Economic Crisis? Multifamily Investors See a Way Out

With GDP going negative and job growth “well below expectations,” the US economy is facing a sharp increase in uncertainty and volatility. Amid the prospect of a declining economy, investors have not withdrawn their interest in the multifamily market. The substantial momentum of apartment demand is promising news for a more balanced market, but multifamily performance will continue to vary.

Multifamily, the Nation, and the Economy

- Multifamily Well Positioned to Face Economic Headwinds

- Marcus & Millichap: “Positive demographics, increased renter retention, and tapering construction favor multifamily performance over the longer term[,but u]ncertainty driven headwinds may weigh on housing demand in 2025.”

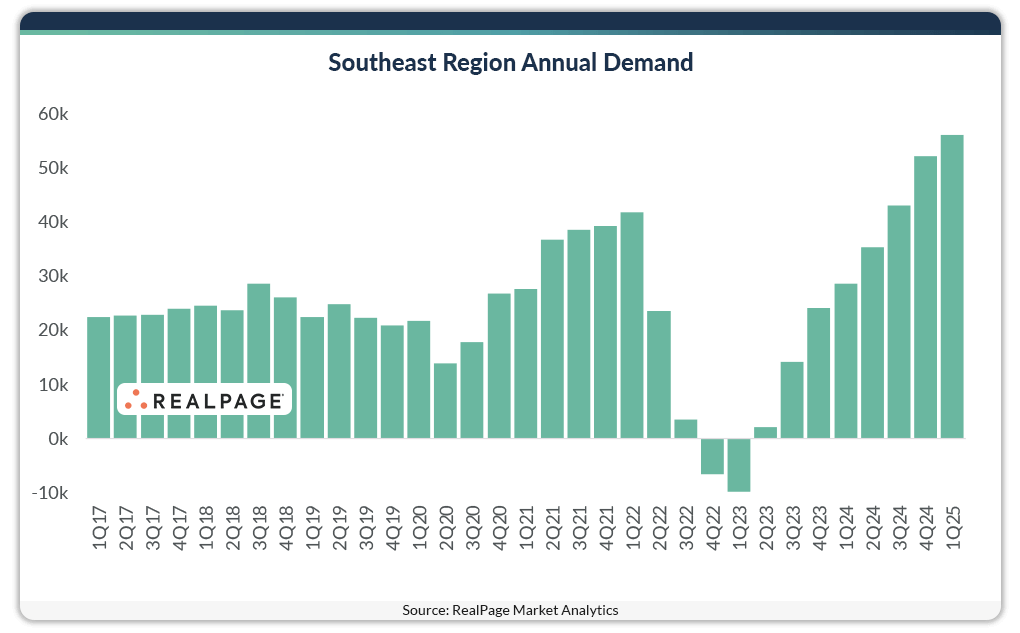

- U.S. Apartment Market Sees Strong Leasing Momentum (RealPage)

- Multifamily Muddles Through Uncertainty (Yardi Matrix)

- Washington State Lawmakers Vote to Limit Rent Increases (The New York Times)

- NMHC Apartment Conditions Survey: Sentiment Stays Afloat (NMHC)

Multifamily and the Housing Market

Homeownership Rate Dips to Five-Year Low

NAHB: “The homeownership rate declined to 65.1% in the first quarter of 2025, the lowest level since the first quarter of 2020 . . . Amid elevated mortgage interest rates and tight housing supply, housing affordability is at a multidecade low.”

- Why this spring selling season isn’t feeling quite like spring yet (John Burns Research and Consulting)

- Homebuyer mortgage demand drops further as economic uncertainty roils the housing market (NBC News)

- April 2025 Economic and Housing Outlook (Fannie Mae)

Multifamily Markets and Reports

April 2025 National Rent Report

Apartment List: “[W]e normally expect to see rent growth accelerating at this time of year rather than decelerating. This month’s reading may be the first indication of demand slowing due to declining consumer confidence amid a more uncertain macroeconomic outlook.”

