CRE Investors Getting Nervous, or Is Confidence Building?

Economic uncertainty continues, but the fundamentals of the multifamily market have been steadily improving. With this in mind, recent data on investor sentiment shows a mix between long-term confidence and short-term worries. The longer-term investment period of CRE investments favors an extended outlook, but pressure has not abated owners of struggling properties. “Survive through ’25” may be a fitting slogan for the year as multifamily owners and investors look forward to a more favorable market and more predictable economic conditions over the longer-term.

Multifamily, the Nation, and the Economy

- Transitory Uncertainty Weighs on Investment Activity

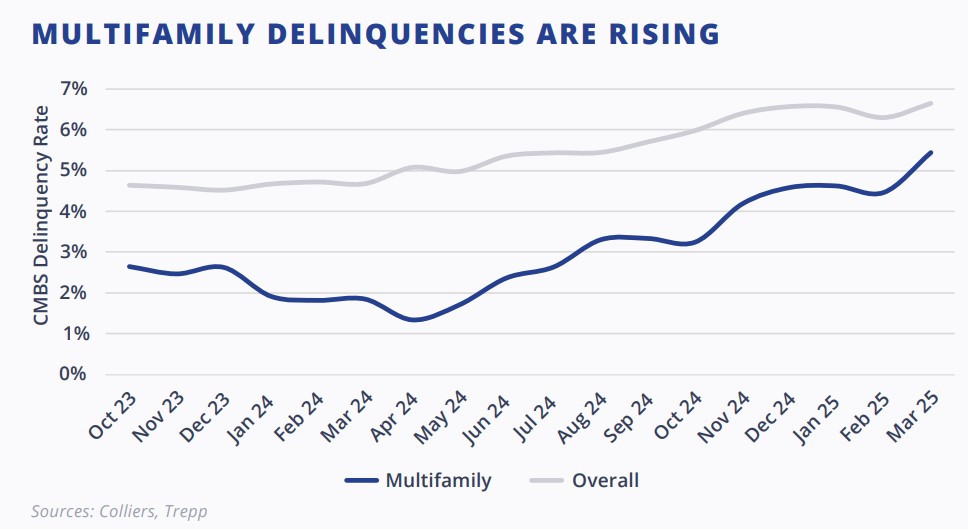

- Colliers: “Those looking for distress are likely to see more opportunities in the quarters ahead. Delinquency rates are rising, and refinancing deals executed at the top of the market are proving challenging without a restructured capital stack. Investors are targeting deals priced below replacement cost, and while they are available, a delta remains between seller expectations and buyer pricing and cap rate limitations.”

- Private Investors Taking the Lead in CRE Investment? (Marcus & Millichap)

- Will younger generations embrace higher-density housing? (John Burns Research and Consulting)

- An Inconvenient Call: Capital Calls During a Crisis (MSCI)

Multifamily and the Housing Market

Multifamily Buyer & Seller Sentiment Improves in Q1

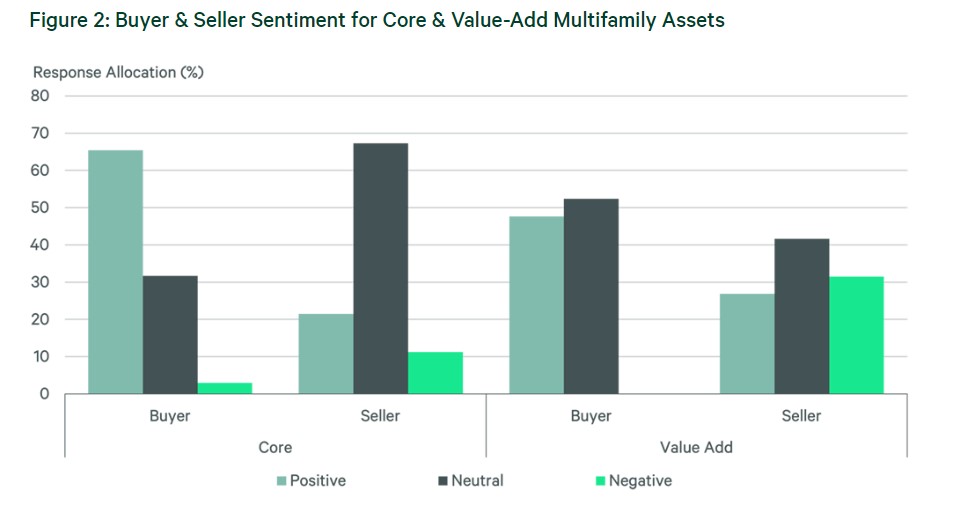

CBRE: “Underwriting assumptions for core multifamily assets improved in Q1, while those for value-add assets slightly weakened. Buyer and seller sentiment improved for both core and value-add assets. This comes despite the Federal Reserve indicating a slower pace of interest rate cuts this year as it awaits more clarity on policy shifts by the Trump administration.”

