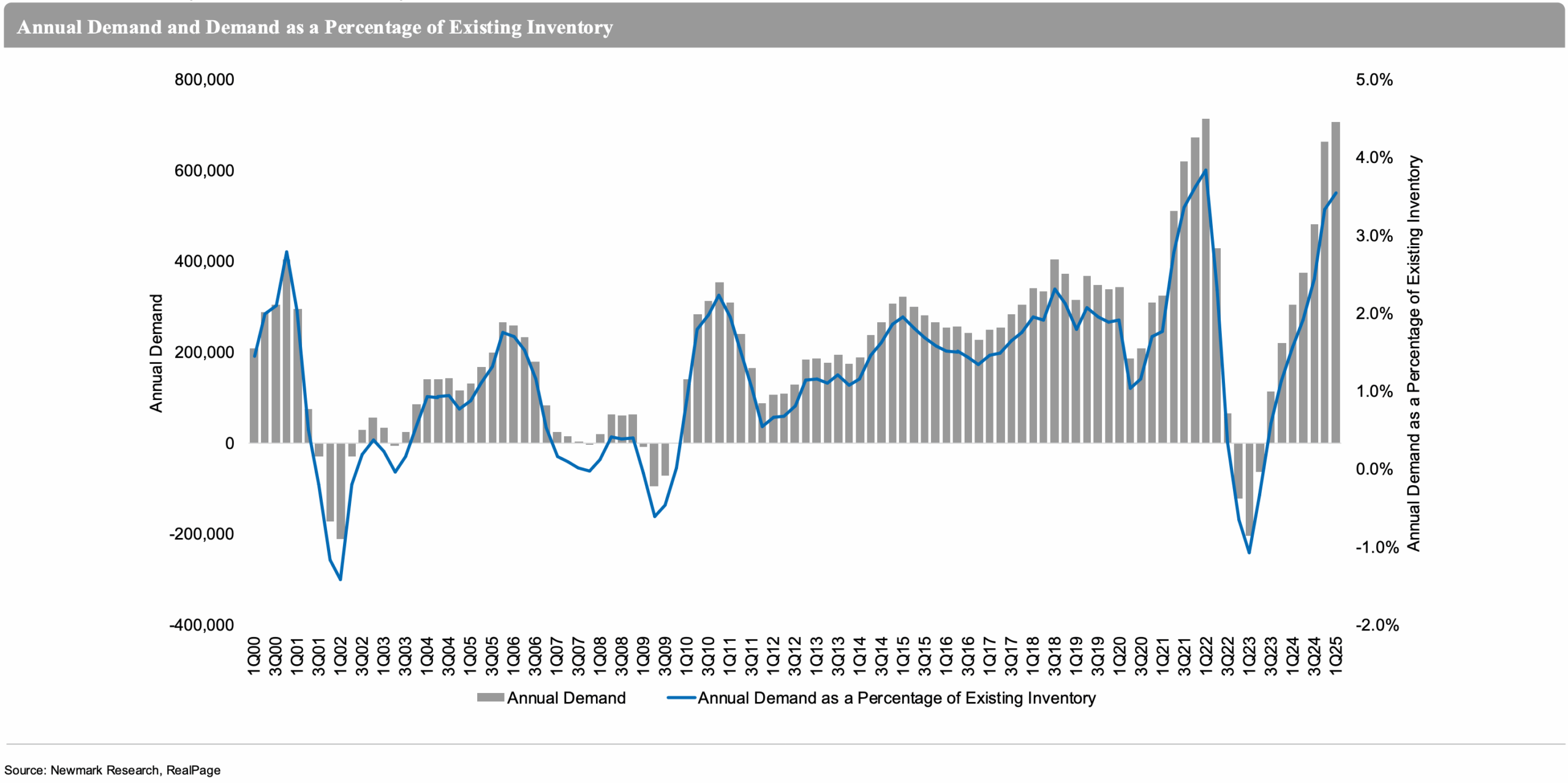

- Newmark: “Over the past 12 months, demand outpaced supply by 131,151 units, even in the face of record-high deliveries. Absorption reached 707,811 units—more than 3.5 times the long-term average. Demand as a share of inventory rose to 3.5%, marking the third-highest level on record.”