- National Multifamily Market Report | Q1 2025 (Berkadia)

- “Apartment affordability has improved, while affordability for single-family rentals has declined.” (Zillow)

- Rents Fell 1.2% YoY in March (Realtor.com)

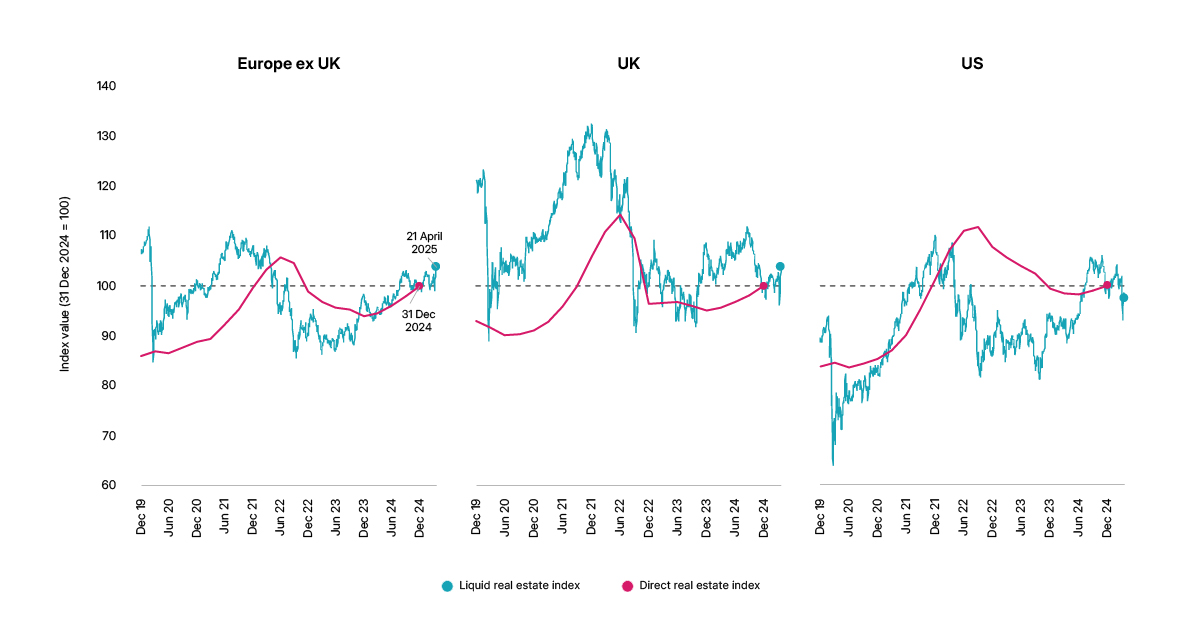

Commercial Real Estate and the Macro Economy

CRE Finance Council Sentiment Index Shows Steep Decline Amid Rising Tariff and Market Uncertainty

Via CREFC: “The 1Q25 Sentiment Index fell 30.5% to 87.9 from 126.6 in 4Q24 – the second-largest drop on record and exceeded only by the onset of the pandemic in 1Q20. Specifically, the decline brings the index below the baseline of 100 for the first time since the pandemic era.”

- Foreign Investor Report: Investment Outlook Worsens, but More Intend to Increase Investments (AFIRE)

- Winning Office: Where U.S. Office Space is Thriving and Why (Newmark)

- April 2025 Office Market Report: Large Urban Properties Vulnerable to Distress (Yardi Matrix)

Other Real Estate News and Reports

How to Think About Tariffs & CRE

Via Newmark: “The main result of the ”Liberation Day” announcements so far is uncertainty, leading to sclerosis in decision making and capital flows, as well as a general cautionary posture.”

- 2025 Hospitality Investment Outlook (Marcus & Millichap)

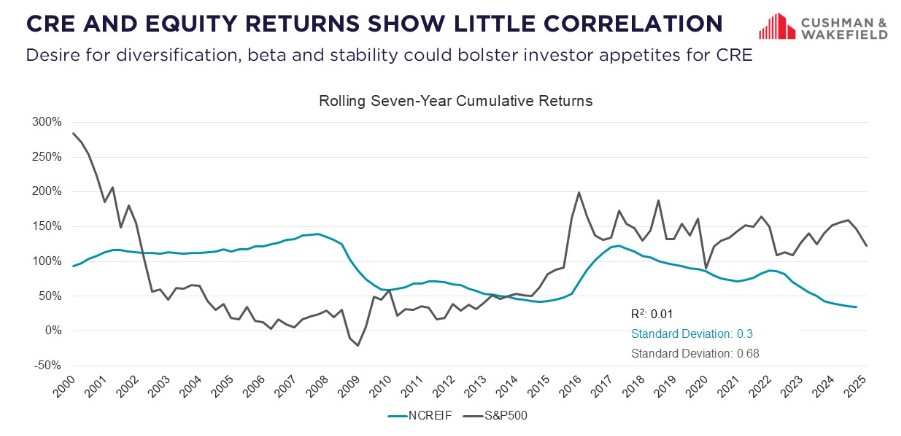

- Trump Admin First 100 Days: Implications for the Economy & Property (Cushman & Wakefield)

- Effective Technology and AI in CRE (CBRE)