- Fannie Mae Home Price Index Showed Year-over-Year Increase of 5.2 Percent in Q1 2025 (Fannie Mae)

- Economic Fears Change Homebuying Plans (John Burns Research and Consulting)

- Continued Gains Projected for Remodeling Amid Economic Uncertainty (Harvard Joint Center for Housing Studies)

Multifamily Markets and Reports

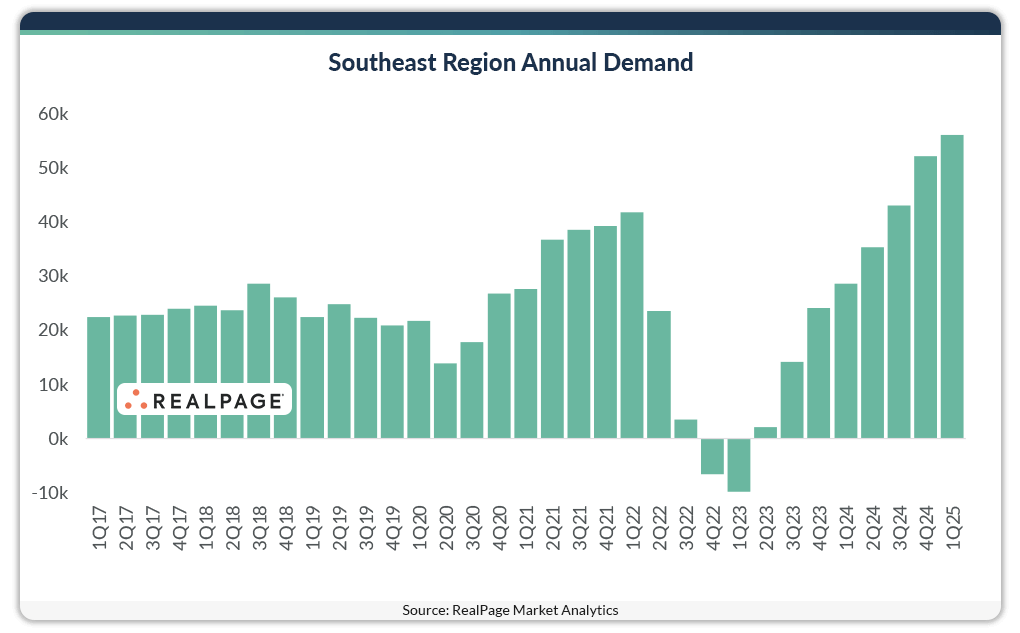

Apartment Demand in Southeast Markets Swells Ahead of Fading Supply Volumes

RealPage: “Apartment demand in the Southeast region of the U.S. surged to a record high in 1st quarter. At the same time, construction volumes are declining in the region.”

- U.S. Asking Rents Fell Slightly in March, But Tariffs Could Drive Up Costs for Renters (Redfin)

- How Evolving Supply & Demand Dynamics Are Impacting Multifamily Investments (Trepp)

- New Home Sales Rise in March (NAHB)