- Conviction Amid Complexity: Multifamily Market Outlook (CBRE)

- Seeing Opportunity In Trump, Apartment Lobbyists Welcome ‘The Moment We’ve All Been Waiting For’ (Bisnow)

- Wall Street Bets Big on Rental Homes as Mortgage Costs Soar (GlobeSt)

Multifamily and the Housing Market

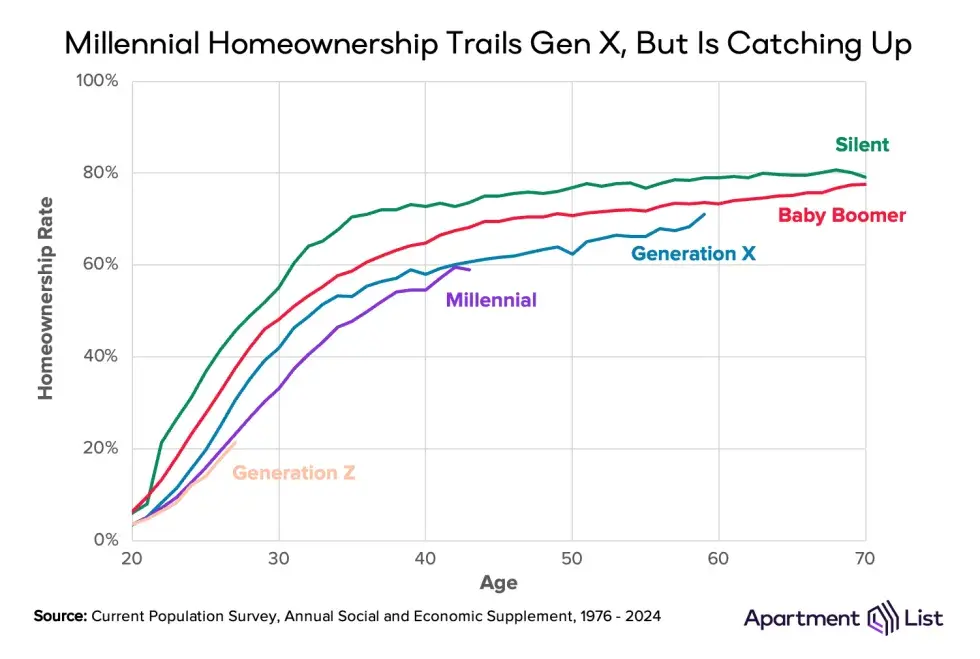

Apartment List’s 2025 Millennial Homeownership Report

Apartment List: “Data from the Census Bureau shows that by sheer volume, Millennials are buying more homes today than any other generation. But on a per-capita basis, the Millennial homeownership rate has been growing slower than that of previous generations. And an early look at Generation Z shows the trend is worsening, not improving.”

- Housing (Un)Affordability: “Rising Inventory, Persistent Gaps” (NAR)

- May 2025 Economic and Housing Outlook (Fannie Mae)

- The Dual Burden of Housing and Care for Older Adults (Harvard Joint Center for Housing Studies)

Multifamily Markets and Reports

U.S. Asking Rents Fell 1% Year Over Year in April—Biggest Drop in 14 Months

Redfin: “Renter demand is strong, but growth in apartment supply is even stronger because multifamily construction surged in the wake of the pandemic moving frenzy. Permits to build apartments have started to taper off, though, so asking rents could rebound in the coming months.”

- Apartment Transactions Ease in 2025’s 1st Quarter (RealPage)

- Multifamily Investors Unfazed by Tariffs, Policy Agendas (GlobeSt)

- Can opening federal land fix the housing crisis? (Cotality)

Commercial Real Estate and the Macro Economy

Understanding Today’s CRE Distress Landscape

Via Marcus & Millichap: Lenders are becoming “more stringent in policing their loans that aren’t in compliance . . . requiring the borrower to refinance the property or sell it, or in some cases the banks are selling the note to another lender or even initiating the foreclosure process.”

