Higher For Longer or Higher Forever? Fed Keeps Rates Elevated

Are CRE and multifamily investors prepared for higher-for-even-longer rates? The Fed’s decision to maintain the current level of the federal funds rate is no surprise, but this does not eliminate the challenges that persistently high interest rates have brought. That being said, the multifamily market may be the best-positioned CRE sector in the current economic environment, but apartment operators are taking a cautious “heads in beds” strategy.

Multifamily, the Nation, and the Economy

- As Fed Holds Rates Steady, Powell Says Next Step Is ‘Not at All Clear’

- The New York Times: “The unanimous decision to stand pat will keep interest rates at 4.25 percent to 4.5 percent, where they have been since December after a series of cuts in the second half of 2024.”

- Permits to Build U.S. Apartments Drop Below Pre-Pandemic Levels (Redfin)

- The Extend & Pretend Surge: $40 Billion in CRE Loan Modifications Signals a Shifting Market (CRED iQ)

- Population Growth Buoys Apartment Occupancy in Smaller Markets (RealPage)

- Trump Aims To Cut HUD Funding By 44%, Reshape Housing Assistance (Bisnow)

Multifamily and the Housing Market

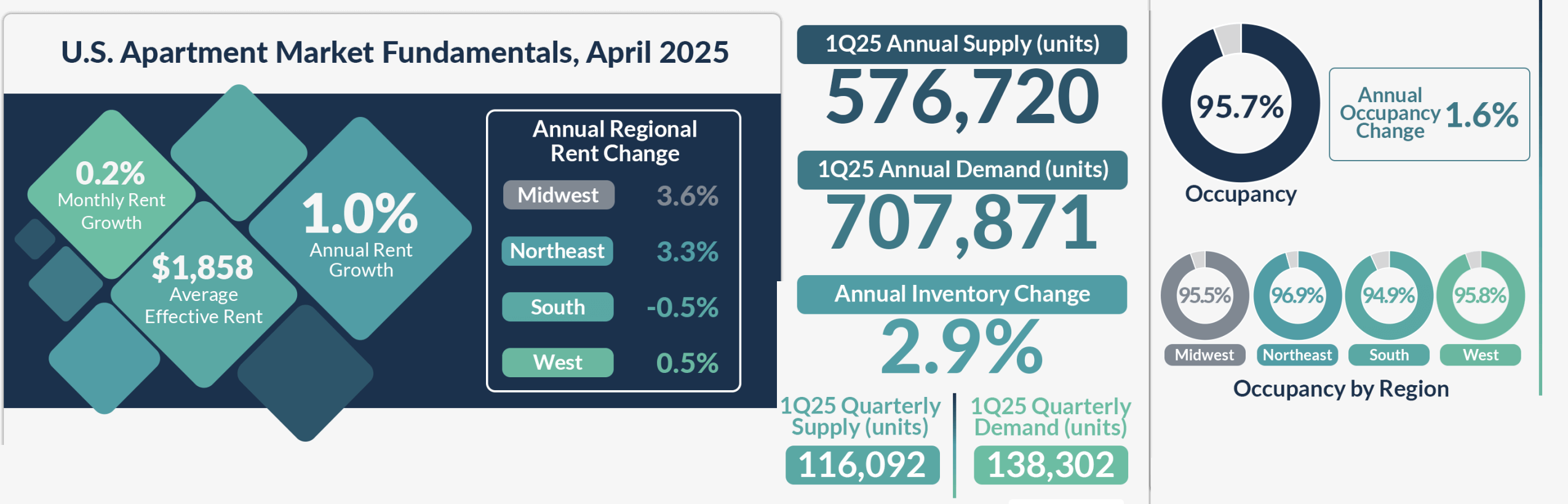

Operators Appear to Buy Occupancy as Rent Growth Slows in April

RealPage: “In a strong start to the prime leasing season, U.S. apartment occupancy surged in April. At the same time, rent growth, which had displayed modest momentum in recent months, backtracked slightly.”

- “Multifamily remains CRE’s most defensive asset class” (Cushman & Wakefield)

- The Hottest U.S. Multifamily Markets in 2025 (CRED iQ)

- Renter Engagement Tracker: Washington, D.C. Ranks 1st With South Claiming Half of Top 30 (RentCafe)