Commercial Real Estate and the Macro Economy

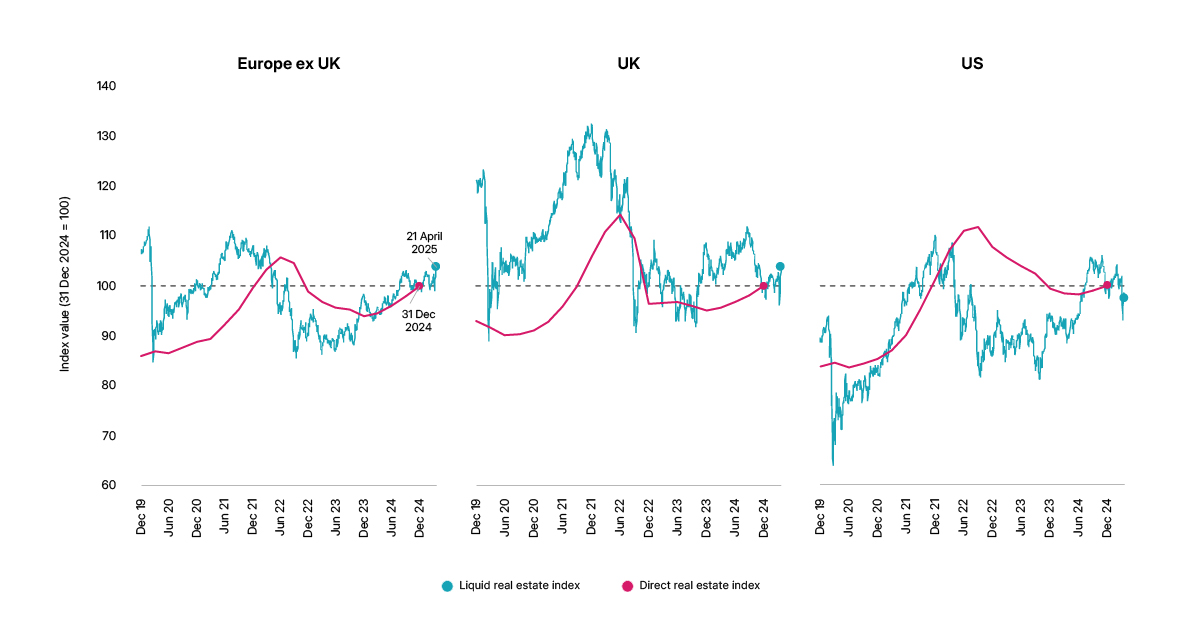

Signals on Private Real Estate amid Trade Turmoil

Via MSCI: “Between April 2 and April 8, the MSCI USA IMI Liquid Real Estate Index fell by 8.9% and even after the April 9 announcement of a tariff pause remained 4.6% down by the close of April 21. The indexes for the U.K. and Europe also posted notable declines, of 6.4% and 3.3%, respectively, but have since regained all lost ground.”

- Blackstone Says Tariffs Are Affecting CRE Investment (GlobeSt)

- Office Market Statistics | Q1 2025 (Colliers)

- Emerging Signals in the Office Investment Market (Marcus & Millichap

Other Real Estate News and Reports

Financial Market Volatility Casts Shadow on Capital Markets Recovery

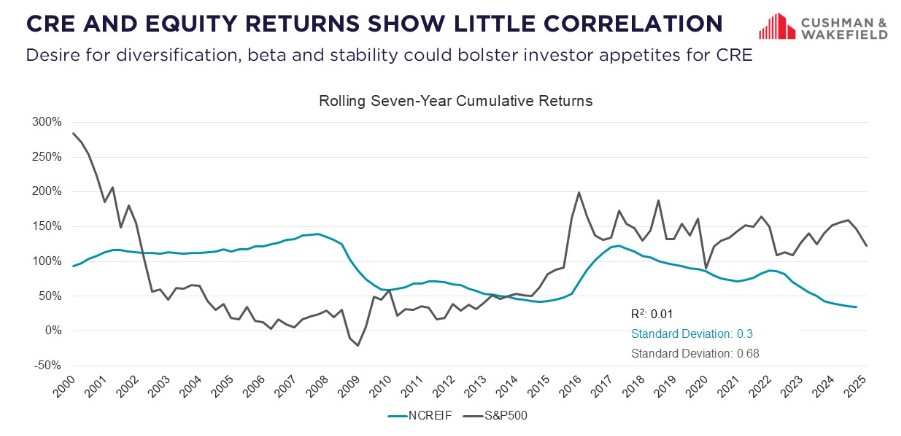

Via Cushman & Wakefield: “In the near-term, investors should plan and strategize around the fact that Treasuries are likely to experience upward pressure. If the viability of the Treasury market were in question entirely, we wouldn’t be seeing evidence of persistent demand from recent Treasury auctions (as was the case this week for both 10Y and 30Y USTs).”

- Industrial Market Statistics | Q1 2025 (Colliers)

- Bank Earnings Review – Q1 2025: Earnings Beat Expectations Driven by Interest Income & Trading, on the Eve of Liberation Day (Trepp)

- CRE Holds Steady as Tariffs Reshape the Economic Landscape (GlobeSt)