- Special Servicing Rate Inches Upward in April 2025, Mainly Driven by Lodging (Trepp)

- Supply Chain State of the Industry Report: May 2025 (Colliers)

- The Case for Commercial Real Estate Amid Market Volatility (CBRE)

Other Real Estate News and Reports

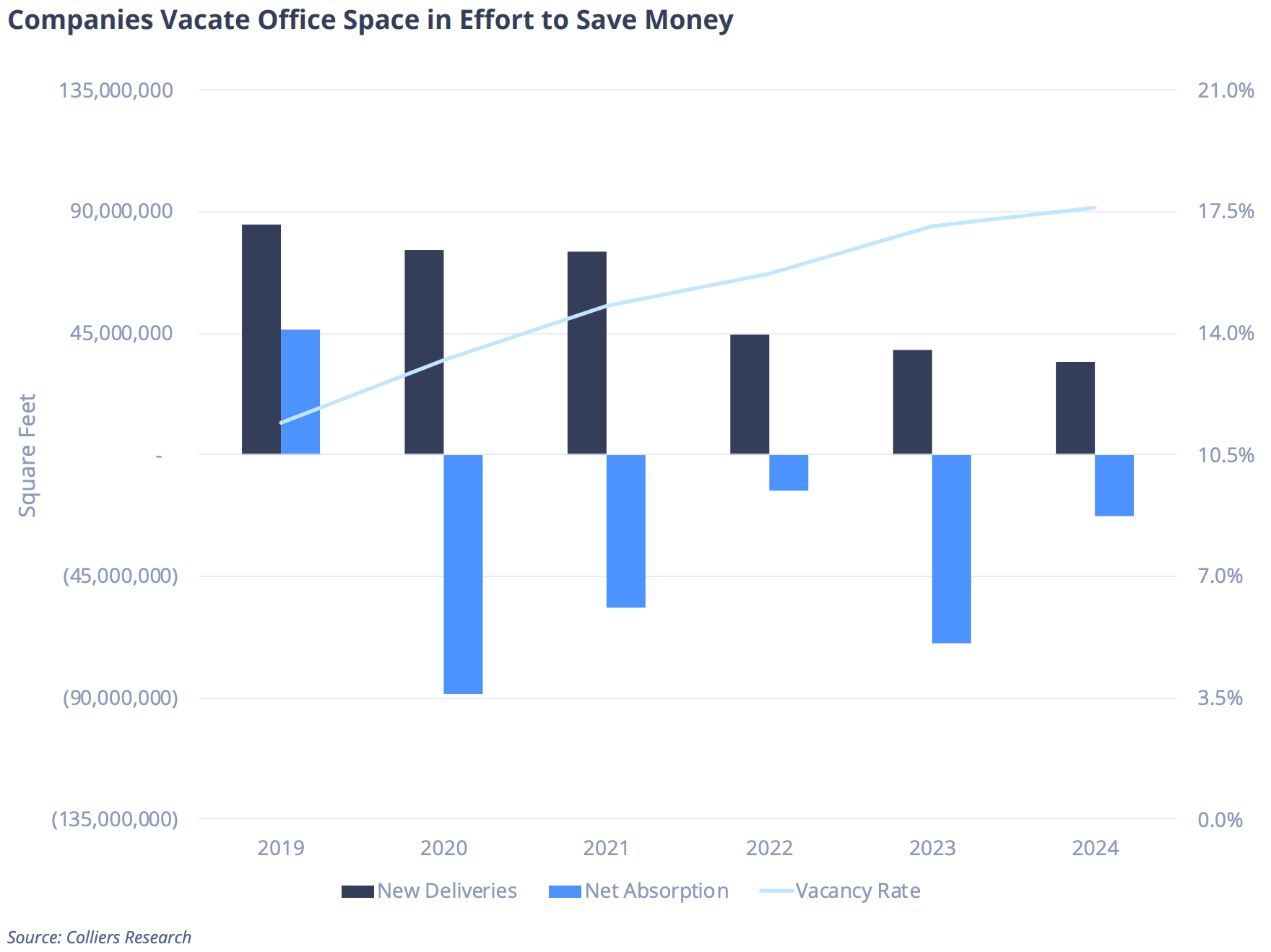

U.S. Office Market Five Years After the Pandemic

Via Colliers: “Between 2020 and 2024, more than 251 MSF of U.S. office space was returned to the market[, but i]n In the second half of [2024,] office fundamentals improved, with 2.3 MSF of net absorption and a 10-basis-point decline in vacancy.”

- Delays, Cancellations Of Construction Projects Becoming More Common (Bisnow)

- Beyond Borders: CRE Implications and Strategy Amid Trade Tensions (Colliers)

- Delays, Cancellations Of Construction Projects Becoming More Common (Bisnow)