Multifamily Markets and Reports

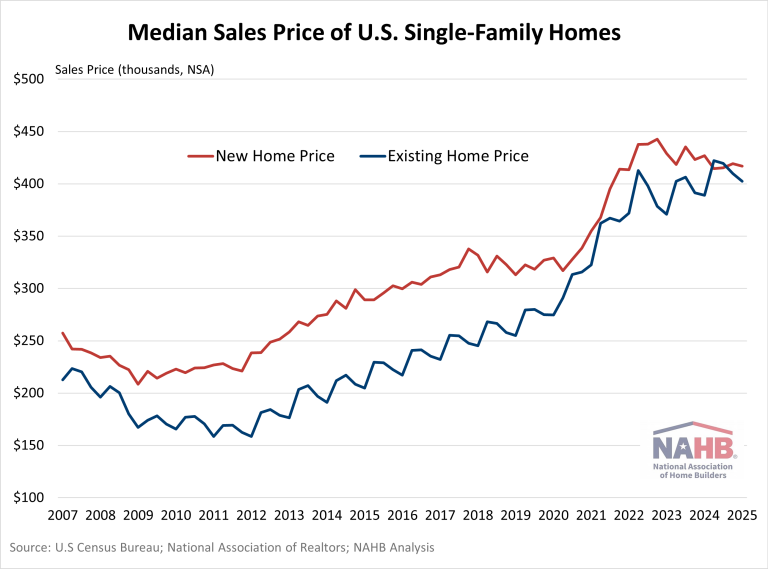

Prices for New Homes Continue to Drop as Existing Rises

NAHB: “While overall home prices remain elevated compared to historical norms, new home prices have moderated due to builder business decisions, but existing home prices continue to increase because of lean supply.”

- Baby Boomers and Gen X Are Flocking to the Hottest Housing Markets (Realtor.com)

- US home price insights – May 2025 (Cotality)

- Older Adults Experience Disparate Outcomes When Relocating (Harvard Joint Center for Housing Studies)

Commercial Real Estate and the Macro Economy

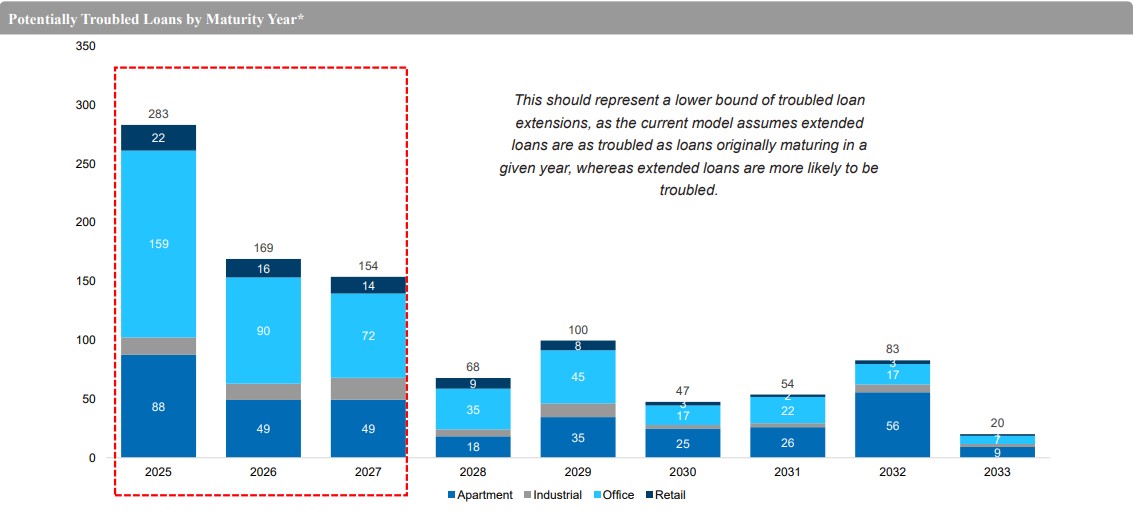

Q1 2025 CRE Capital Markets Report: Credit and Debt Markets Loom Large

Via Newmark: “The high office volume results from most loans being underwater. The distribution of LTV ratios for multifamily are more favorable overall, but the greater size of the multifamily market and the concentration of lending during the recent liquidity bubble drive high nominal exposure.”

- Retail CRE Positioned to Withstand Potential Headwinds (Marcus & Millichap)

- Strategic Perspectives in Uncertain Markets, A CIO Outlook (CBRE)

- Repositioning and redevelopment strategies for at-risk assets and portfolios (JLL)

Other Real Estate News and Reports

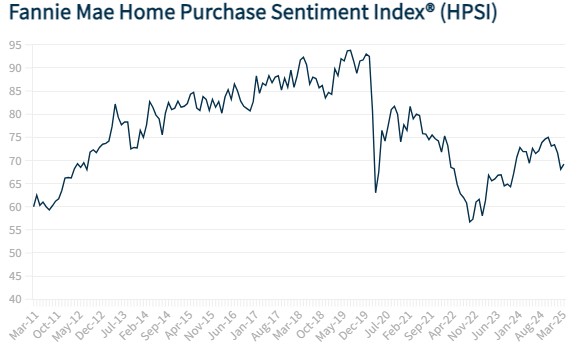

Via Fannie Mae: “Month over month, the Home Purchase Sentiment Index increased 1.1 points to 69.2. Year over year, the HPSI is down 2.7 points.”

- New Research Warns Carried Interest Tax Change Could Slash Jobs and Shrink Industries (GlobeSt)

- The Secrets of Luxury Retail (Crexi)

- Industrial Investments Durable Amid Uncertainty (Marcus & Millichap)